EBC Markets Briefing | Loonie grapples with Trump's indignation

The Canadian dollar dropped on Friday on more signs of upheaval in the global trade landscape, as Trump said he planned to impose blanket levies of 15% or 20% on most trade partners.

Canadian imports currently face a 25% tariff that Trump imposed earlier this year over the country's alleged role in the flow of fentanyl, with exemptions for those in compliance with the UMCA.

At the G7 Summit in June, PM Carney and Trump said they were committed to reaching a new deal before 21 July. In late June, Ottawa removed a tax on Big Tech to facilitate the talk.

Canadian companies are boosting trade with other countries to minimize economic damage, government data shows. But economists said there are limits to how much it can diversify.

Carney said that Ottawa is prepared to prioritize a new pipeline from Alberta to the Pacific. Building a new pipeline would signal that Canada is getting serious about reaching Asian markets with its oil.

The OPEC cut its forecasts for global oil demand in 2026 to 2029 because of slowing Chinese demand. The EU is expected to propose a floating Russian oil price cap in a new sanctions package this week.

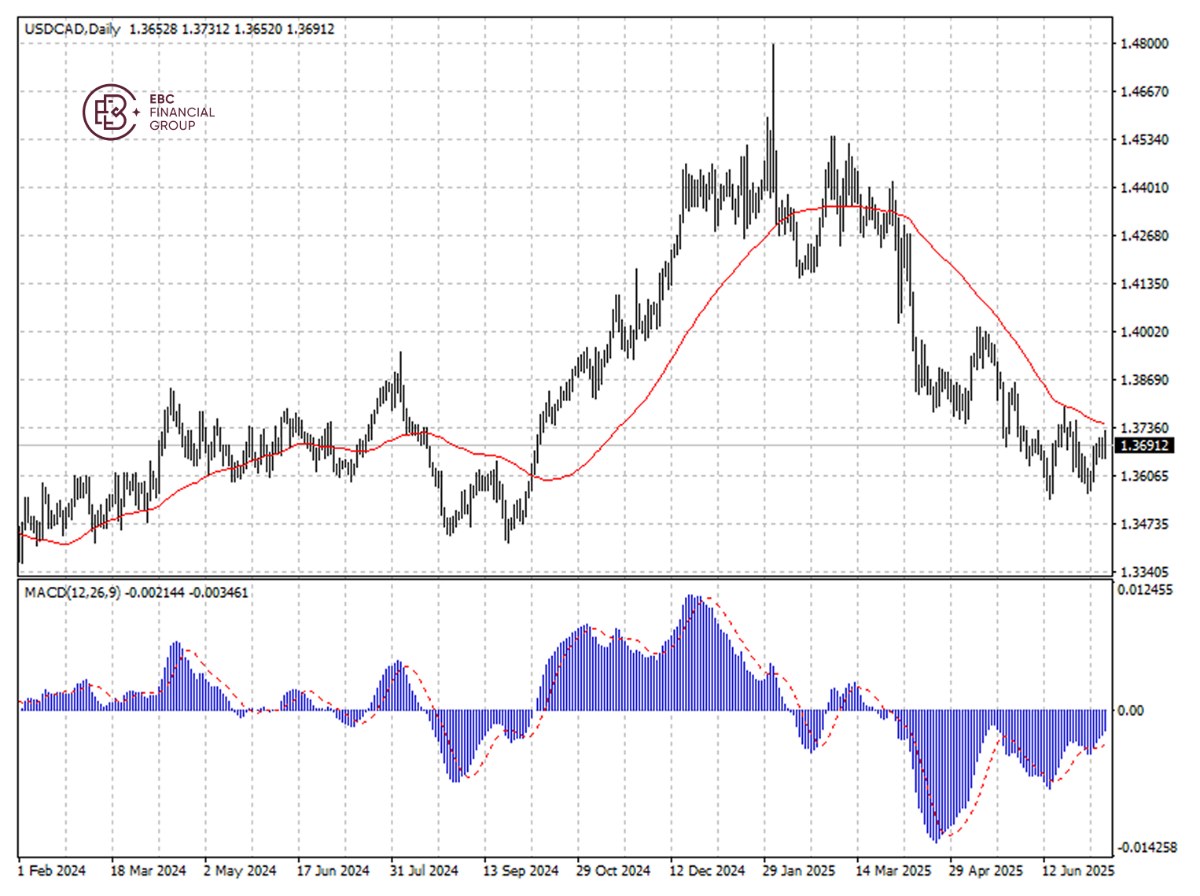

MACD divergence indicates the loonie's rise will be challenged soon. It is expected to weaken to 1.3720 per dollar, which would expose 1.3760 per dollar.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.