Dollar weakness persists

Dollar retreats despite improved risk appetite

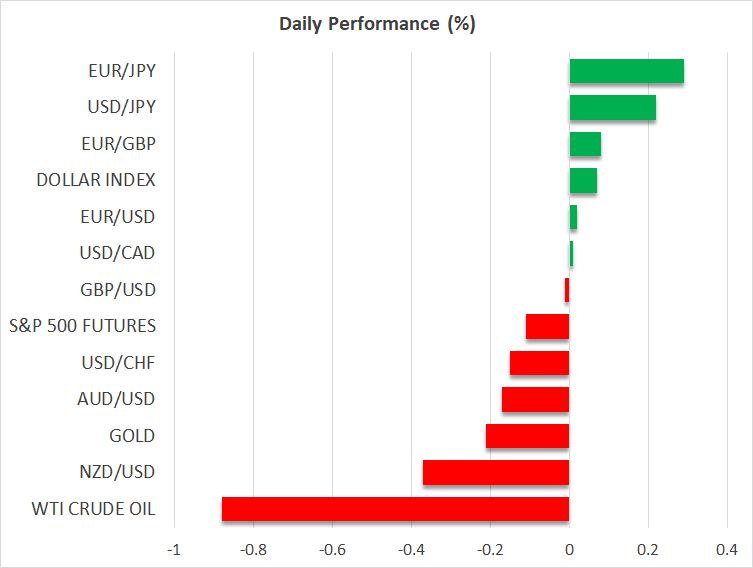

The dollar has started the new week on the back foot, losing ground against both the euro and the pound, and quickly surrendering last week’s hard-earned gains. There is no clear catalyst for the dollar’s weakness, with investors preparing for the heavy earnings schedule ahead and the ongoing tariff and Fed uncertainty. Notably, gold rose to $3,400 overnight, as certain market participants remain worried about the broader outlook. The precious metal is proving very resilient, even in periods typically less supportive of its risk-off nature.

Meanwhile, both the S&P 500 and Nasdaq 100 indices posted new all-time highs yesterday, as the wait for key technology stock earnings is almost over. Alphabet and Tesla are scheduled to publish their Q2 earnings and guidance on Wednesday, after the US markets close. Microsoft and most of the remaining heavyweights will report their results next week.

Notably, despite the muted risk-on sentiment, bitcoin is in the red this week, severely underperforming alternative cryptocurrencies, and more specifically ethereum and XRP. Last week’s approval of the GENIOUS act, along with two additional crypto-related bills on their way to the Senate, have been boosting stablecoins and altcoins at the expense of bitcoin. The king of cryptocurrencies is still up 25% this year though, outperforming most major equity indices.

Tariffs: No real progress achieved

The US administration continues to employ the carrot-and-stick approach on tariffs. One day, negotiations are said to be progressing well, with countries reportedly eager for an agreement; the next, White House Press Secretary Leavitt leaves the door open to further tariffs letters being sent out. Notably, negotiations with the EU, India and Japan appear to have stalled, most likely as these states have yet to cave in.

August 1 is fast approaching and the lack of significant trade deals raises the odds of reciprocal tariffs being imposed temporarily to scare nations into accepting Trump’s demands. The US President will most likely then decide to postpone these tariffs again until September 1, or to some other key date, allowing more time for negotiations.

What is Trump aiming for with the Fed?

While markets have mostly understood Trump’s tariff action plan, they are mostly clueless about Trump’s true intention for the Fed. The US President has repeatedly expressed his preference for lower rates, blaming Chair Powell for keeping US rates too high compared to those of the ECB.

Trump would love to replace Powell with a more subordinate candidate from his already-drawn up list, but he has to wait until May 2026 for his wish to come true. However, the continued speculation about Powell’s future and the possibility of a shadow Fed Chair influencing FOMC decisions well before Powell’s term expiry, is probably the worst-case scenario for investors.

Interestingly, both Chair Powell and rate cut supporter Bowman are scheduled to speak later today. There is growing speculation that Powell might talk about monetary policy, potentially laying the groundwork for next week’s meeting, which is not forecast to produce a rate cut. However, the official blackout period is in effect at the moment, reducing the possibility of comments on the monetary policy outlook today.

Yen’s future is clouded

Yen investors are putting on a brave face following Sunday’s disastrous election result for incumbent PM Ishiba, but the outlook is clouded for the Japanese economy. Negotiations with the US have stalled, and, pending a breakthrough, a trade agreement is still not in sight, further denting Japan’s current weak economic momentum. Only a successful deal with the US that protects Japan’s critical industries could help Ishiba retain the PM spot and potentially reopen the door to a BoJ rate hike during 2025. At the time of writing, dollar/yen is edging higher, with the next key resistance level being at 149.57.

.jpg)