Crypto market calm

Market Picture

Cryptocurrency market capitalisation has changed little over the past 24 hours, falling 0.1% to $2.03 trillion. The sentiment index remains in the ‘Fear’ territory despite rising 1 point to 32 on Friday.

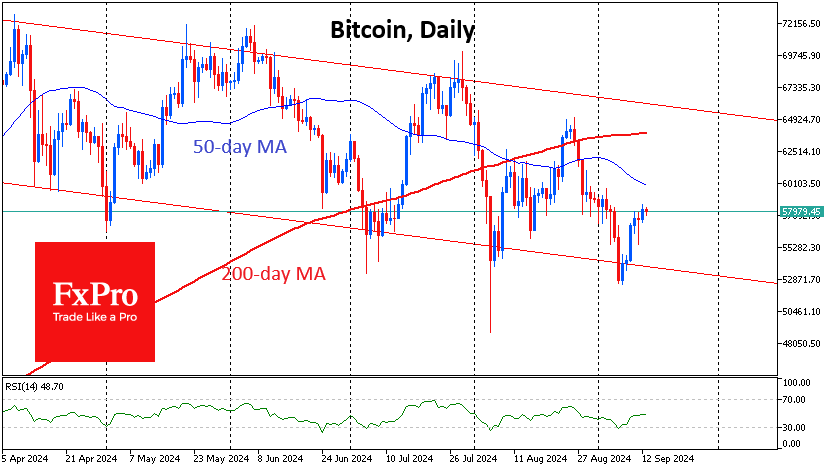

Bitcoin has found a balance between buyers and sellers, remaining at $58,000. The most active buyers seem to have temporarily switched to gold and equities. The daily chart shows a series of higher intraday highs, indicating a bullish advantage.

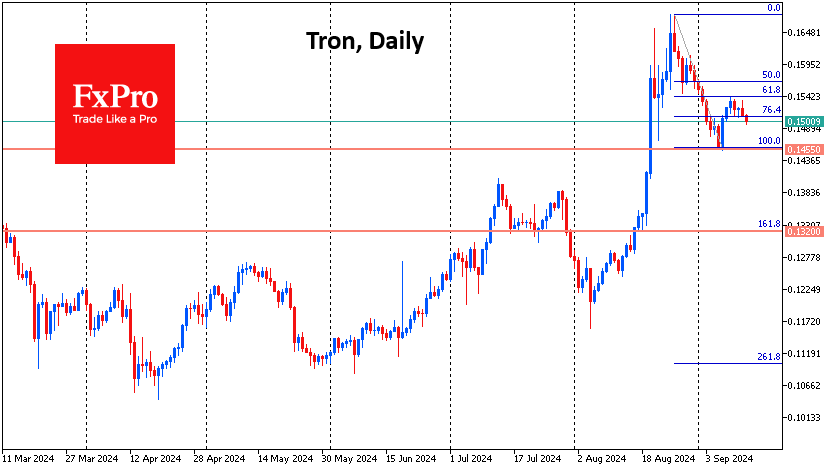

Tron continues to be under pressure and has returned to $0.15. The recent rebound fits into a technical Fibonacci retracement pattern to 61.8% of the initial decline. A break of $0.1455 could accelerate the decline, making $0.1320 a bearish target.

News Background

Bitcoin could reach a new record by the end of the year, regardless of the outcome of the US presidential election. Standard Chartered predicts that a Trump victory will push the price to $125K, while a Harris victory will push it to $75K. Recent polls show Harris with an advantage.

The FTX and Alameda-linked wallet has withdrawn 177,693 SOL ($23.75 million). These coins can be transferred to central exchanges for sale.

The US SEC has fined eToro USA $1.5 million for trading in unregistered securities. US clients can now only trade Bitcoin, Bitcoin Cash, and Ethereum on the platform.

Republicans in the US House of Representatives will investigate the SEC for politically motivated hiring practices.

The UK government introduced a bill to Parliament on the legal status of Bitcoin and other cryptocurrencies, which could be recognised as a new form of property.

Uniswap's share of the DEX market has fallen from more than 50% in October 2023 to 36% now. The Block attributes this trend to increased competition and innovation in the crypto space.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)