EBC Markets Briefing | Gold prices are going through the roof

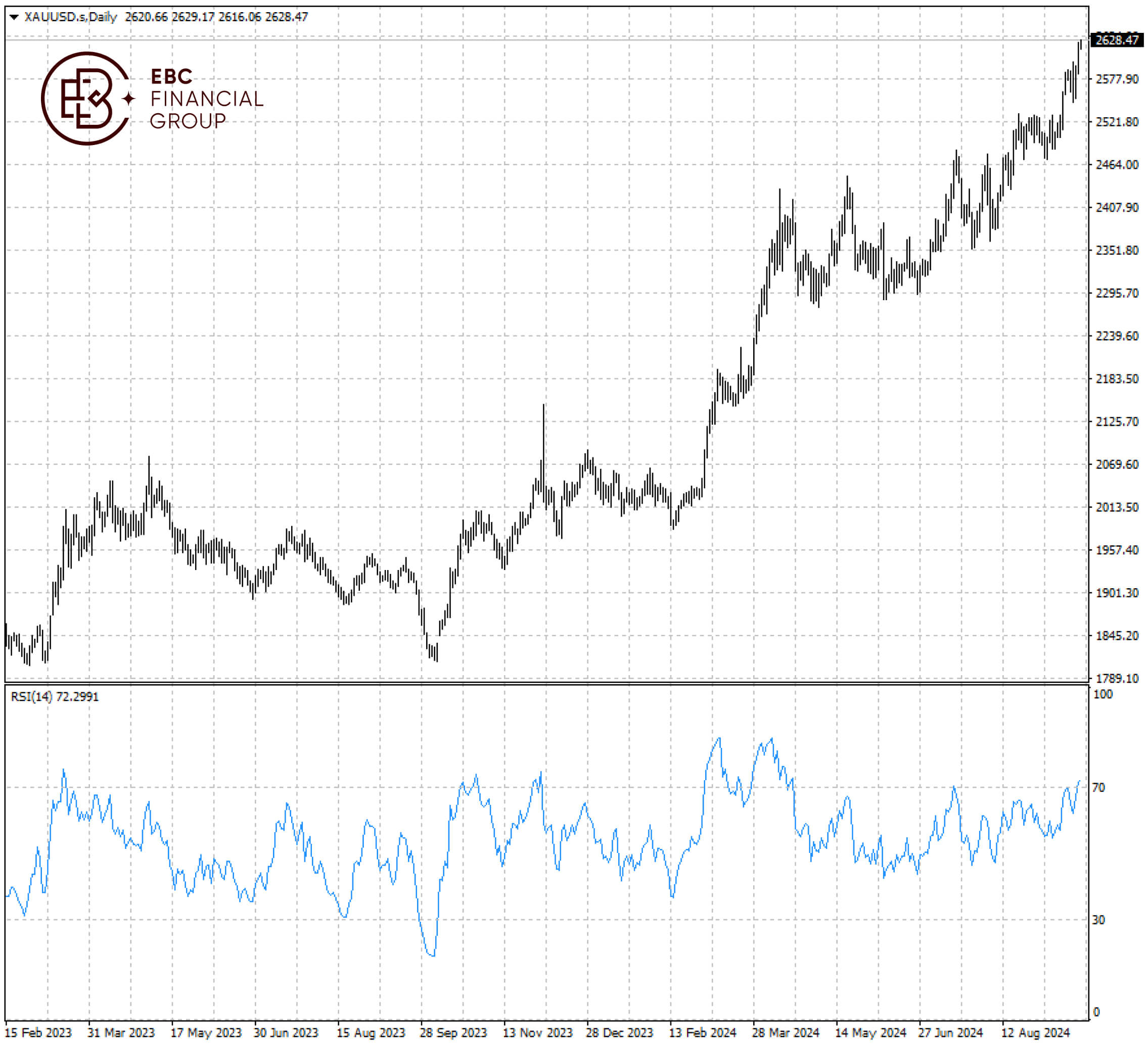

Gold held onto its gains on Monday after rising beyond the $2,600 mark as the prospect of more US interest rate cuts and global geo-political uncertainty boosted its appeal.

Israel and Hezbollah both threatened to increase their cross-border attacks on Sunday. The UN special co-ordinator in Lebanon posted on X that the Middle East was on the brink of "imminent catastrophe".

Ukraine’s President Volodymyr Zelensky is going to meet several US representatives this week to discuss whether Ukraine should be allowed to use long-range Western-supplied missiles on Russian soil.

Meanwhile, a surge in demand among Indian consumers for gold jewellery and bars after a recent cut to tariffs. India’s gold imports hit their highest level on record by dollar value in August, government data showed.

India accounted for about a third of gold jewellery demand last year, and has become the world’s second-largest bar and coin market despite rising purchase costs, according to data from the WGC.

In China, the world’s biggest physical buyer of gold, high prices have led to fewer jewellery sales, but more sales of gold bars and coins, which surged 62% in Q2 compared with a year earlier.

Bullion entered overbought territory, but it is expected to stay above the psychological support level. The strong momentum signals more upside room unless $2,560 does not hold.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.