Australian Dollar Gains, but Rate Uncertainty Limits Potential

By RoboForex Analytical Department

The AUD/USD pair climbed to 0.6192 midweek, reflecting cautious optimism in the market. Traders remain vigilant ahead of key December inflation data from the US, which could influence expectations regarding the Federal Reserve’s potential interest rate cuts in 2025. Earlier, the Australian dollar recovered some of its losses as the US dollar reacted to Producer Price Index statistics.

Key upcoming events for the AUD

Australia will release its employment report on Thursday, a critical data point for assessing the state of the labour market. These figures are crucial for adjusting forecasts concerning the Reserve Bank of Australia’s (RBA) interest rate trajectory.

Fresh Q4 2024 inflation data for Australia will also be published at the end of the month. These data will be pivotal in shaping expectations for the RBA’s upcoming meeting and its decisions on borrowing costs.

Investors currently assign a 70% probability of a rate cut at the RBA’s February meeting. If realised, the rate could decrease by 25 basis points from the current 4.35% per annum. Market prices have already factored in this potential decision.

However, lingering uncertainty about the RBA’s future policy direction and the terminal rate target for the year keeps investors cautious, limiting the AUD’s upside potential.

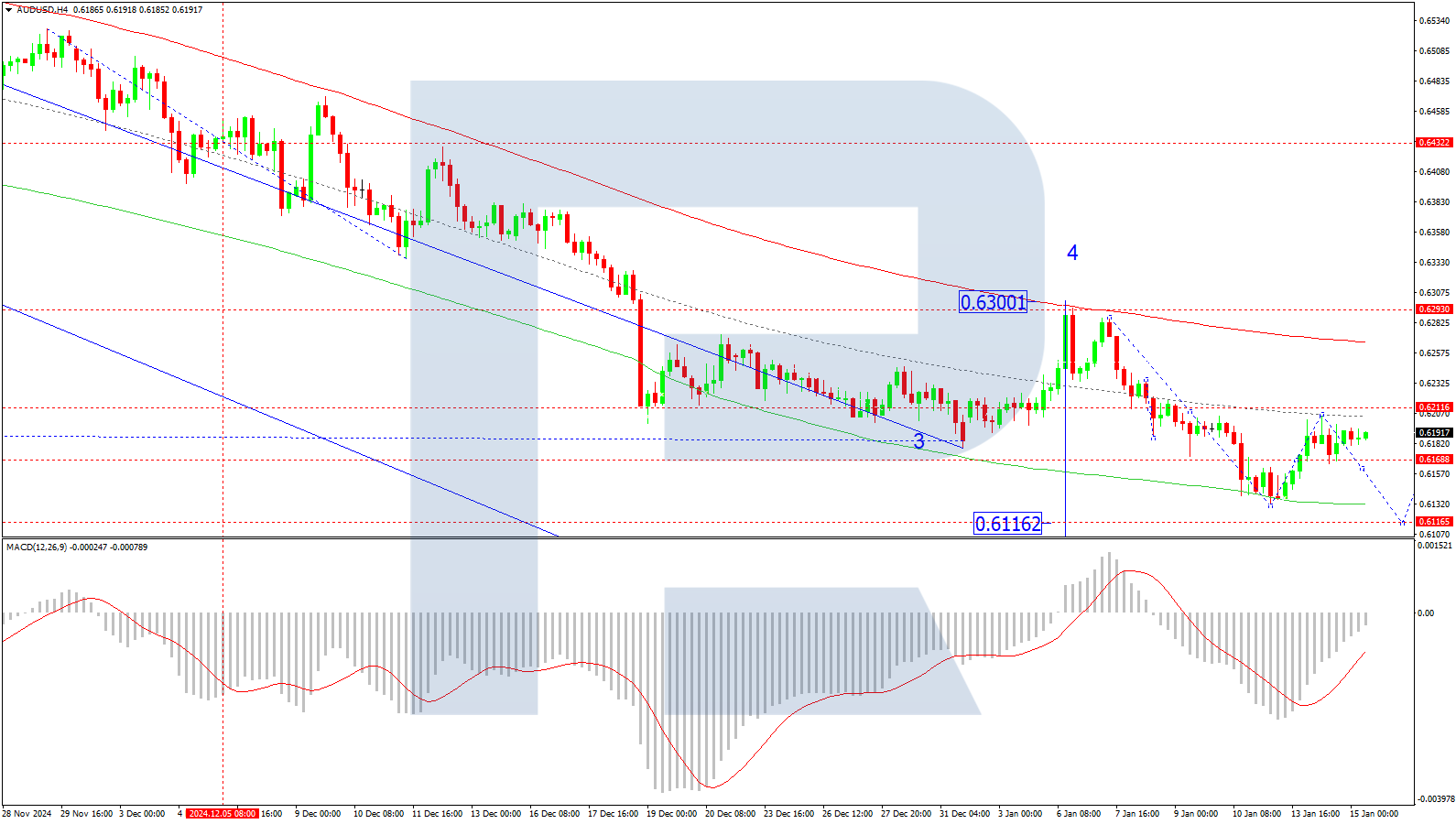

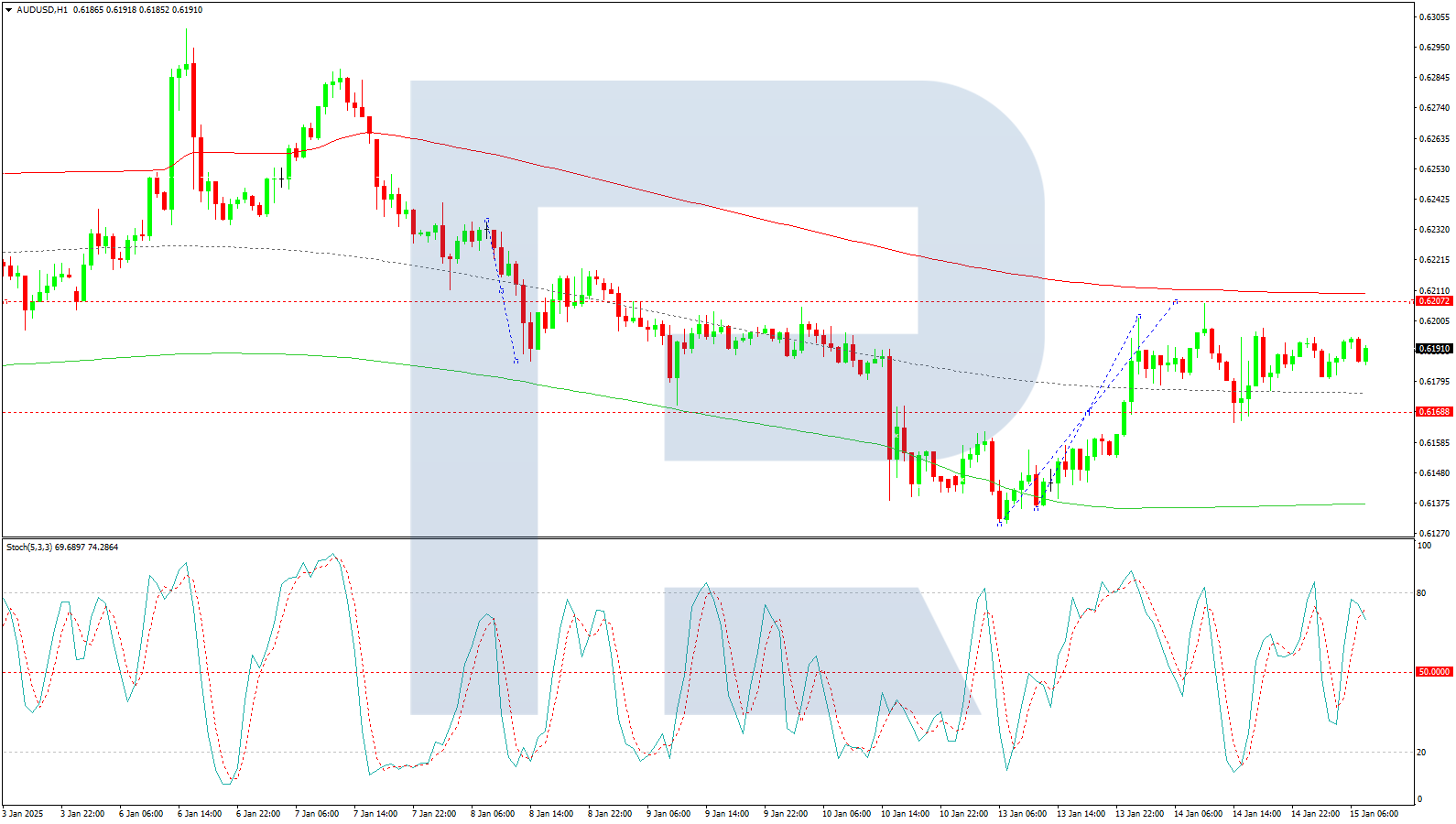

Technical analysis of AUD/USD

On the H4 chart, AUD/USD is developing an upward wave targeting 0.6211. This level is expected to be tested today, followed by a potential decline towards 0.6161. A consolidation range is likely to form around 0.6161. If the pair breaks upwards from this range, a correction to 0.6290 could materialise. Conversely, a downward breakout could trigger a new wave targeting 0.6116. The MACD indicator supports this scenario, with its signal line below the zero mark but pointing sharply upwards.

On the H1 chart, the pair is building a growth wave towards 0.6211, which is expected to be reached today. Following this, a corrective move to 0.6161 may occur. The Stochastic oscillator confirms this scenario, with its signal line above the 50 mark and trending upwards towards 80.

Conclusion

The Australian dollar’s recent recovery is tempered by uncertainty surrounding the RBA’s future policy decisions. Key domestic data, including employment figures and Q4 inflation, heavily influence market expectations. While technical indicators suggest short-term growth potential for AUD/USD, further gains will depend on clarity regarding the RBA’s policy trajectory and broader economic conditions.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.