Edit Your Comment

Forex is profitable ?

Členem od Aug 11, 2017

870 příspěvků

Jul 13, 2018 at 11:43

Členem od Aug 11, 2017

870 příspěvků

trading practically is the best course than others , sometimes we think bookish knowledge can play an important role in Forex trading but actually not. only practical trading knowledge is real.

Členem od Jul 12, 2018

18 příspěvků

Jul 15, 2018 at 04:56

Členem od Jul 12, 2018

18 příspěvků

Adribaasmet posted:Elanbani posted:

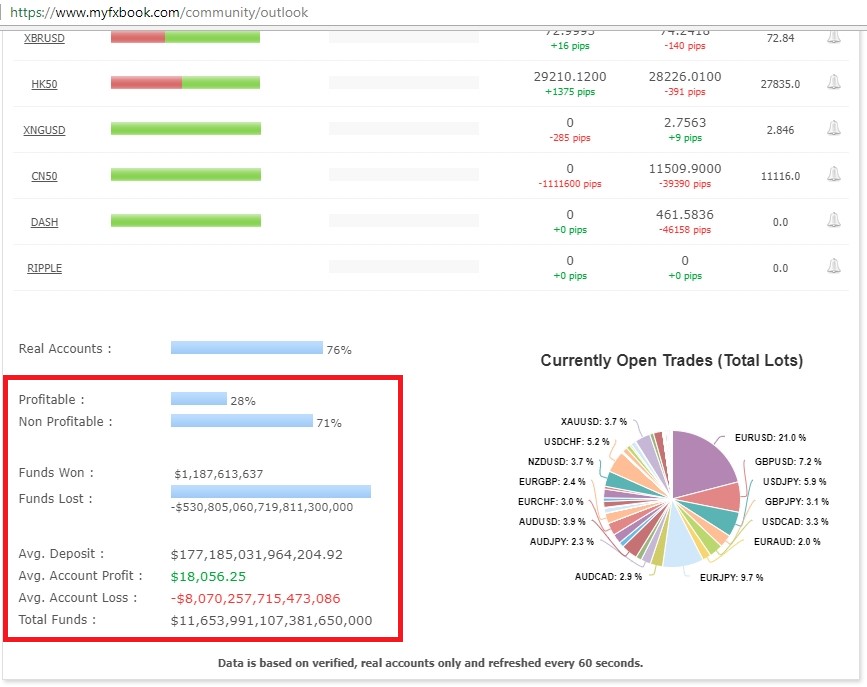

Definitely Forex is profitable but unfortunately not for everyone. More than 90% traders are loser in the Forex.

Yes, the ratio is too horrible! But, end of the day knowledge traders can make enough money because of their good trading skill.

Agree with you, traders who have enough knowledge and experience of Forex are making millions from it.

Členem od Jan 25, 2010

1288 příspěvků

Jul 15, 2018 at 05:47

Členem od Jan 25, 2010

1288 příspěvků

BluePanther posted:

Mark Shawzin:"Out of the 241 trades, 16 of them were responsible for ALL of the profit.

Most people in this world can't handle it. Yet, it is the only way I have ever seen anyone make money trading. Ever.

I was on Wall Street for 23 years. All of the successful fund managers will have long losing streaks, sometimes lasting 6 months to a year.

And then... boom! They let their winners run and they wipe out all of their losses.

It is how trading works.

https://thepatterntrader.com/the-pattern-trader-bundle-35/

My losing streak has lasted almost ten years...

And then... boom! I let my winners run and they wipe out all of my losses.😎

It is how trading works.

Členem od Dec 17, 2016

3 příspěvků

Členem od Aug 11, 2017

870 příspěvků

Jul 15, 2018 at 09:59

Členem od Aug 11, 2017

870 příspěvků

I have seen according to my trading experience, mostly traders in particularly the newcomers think , only most powerful analyzing trade knowledge can bring success in this market place , but practically despite of having good trading knowledge that’s not possible at all lead a profitable trading life with certainly of you don’t have a reliable support from a credible trading broker , because the trading broker can affects the result of our trading with certainly.

Členem od Aug 27, 2017

875 příspěvků

Jul 16, 2018 at 05:44

Členem od Aug 27, 2017

875 příspěvků

Mohammadi posted:

I have seen according to my trading experience, mostly traders in particularly the newcomers think , only most powerful analyzing trade knowledge can bring success in this market place , but practically despite of having good trading knowledge that’s not possible at all lead a profitable trading life with certainly of you don’t have a reliable support from a credible trading broker , because the trading broker can affects the result of our trading with certainly.

No doubt, broker is another important parameter here! But I see, nowadays there have so many good review sites, that’s really a good sign for the newcomers.

keeping patience.......

Členem od Jan 25, 2010

1288 příspěvků

Členem od May 30, 2018

11 příspěvků

Jul 16, 2018 at 10:52

Členem od May 30, 2018

11 příspěvků

Elanbani posted:Yep! There's all this noise you'll hear about forex being profitable. It makes everyone believe that anyone can succeed here no matter what. But the hard truth is that only a very small percentage of people can be profitable here, those with the right combination of knowledge, skills, experience, dedication, discipline, patience, hard work and sharp trading instincts!

Definitely Forex is profitable but unfortunately not for everyone. More than 90% traders are loser in the Forex.

Členem od Dec 31, 2017

5 příspěvků

Jul 17, 2018 at 06:00

Členem od Dec 31, 2017

5 příspěvků

Forex is profitable, but all in a different way than the advertisements do to attract people.

You need to lose, you need to study over you losses, you need to refine.

Risk is always unpredictable and changing according to new commercial terms (ESMA...😕)

You need to lose, you need to study over you losses, you need to refine.

Risk is always unpredictable and changing according to new commercial terms (ESMA...😕)

Členem od Aug 10, 2012

57 příspěvků

Jul 17, 2018 at 06:01

Členem od Aug 10, 2012

57 příspěvků

What you win is excatly what the other loose, nothing more

Forex do not create nothing

and only brokers winn any where

Forex do not create nothing

and only brokers winn any where

Členem od Aug 10, 2012

57 příspěvků

Členem od Aug 27, 2017

875 příspěvků

Jul 17, 2018 at 10:57

Členem od Aug 27, 2017

875 příspěvků

Forex is one of the most popular trading profession, the beauty is there is no restriction; that’s why I started my trading when I was under 18; although then I was involved with only learning.

keeping patience.......

Členem od May 30, 2018

9 příspěvků

Jul 22, 2018 at 05:52

Členem od May 30, 2018

9 příspěvků

The truth is that you should know how to make it profitable. If you don't know that then I don't really think it's going to be of any help.

Členem od May 11, 2018

14 příspěvků

Jul 25, 2018 at 06:27

Členem od May 11, 2018

14 příspěvků

Admoni posted:

then before you get a real account , get a demo account and practice as much as you can so you will get a better idea about the market. You probably should use the demo account for months. However , if you feel like you are ready , then by all means open up a real account.

Demo can never help to get ready for live actually. How many times you have heard this "very much profitable in demo, but why I can't make profits in live?"

Use broker for knowledge, of using platform or of using analytics, but demo is not for testing if profitable or not. My piece of advice.

Členem od Sep 15, 2016

24 příspěvků

Jul 26, 2018 at 10:22

Členem od Sep 15, 2016

24 příspěvků

yes for those who know what they are doing, forex can be profitable. it all depends on your trading strategy and consistency. flipping the switch frequently will never let you make constant gains.

Členem od Jul 26, 2018

8 příspěvků

Jul 26, 2018 at 11:34

Členem od Jul 26, 2018

8 příspěvků

Getting the right trading strategy is the biggest problem. There are so many out there and none seem to work! I have tried some EAs with success but the manual strategies that are taught never seem to work for me

Členem od Jan 25, 2010

1288 příspěvků

Aug 05, 2018 at 06:36

Členem od Jan 25, 2010

1288 příspěvků

Členem od Apr 06, 2018

242 příspěvků

Aug 06, 2018 at 05:41

Členem od Apr 06, 2018

242 příspěvků

BluePanther posted:

Trading is zero sum game retail traders are trading against large corporate bank(liquidity providers). Most traders are not discipline and using high leverage to maximize there profit but they don't care about drawdown and loss money.

The market will trade through it’s path of least resistance .

Členem od Aug 06, 2018

13 příspěvků

Aug 06, 2018 at 12:32

Členem od Aug 06, 2018

13 příspěvků

Forex is profitable, yes, but not as easy as you people might think. It's not like "this and that, then done" strategy. It's a process where learning never ends, or strategy may not become permanent. There will be continuous knowledge, continuous analysis, risk management, or if necessary, tracking the records. These all are in the personal room of successful trading life.

Členem od Feb 22, 2011

4573 příspěvků

Aug 06, 2018 at 13:36

Členem od Feb 22, 2011

4573 příspěvků

My7book posted:

Forex is profitable, yes, but not as easy as you people might think. It's not like "this and that, then done" strategy. It's a process where learning never ends, or strategy may not become permanent. There will be continuous knowledge, continuous analysis, risk management, or if necessary, tracking the records. These all are in the personal room of successful trading life.

Forex not profitable nor losing. Forex is zero sum game - someone has to buy at the price someone else is selling. Forex is a market.

So WHO is profitable?

1. middle man allowing buyer and seller to execute the trade. For us it is usually broker.

2. Government- it got its taxes

3. A few percent of traders whose are successful.

4. Sellers of shits like training courses, books, memberships, etc...

Anybody else profiting from forex?

*Komerční použití a spam nebudou tolerovány a mohou vést ke zrušení účtu.

Tip: Zveřejněním adresy URL obrázku /služby YouTube se automaticky vloží do vašeho příspěvku!

Tip: Zadejte znak @, abyste automaticky vyplnili jméno uživatele, který se účastní této diskuse.