EBC Markets Briefing | Oil in the doldrums despite Libya’s lower output

Oil prices held mostly steady on Thursday as a smaller-than-expected draw in US crude inventories and continued worries over China demand countered supply disruptions out of Libya.

Both contracts lost over 1% in the last session, after data showed that US crude inventories dropped by 846,000 barrels last week, less than analyst expectations for a draw of 2.3 million barrels.

A number of oil fields in Libya have halted production amid a fight for control of the country's central bank, with one consulting firm estimating output disruptions of between 900,000 and 1 million bpd for several weeks.

Wall Street is beginning to sour on the outlook for crude next year, with Goldman Sachs and Morgan Stanley seeing that the crude market will be in surplus thanks to potentially increasing supplies.

The two banks now foresee global benchmark Brent averaging less than $80 a barrel in 2025, with Goldman’s revised forecast cut to $77, while Morgan Stanley sees futures ranging from $75 to $78.

Goldman said prices could significantly undershoot in the short term, especially if OPEC were to strategically discourage US shale growth more forcefully, or if a recession were to reduce oil demand.

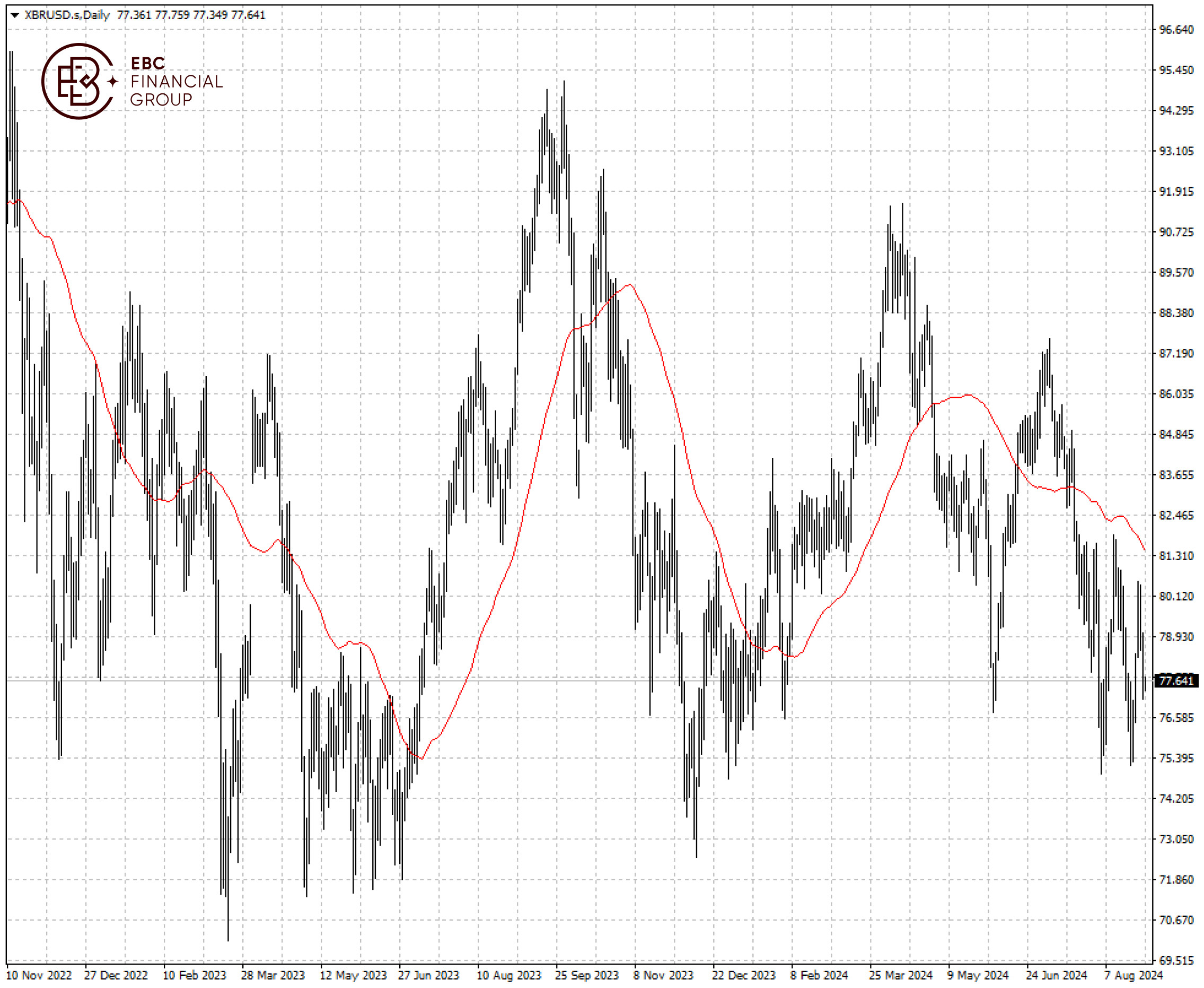

Brent crude looks bearish trading below 50 SMA and with the latest rally ending around $80. The path of least resistance is inclined to downwards, potentially edging closer to $76.4.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.