GBPJPY buyers stay away but ready to step in

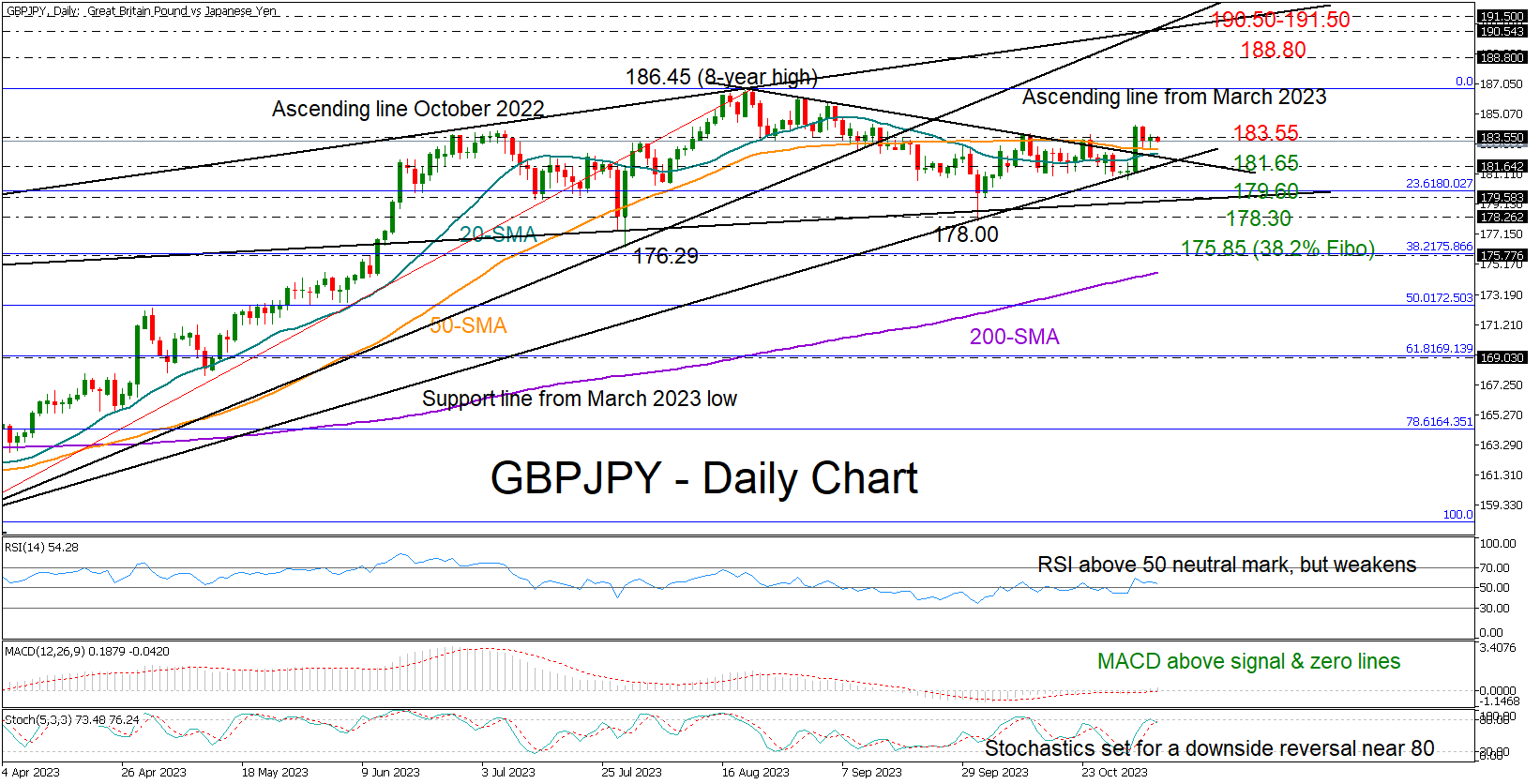

GBPJPY could not capitalize from Tuesday’s surge above the short-term resistance trendline, staying muted around the 183.55 area.

The RSI is above its 50 neutral mark, although weaker, and the MACD is keeping its footing above its red signal line and within the positive area, both reflecting that buyers are still active. Yet, with the stochastic oscillator looking for a downside reversal near its 80 overbought level, it’s uncertain if there is enough bullish power to boost the price towards the August top of 186.45.

Nevertheless, the pair has key levels underneath for protection against selling forces. The 50-day simple moving average (SMA) has been limiting downside movements over the past two days at 182.67, while the ascending trendline from March at 181.65 and the ascending line from April 2022 at 179.60 could also prevent a continuation lower. If the bears take the lead, the pair could plummet towards the 175.85 region, which overlaps with the 38.2% Fibonacci retracement of the 158.25-186.45 upleg, unless the 178.30 restrictive zone calms selling impulses beforehand.

In the event of an uptrend resumption above the eight-year high of 186.45, the bulls might take a breather near the November 2015 high of 188.80 before stretching towards the critical resistance line from October 2022 at 190.50. The broken ascending line from the March low might attract attention in the same region. Should it give way, the door will open for the 2015 ceiling of 195.30.

In brief, GBPJPY buyers are holding back despite the latest bullish trendline breakout. On the other hand, sellers cannot head up either, as important support levels remain.

intact. A close above 183.55 or below 179.60 could provide the next direction in the market.

intact. A close above 183.55 or below 179.60 could provide the next direction in the market.

.jpg)