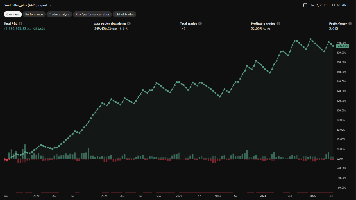

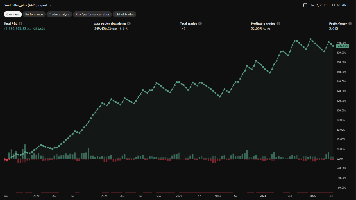

VoidFiller PlusVoidFiller Plus represents the advanced, high-intensity version of the proprietary quantitative model VoidFiller, designed to exploit more decisively the price inefficiencies and liquidity distortions present in major U.S. equities.

Built upon the structural principle of “void filling”, the strategy combines momentum and mean-reversion algorithms across multiple timeframes, operating on a broad basket of S&P 500 stocks. This multi-equity architecture enables dynamic risk diversification and ensures high stability of the equity curve, even in the most volatile market conditions.

The Plus version adopts an enhanced risk profile, with greater operational leverage and optimized exposure parameters aimed at increasing the average profitability per trade, while maintaining a maximum drawdown below 20%.All parameters have been tested on over 15 years of historical data, providing the model with robustness and operational consistency suitable for prop trading and institutional portfolio management.

Thanks to its adaptive structure and algorithmic risk control, VoidFiller Plus stands as a scalable, high-performance strategy aligned with the highest professional standards, ideal for those seeking a balance between capital growth and risk control.

⚠️ Disclaimer: The performance results shown are based on historical backtests and do not guarantee future results. Equity trading involves significant risks of capital loss and should only be undertaken with full awareness and proper risk management.

Trade smart. Trade with Pinealgos.