UK Inflation Cools Down Pound

UK Inflation Cools Down Pound

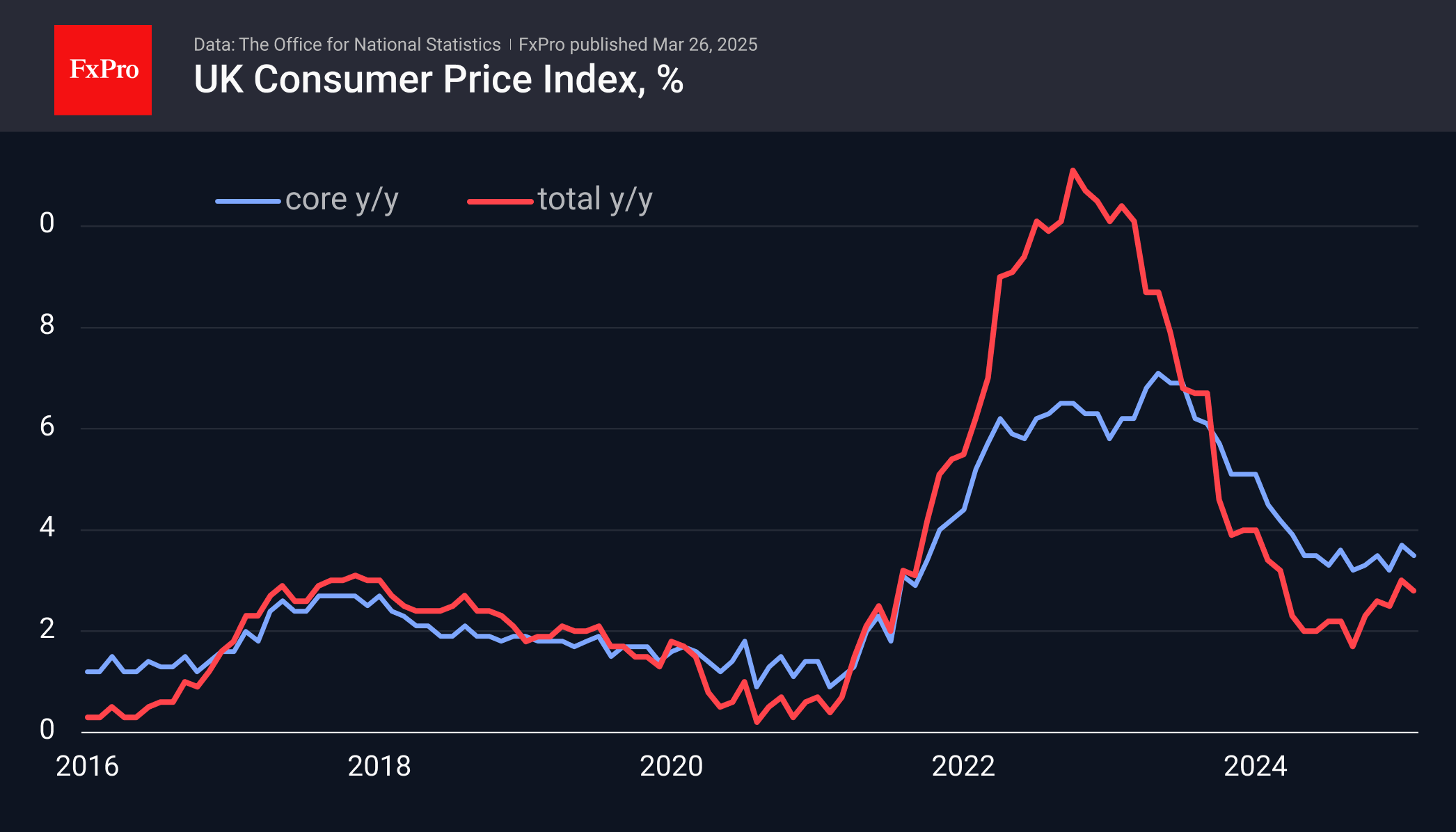

UK consumer inflation was weaker than expected. The annual rate of price increases slowed to 2.8% from 3.0%. It remains well above the local low of 1.7% recorded in September. The latest deceleration is still more of a hope than a signal that inflation is slowing, as the previous reading was the highest since March 2024.

However, the downside surprise may allow the Bank of England to return to cutting interest rates sooner and maintain the pace of quarterly cuts.

The GBPUSD reacted to the weaker-than-expected data by falling around 0.5% to 1.2885 before stabilising around 1.2900. Technically, the Pound is at risk of a correction (at least) after a 7.5% rally from the January lows. In the middle of last week, the GBPUSD stalled near 1.3000, clearly reluctant to cross the psychologically important line without fundamental support and amid accumulated local overheating.

Possible correction targets are 1.2800 and 1.2650. The 200-day moving average and 76.4% retracement level lie around the former. The 50-day average and 61.8% level cross the latter.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)