The crypto market continues its move up

Market picture

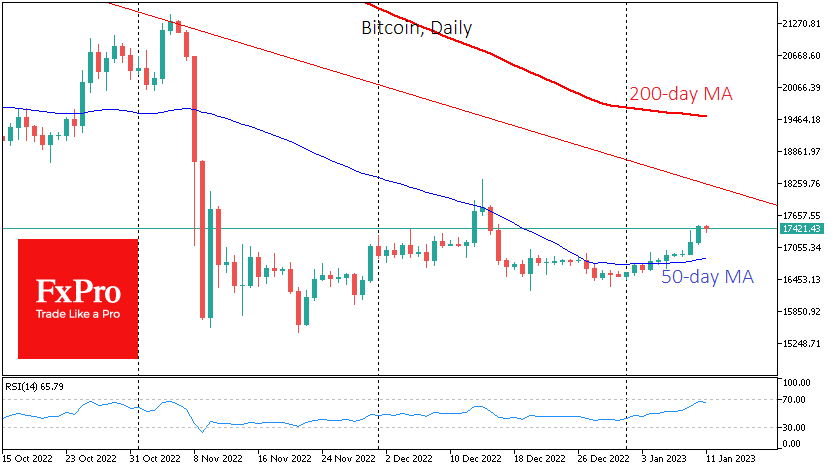

Bitcoin returned to growth on Tuesday and was approaching $17.5K in early trading on Wednesday, developing its smooth ascent to levels last seen in mid-December.

Total crypto market capitalisation has risen 1% in the last 24 hours to $857bn, while top altcoins are adding between 0.1% (Cardano) and 3.9% (XRP).

Bitcoin will confirm its bullish trend if it consolidates above 17800 at the end - the highest close of the day in December. In this case, the sequence of higher highs will be started, whereas, since November, we only have a sequence of higher local lows.

News background

Gemini co-founder Cameron Winklevoss in another open letter, called on Digital Currency Group (DCG) head Barry Silbert to step down due to $900 million in outstanding debt.

Despite DCG's accumulated problems, the price of bitcoin trust Grayscale (GBTC) rose 12% overnight thanks to news of Morgan Stanley's $3.6 purchase of Grayscale Investments' bitcoin shares. The discount in the value of GBTC relative to NAV (bitcoin market price) fell to 38% from a record 49% recorded on 13 December.

The former CTO of the bankrupt FTX exchange has begun cooperating with the investigation, which could shed light on the details of multi-million-dollar donations to US politicians by FTX and its former head Sam Bankman-Fried.

Meanwhile, DeFi project Ondo Finance has launched tokenised US Treasury bonds.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)