To US Market Bulls: Ready, Steady…

To US Market Bulls: Ready, Steady…

The pressure on the US indices has intensified. The acceleration is explained by the change of the market regime to bearish. Last week, the S&P500 and Nasdaq100 closed below their 200-day moving averages. The key US indices have not traded consistently below this curve since early 2023, and a dip below it in early 2022 signalled the start of a broad correction.

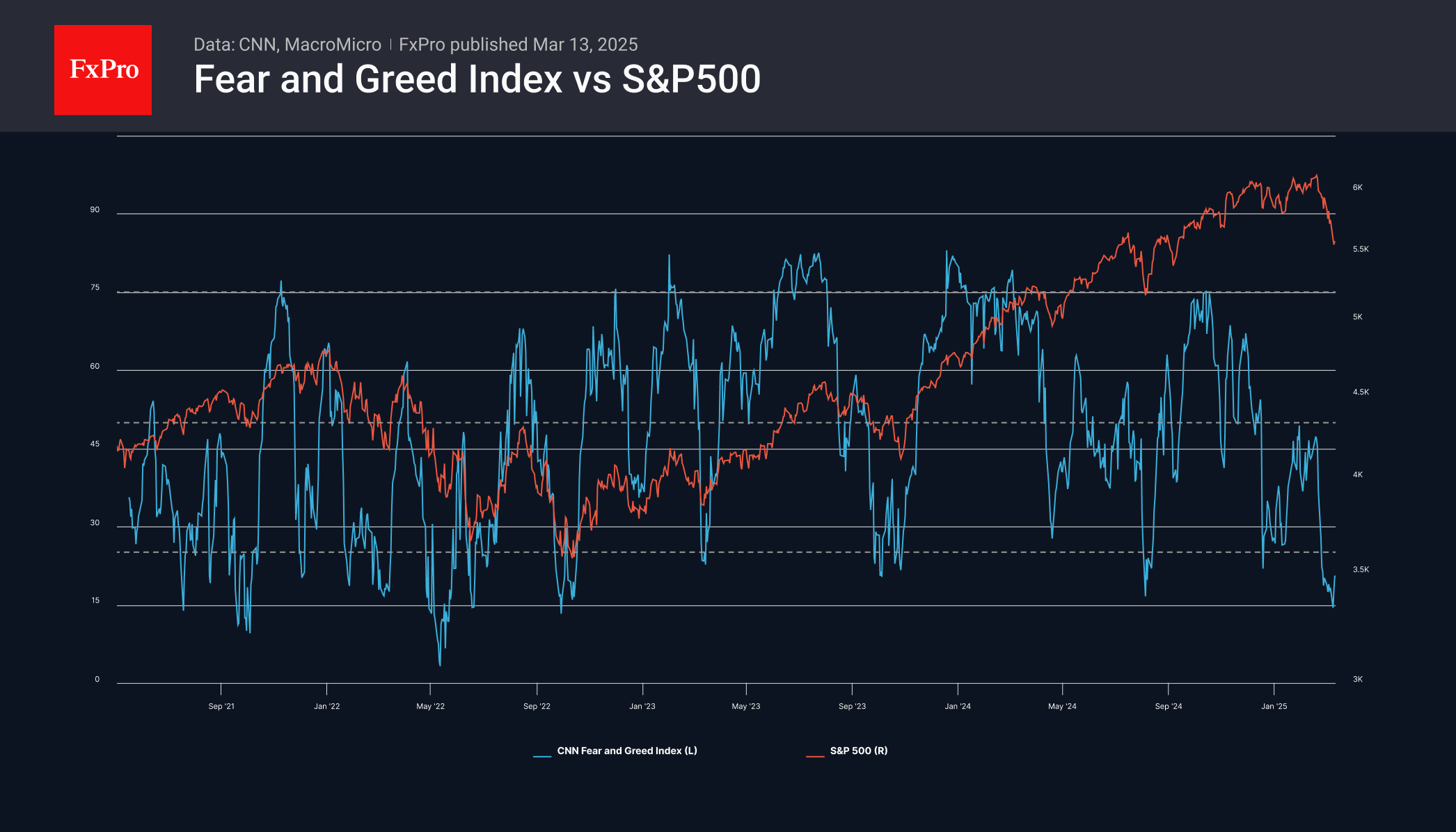

Now, the trillion-dollar question is when will the bottom be? It is commonly said how important it is to be bold when everyone is afraid. The sentiment index is in the extreme fear zone, and earlier in the week, it was down to 14. These were the lowest levels since May 2022. But a word of caution to early buyers: In the previous market cycle, the S&P500 did not bottom until October, five months later.

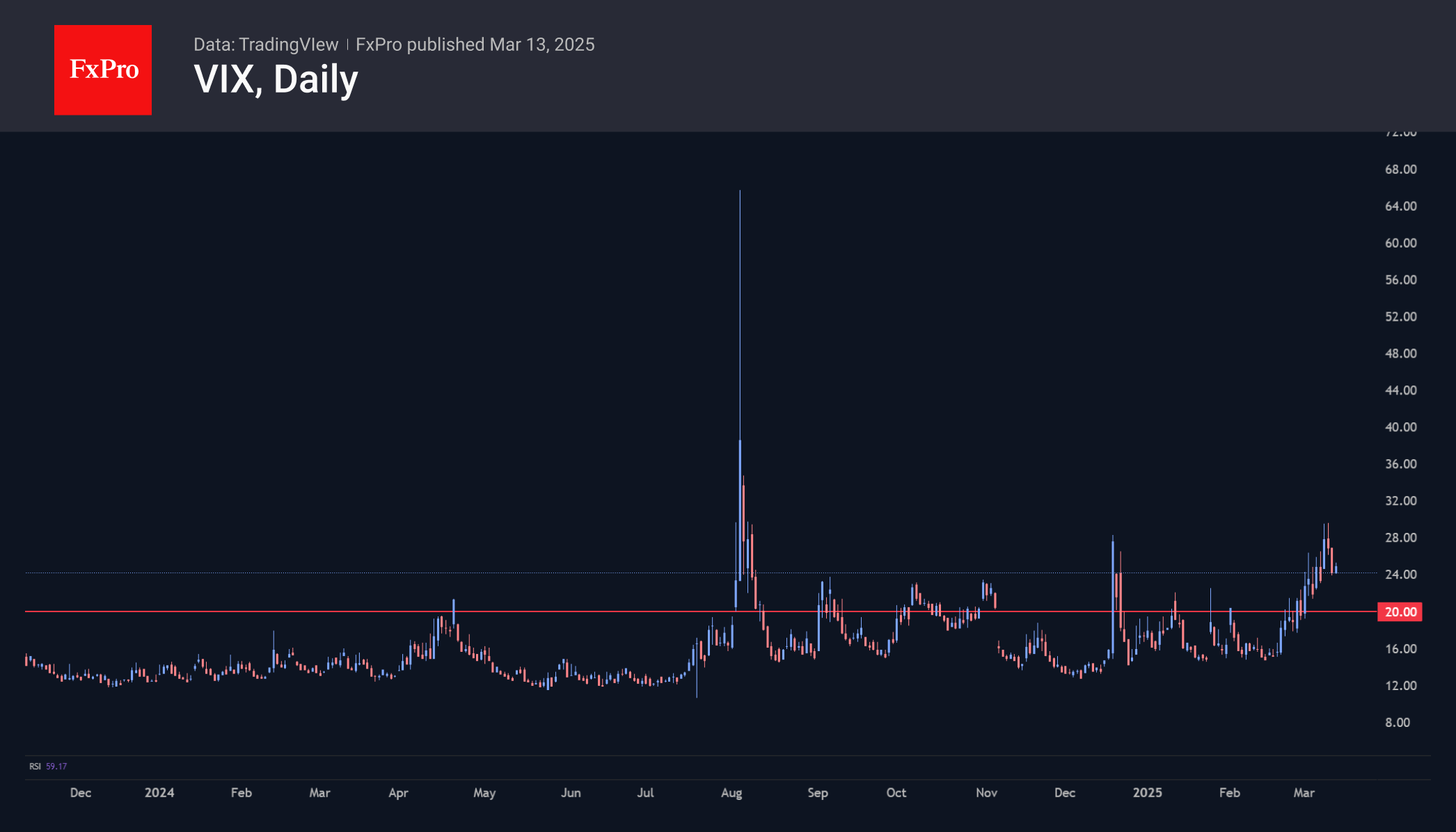

Another measure of fear, the VIX indicator, remains above 20, indicating heightened investor nervousness.

Daily timeframes show oversold conditions, with the RSI index last hitting this level in early 2020. However, similar conditions occurred nearly 20 times in 2018, signalling extreme oversold levels. Back then, the market experienced a brief bounce rather than a full reversal.

The technical picture makes us cautious about short positions, suggesting a high chance of a bounce or reversal. However, signals from Trump or Powell-level politicians are needed to ensure a reversal.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)