Weak eurozone PMI cementing the resistance area near 1.1300

Weak eurozone PMI cementing the resistance area near 1.1300

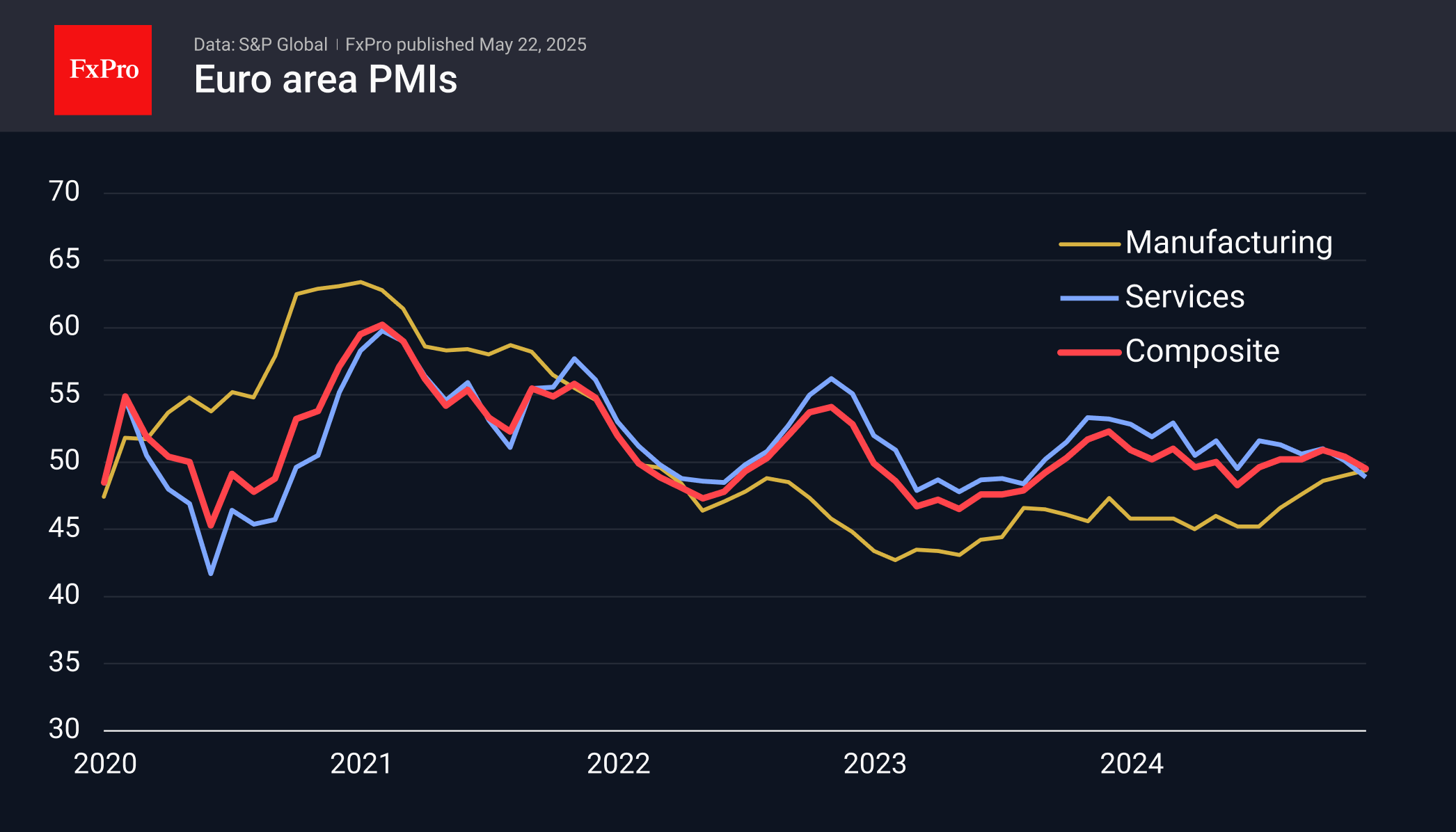

Preliminary Eurozone business activity estimates moved into contractionary territory due to a sharp dip in the services sector.

The Euro-region manufacturing PMI rose to 49.4, the highest reading since August 2022, but still in contractionary territory as it is below 50. The index shows that the sector has been gaining momentum since last December, which can easily be linked to expectations of lavish spending by the new German government and potential repetition by other countries.

Interestingly, the strengthening euro is still not hurting manufacturers. We think it is a fallacy to believe that eurozone manufacturers are sensitive to such 10% exchange rate fluctuations. Our observations suggest the opposite: the appreciation of the exchange rate does not hurt the economy, lowering energy costs and generally boosting demand.

The services sector, on the other hand, is not doing so well. The index has fallen back to 48.5, its lowest level since January 2024, and has been drifting downwards all this time. With this setback, the composite index went into contraction territory, below 50. The service sector and the general state of the economy were worse than economists' expectations, dragging the Euro.

EURUSD pulled back to 1.1300, losing about a third of a cent from intraday highs before publication. The same area worked as strong resistance, and the latest data favoured the bears in the pair.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)