Altcoin outpaces Bitcoin in growth

Altcoin outpaces Bitcoin in growth

Market picture

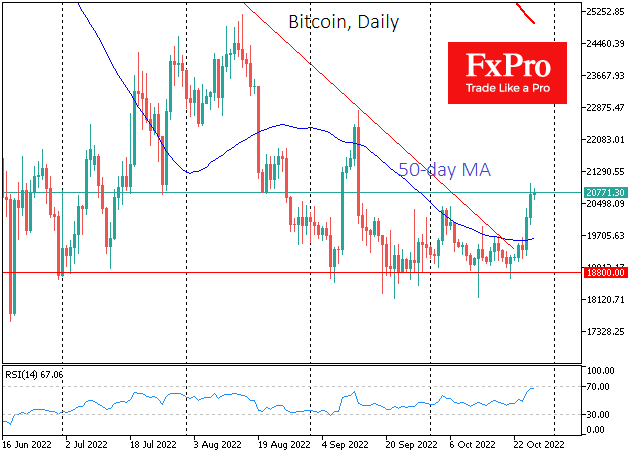

Bitcoin has added another 3.3% in the past 24 hours to $20.8K, bringing the gain over the past seven days to 9%. Ethereum is growing at a higher rate, reaching $1570 (+5.8% in 24 hours and 21% in 7 days).

Over the last day, major altcoins added between 1.5% (DOT) and 21% (DOGE). According to CoinMarketCap estimates, total cryptocurrency capitalisation surpassed the $1 trillion mark, up 3.3% on the day.

Dogecoin was again buying from Twitter's acquisition by Elon Musk, who had previously said he might add the coin to pay for the social network's services. However, the latest rise looks more like a 'buy rumour' pattern, and it can't be ruled out that the pump will soon turn into a dump.

News background

Bloomberg exchange strategist Mike McGlone is confident that the Ethereum network's successful transition to the Proof-of-Stake consensus algorithm has laid the foundation for steady growth in the second-capitalised cryptocurrency.

The first US bitcoin futures ETF from ProShares lost a record $1.2bn in investor funds the year after launch. This was the worst debut result in the history of the exchange-traded fund industry. Despite this, several investors retain faith in BTC - the ProShares Bitcoin-ETF has seen net inflows of $87 million in the past six months.

According to the Wall Street Journal, the capitalisation of Andreessen Horowitz, the largest crypto venture capital fund, fell by 40% in the year's first half.

The UK Parliament voted to amend the Financial Services and Markets Bill to mandate the regulation of cryptocurrencies as financial instruments.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)