EBC Markets Briefing | Aussie dollar fragile after US blacklisted Tencent

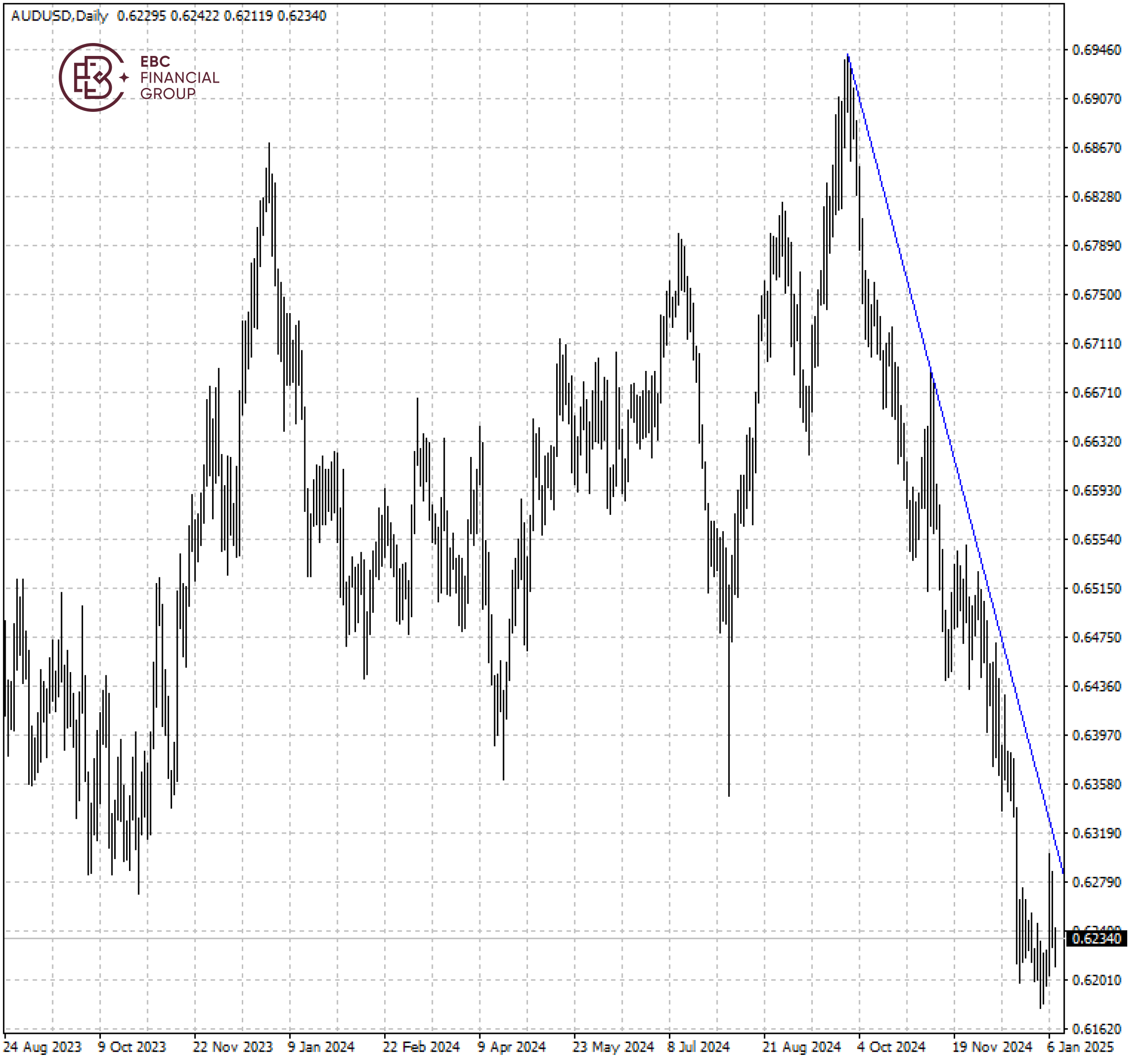

The Australian dollar barely moved on Wednesday as sentiment soured. The currency has weakened more than 7% against the greenback and fallen against every G7 peer over the last three months.

Hedge funds boosted their bearish Aussie wagers to the most since March 2022 in the week ended 31 Dec, CFTC data showed, as Trump-nominated hawkish cabinet could harm Chinese economy.

Tencent and the CATL are among a swath of Chinese companies that have been designated by the Pentagon as having alleged military links, in a move that sent the industry giants’ shares tumbling on Tuesday.

Some analysts say that it could fall below 60 US cents in the coming months. Australia’s economy posted its worst performance in more than 30 years in Q3, excluding the first year of the COVID-19 pandemic.

Westpac said the minutes of RBA’s December gathering tabled the potential for “relaxing the degree of monetary policy tightness.” More key economic data would be available by the time of the February meeting.

A bright spot is that China's iron ore imports are likely to hit a new high in 2025 as trader stockpile cheap ore despite a protracted property crisis weighing on Chinese steel demand.

The sharp slope of descending trendline reflects a strong bearish momentum. The first support level could be the October 2022 low of 0.6170, a break of which could lead to 0.6120.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.