S&P 500 Pauses Amid Hawkish Fed and Tariff Uncertainty

S&P 500 Pauses Amid Hawkish Fed and Tariff Uncertainty

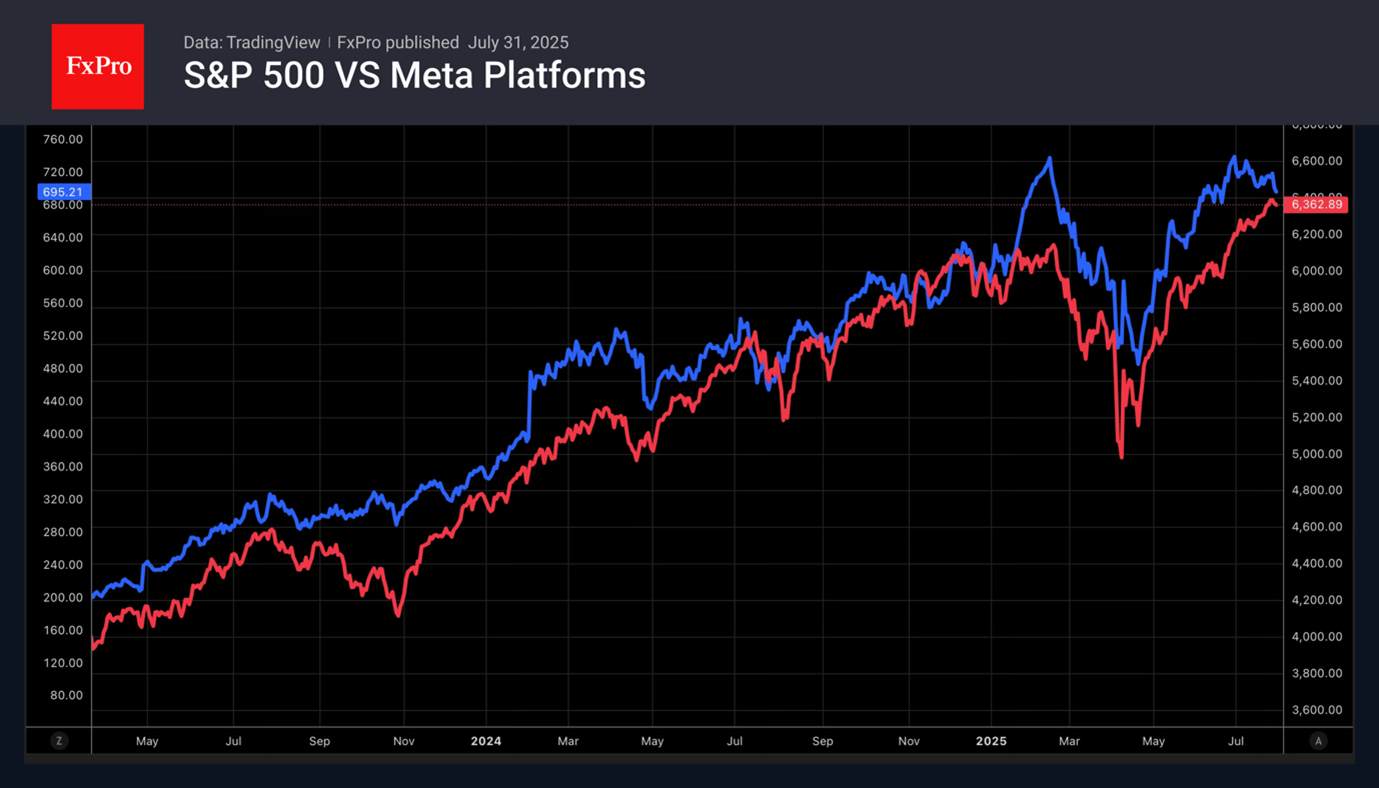

The S&P 500 retreated from record highs, frightened by the Fed's lack of hints about resuming the cycle of monetary expansion in September. Jerome Powell made it clear that lowering rates prematurely is a bad idea. Accelerating inflation will lead to higher borrowing costs, which is ineffective. As a result, the central bank's passivity outweighed the bullish factors.

Trading deals are being concluded en masse ahead of the 1st of August. South Korea has become the White House's latest victim. The US has imposed a 15% tariff and demanded investments of $350 billion and purchases of American energy products worth $100 billion.

S&P 500 companies continue to relish in positive corporate reporting. Meta Platforms and Microsoft have announced increased spending on artificial intelligence technology. However, the onset of a seasonally weak period for US stocks is holding back buyers. Over the past 10 years, the broad stock index has risen only five times in August.

The S&P 500's reluctance to continue its rally in response to good news is an alarming sign. Perhaps most of the positive news has already been factored into the quotes, opening the door for a correction.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)