Is AUDUSD ready to thrive after monthly pause?

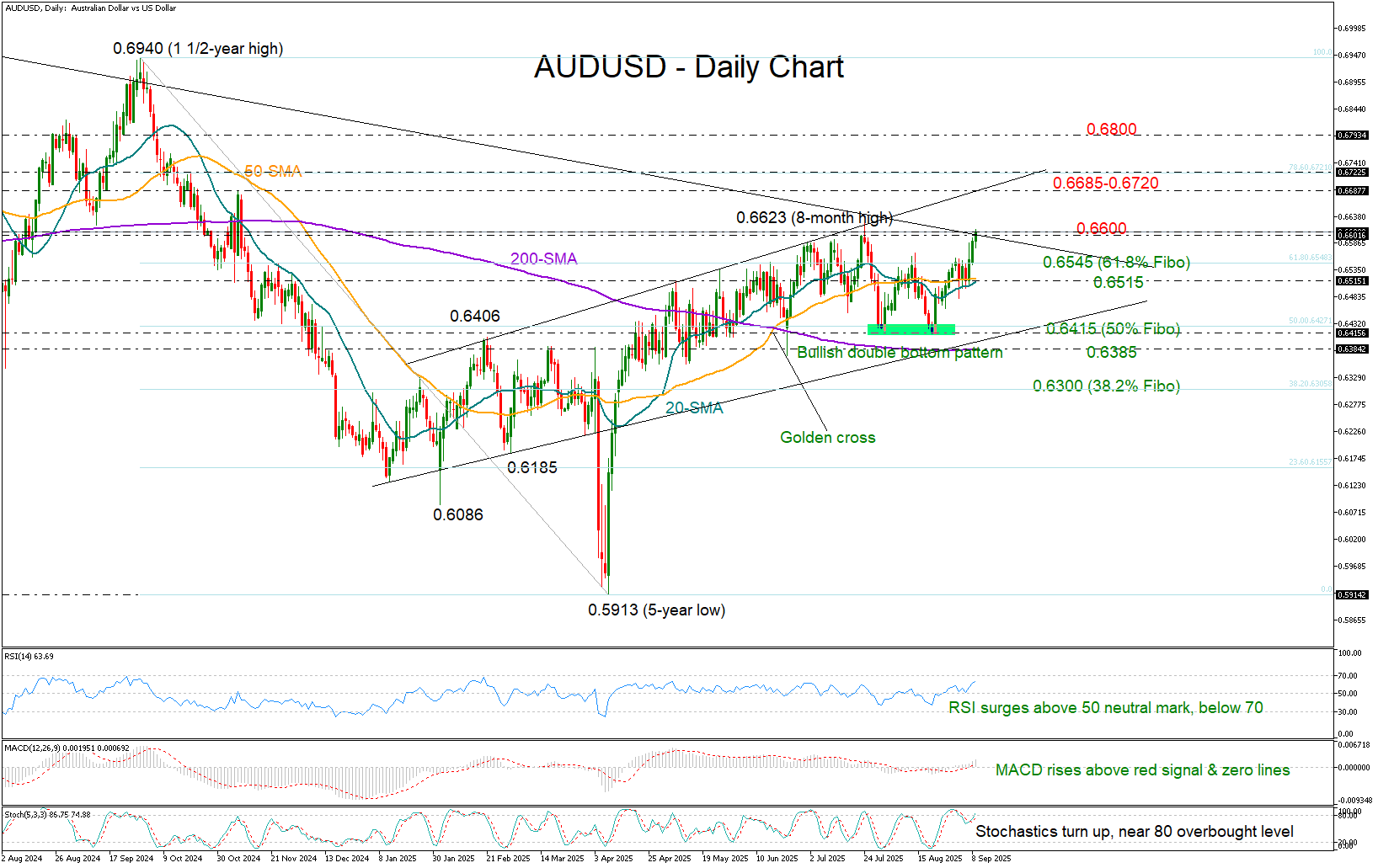

AUDUSD drifted higher following last Friday’s downbeat US nonfarm payrolls, exiting a break consolidation pause to stretch directly to the 0.6600 level, where July’s bullish attempt had previously stalled. Notably, a long-term resistance trendline drawn from the 2021 peak is now challenging the bulls, raising doubts about whether upside momentum can be sustained.

Encouragingly though, the post-NFP breakout appears to have confirmed a bullish double-bottom pattern above the 0.6548 region. With technical indicators maintaining a positive trajectory, the pair has scope for further gains. However, it is worth noting that the stochastic oscillator is hovering near the overbought 80 level, implying that bullish momentum may soon run out of steam.

If the price clears the 0.6600 barrier, the next target could be the 2025 resistance line at 0.6685, followed by the 78.6% Fibonacci retracement level of the prior downleg at 0.6720. Additional advances from there may open the way towards the 0.6800 handle and then to the 2024 ceiling of 0.6900–0.6940.

On the flip side, a reversal below the 0.6545 zone - and more importantly beneath the 20- and 50-day simple moving averages (SMAs) around 0.6515 - would shift the focus back to the double bottom area of 0.6415. The 200-day SMA at 0.6388 could then come into play before sellers aim for the 0.6300 region.

Overall, AUDUSD is looking promising in the short-term picture as analysts are eagerly waiting for the US CPI and PPI inflation indices, though a confirmation above 0.6600 is still needed to activate fresh buying orders.

.jpg)