Gold rises as demand for safe-haven assets returns

By RoboForex Analytical Department

Gold prices climbed to 3,260 USD per troy ounce on Monday, as global uncertainty—particularly around US-China trade negotiations—continues to drive demand for safe-haven assets.

Trade tensions and a weaker dollar support gold

Market sentiment remains cautious after US President Donald Trump stated that China is ready to make a deal, yet offered no specifics on the content or timing of renewed negotiations.

Earlier, Beijing confirmed it was reviewing US proposals to restart talks but reiterated that certain conditions must be met before any dialogue can begin. This lingering uncertainty continues to bolster investor interest in gold.

Adding to the upside pressure, the US dollar weakened, making gold more attractive for holders of other currencies.

Investors are now turning their attention to the upcoming Federal Reserve meeting, which begins on Tuesday and concludes on Wednesday evening. Markets widely expect the Fed to maintain current interest rates, despite renewed calls from Trump to lower them.

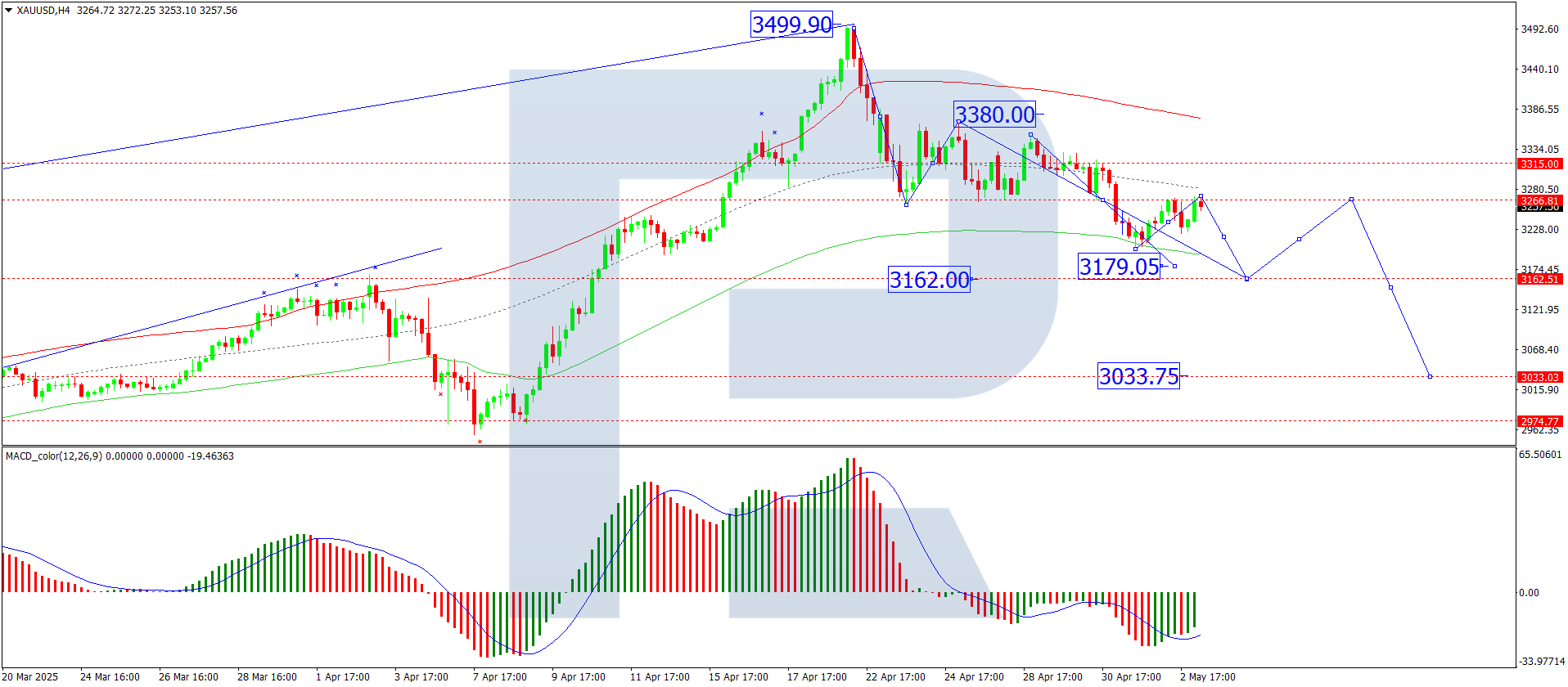

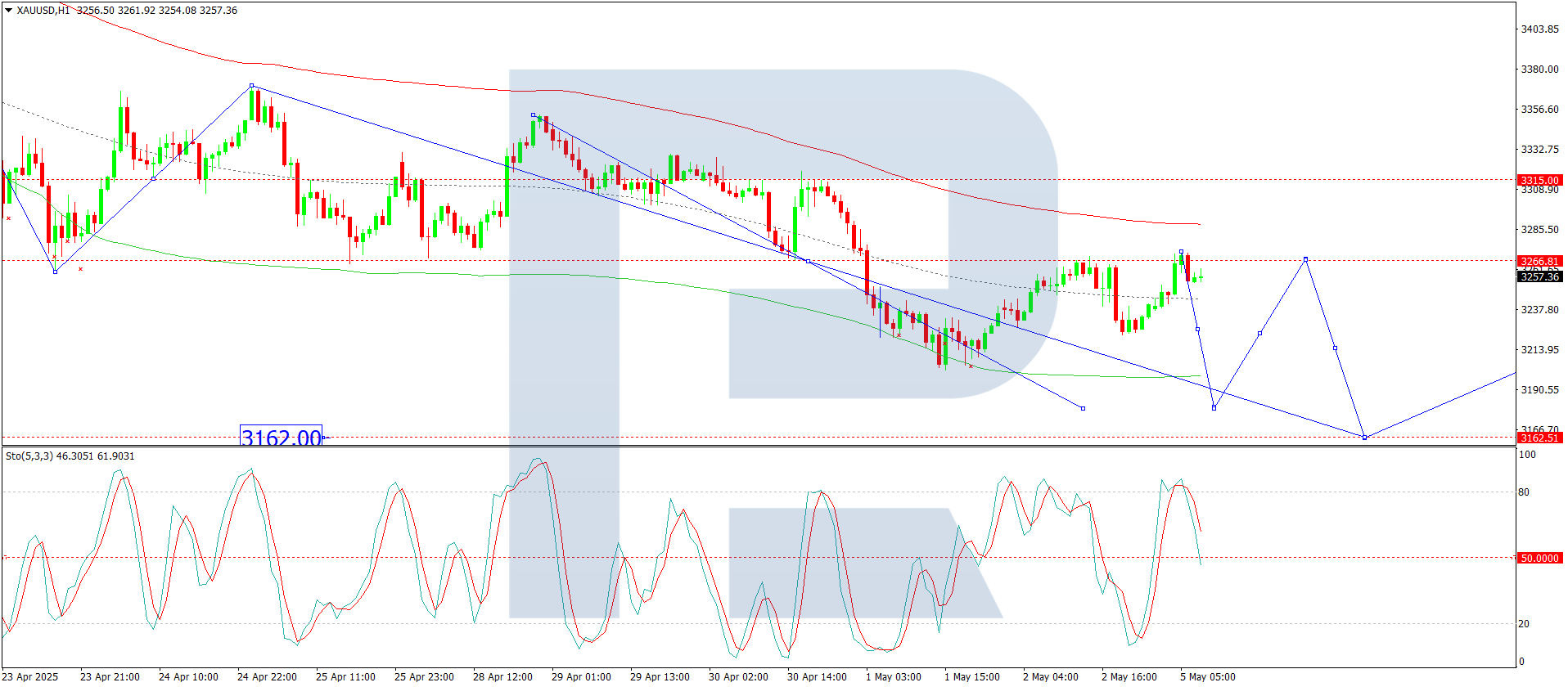

Technical analysis of XAU/USD

On the H4 chart, XAU/USD is consolidating around 3,266 USD. A decline to 3,165 USD is possible in the short term. After reaching this level, the market may correct back up to 3,266 USD. If the correction completes, another downward wave could unfold with a target at 3,033 USD. The MACD indicator supports this bearish scenario, with its signal line below zero and pointing sharply downwards.

On the H1 chart, gold broke below 3,266 USD, reached the local target of 3,202 USD, and then corrected back up to test 3,266 USD from below. The formation of another downside wave towards 3,179 USD is relevant today. The Stochastic oscillator confirms this outlook, with its signal line below 80 and heading directly towards 20, indicating continued downward momentum.

Conclusion

Gold remains supported by geopolitical uncertainty and a weakening dollar, while technical indicators point to short-term downside potential before another possible corrective rebound. Key levels to watch are 3,179 USD and 3,165 USD as near-term support, with a broader bearish target at 3,033 USD. The Fed's upcoming meeting may influence price direction depending on its tone regarding interest rates and the broader economic outlook.

DisclaimerAny forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.