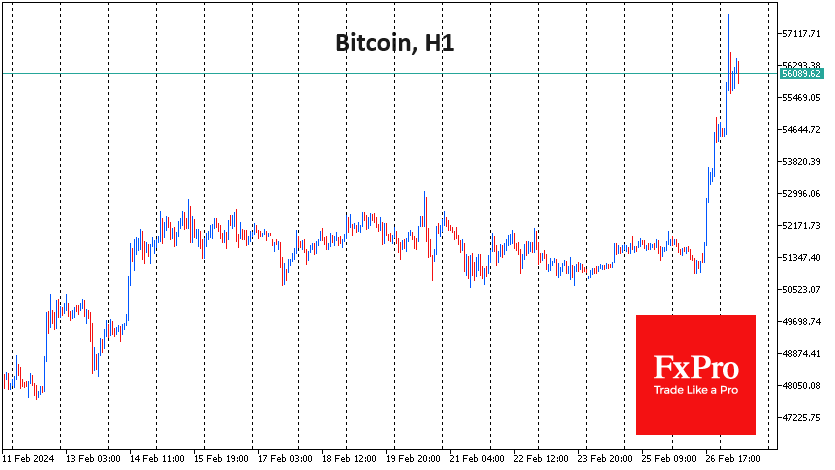

Bitcoin tears the bears apart again

Market picture

The price of the leading cryptocurrency rose decisively during active trading in the US, and in the illiquid Asian session, we saw a wave of stop orders triggered, which at times took the price to $57.8K. Such high levels were last seen in December 2021.

Nevertheless, bitcoin sees no significant barriers to growth to levels just above $60K. Bitcoin can quickly go there or around the historical highs at $69K, but the subsequent growth may require a few months of consolidation.

Growth breeds optimism, and now there is a proliferation of predictions that the price will soon reach six figures. In our view, the chances of a price rise above $100K exceed 50% in the 9–12-month horizon. And if markets come under pressure from an economic slowdown, it could take more than a year to reach a new level.

News background

According to CoinShares, investment in crypto funds rose by $598 million last week, following a record $2.452 billion inflow the week before, the fourth consecutive week of growth. Investments in bitcoin rose by $570 million, Ethereum by $17 million, and Solana fell by $3 million. Investments in funds that allow shorting bitcoin increased by $4 million.

Inflows into crypto funds have exceeded $5.7 billion since the beginning of the year, with total assets under management (AuM) rising to $68.3 billion, although still far from the record high of $87 billion reached in November 2021.

Bitcoin is gaining popularity as a haven asset in countries with persistently high inflation, Bitfinex noted. Macroeconomic risks this year make it relevant to buy the first cryptocurrency, gold, and silver.

According to BitMEX Research, trading volume in the spot bitcoin ETF market exceeded $50 billion. Mike Novogratz, CEO of Galaxy Digital, commented on the growing interest of institutional investors in the cryptocurrency market.

LookIntoBitcoin notes that the value of bitcoin is being affected by the upcoming halving in April, as well as the imbalance between demand for the asset and its availability in the cryptocurrency market.

According to The Block, the cumulative amount raised by crypto and blockchain companies from venture capitalists since 2017 has exceeded $90 billion, with DeFi, infrastructure, NFT/gaming and Web3 attracting the most interest.

MicroStrategy acquired an additional 3,000 BTC, said founder Michael Saylor. MicroStrategy owns 193000 BTCs worth approximately $6.09 billion (average price $31,544).

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)