Bank of England cuts rate and strikes with a dovish tone

Bank of England cuts rate and strikes with a dovish tone

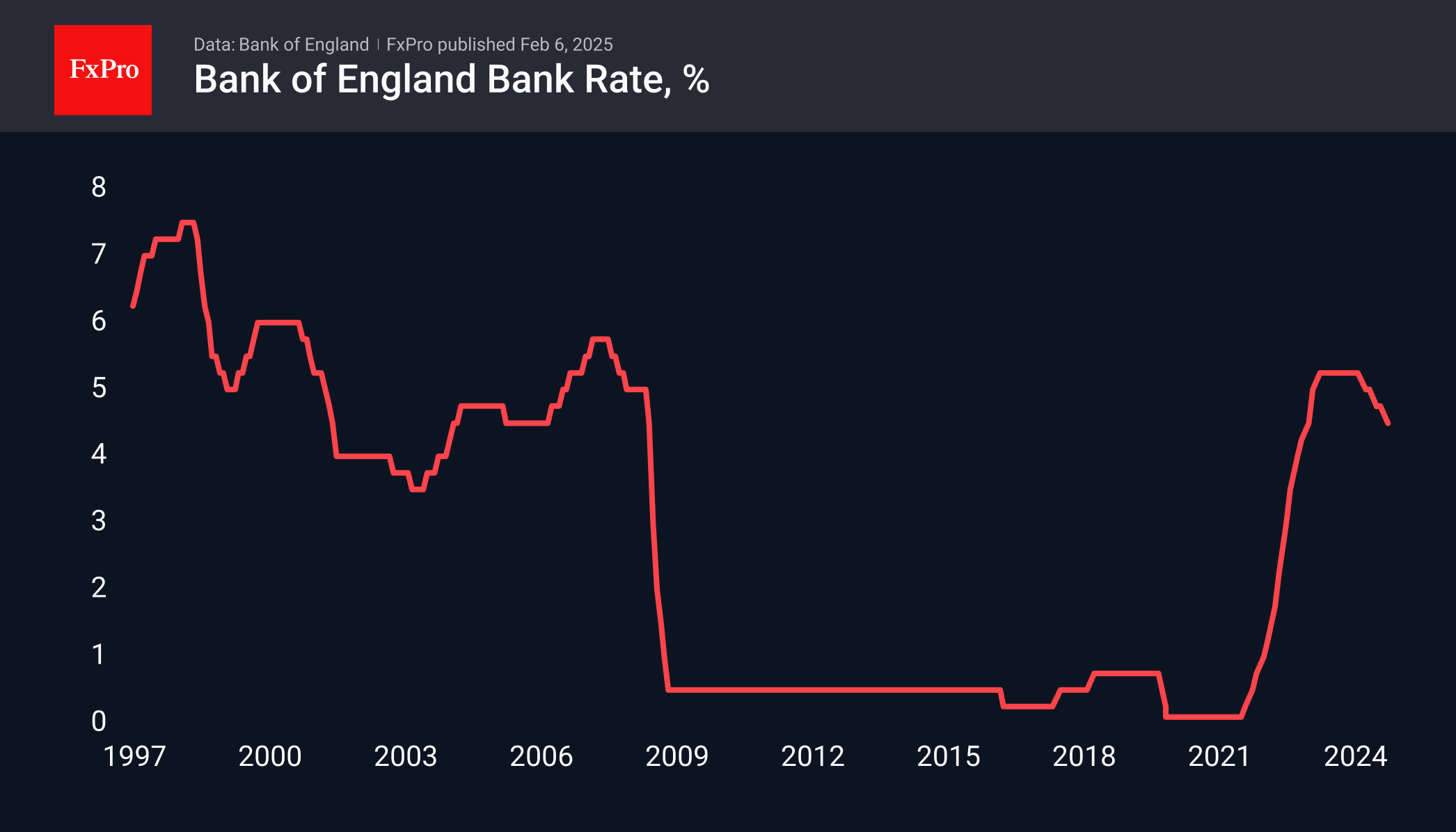

The Bank of England cut its key rate by 25 basis points to 4.5%, which was in line with analysts' expectations. However, the central bank demonstrated a softer stance than the market had forecast, which put pressure on the British Pound.

Minutes of the Monetary Policy Committee meeting showed that two out of nine members supported a rate cut of 50 basis points. At the same time, analysts expected one member to vote in favour of keeping the current rate.

Inflation has exceeded the 2% target over the past three months, reaching 2.5% in December. However, the Bank of England believes disinflationary trends will prevail. The economic growth forecast for 2025 was lowered from 1.5% to 0.75%, indicating the bank's intention to reduce the restrictive bias of monetary policy and narrow the gap between the key rate and inflation.

Following the publication of the rate cut decision, markets are expecting three more rate cuts this year, compared to the one or two cuts previously anticipated.

As a result, the Pound accelerated its decline, reaching 1.2360 before recovering to 1.24. The technical hurdle for GBPUSD was the 50-day moving average, which temporarily halted the recovery move that began last week.

While the Federal Reserve tightens its policy, the Bank of England softens it and gives more dovish signals, which creates preconditions for a further decline in GBPUSD. Under these conditions, we can expect the pair to return to the 1.2100 level, where it was in mid-January and October 2023.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)