Advertisement

Análisis

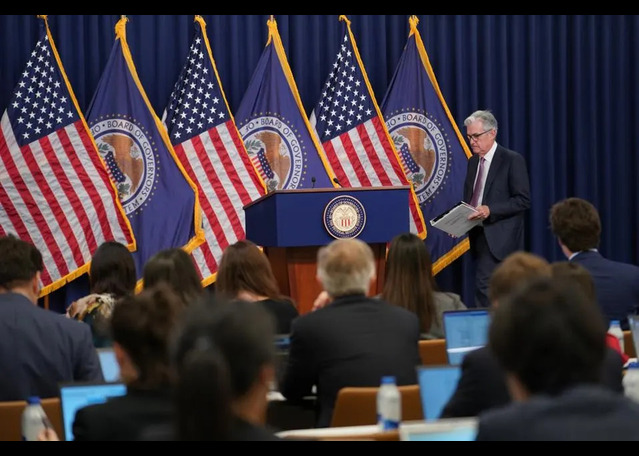

Traders lock gaze on US inflation and Fed decision

Dollar awaits US CPI data and Fed projections - Euro still feels the heat of EU elections - Nasdaq and S&P 500 hit fresh records ahead of Fed

XM Group

|

hace 551

Euro hits monthly low amid political instability in France

The EUR/USD pair declined to 1.0740 on Wednesday, nearing the month’s low. This downward movement is primarily driven by the political instability in France following the significant developments in the European Parliament elections.

RoboForex

|

hace 551

EBC Markets Briefing | US stocks notch records before Fed decision

Nasdaq 100 and S&P 500 hit all-time highs Tuesday. Investors expect no Fed rate change, but the FOMC will release its economic projections.

EBC Financial Group

|

hace 551

EBC Daily Snapshot Jun 11, 2024

Tuesday saw the dollar near a one-month high versus the euro and a one-week peak against the yen, backed by strong job figures last week.

EBC Financial Group

|

hace 551

The U.S. dollar: how will the Fed's key rate decision affect it?

At its May meeting, the Federal Reserve maintained the target range for the federal funds rate at 5.25%-5.50%, marking the sixth consecutive time it has remained unchanged.

The likelihood of a Fed rate cut in September has increased significantly, rising from 50% to 70% during the first week of June due to indicators of a cooling labour market and downward revisions in labour costs.

OctaFX

|

hace 551

EBC Markets Briefing | A perfect storm lurks in Europe after far-right gains

The pound dipped against the euro as Macron's snap election call followed a far-right victory, causing the common currency to tumble.

EBC Financial Group

|

hace 551

The crypto market took a break from support

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: The crypto market took a break from support

FxPro

|

hace 551

Dollar Calm ahead of FOMC Minutes

The dollar index steadied in the last session, trading above the $105 mark, ahead of the highly anticipated FOMC meeting minutes. Market expectations are leaning towards a more hawkish stance from the U.S. central bank due to a tight labour market.

PU Prime

|

hace 551

Daily Global Market Update

Bitcoin, Alibaba stocks down. AUD/USD flat, Gold up slightly. Oil up on forecast, dollar strong. Economic data from Germany, UK, Japan, US Fed rate decision eyed.

Moneta Markets

|

hace 551

Forex Market Report - 12th June 2024

Our forex market report offers an overview of critical economic and financial events that impact the global forex markets. Traders should closely monitor developments to fine-tune their trading strategies accordingly.

DNA Markets

|

hace 551

The dollar fought back its uptrend

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: The dollar fought back its uptrend

FxPro

|

hace 552

Alarming UK labour market data

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: Alarming UK labour market data

FxPro

|

hace 552

Market prepares for Wednesday’s events

Euro tries to recoup part of Monday’s losses. US stock indices trade sideways but volatility remains high. Lighter US calendar but some interest on the 10-year bond auction. Pound is on the backfoot after the weaker jobs data

XM Group

|

hace 552

Brent Crude Oil stabilises around 81.50 USD amid demand optimism

Brent crude oil is holding steady at 81.50 USD per barrel on Tuesday, following a significant surge of over 2.5% the previous day.

RoboForex

|

hace 552

Crypto nosediv

Expert market comment made by senior analyst Alex Kuptsikevich of the FxPro Analyst Team: Crypto nosediv

FxPro

|

hace 552

Dollar Steadies as the Market Await for FOMC Minutes

The dollar index is poised at its recent high level, while U.S. equity markets eked out marginal gains as the market awaits Wednesday’s crucial CPI reading and the FOMC meeting minutes.

PU Prime

|

hace 552

Upcoming Economic Indicators and Federal Reserve Decisions

This Wednesday is set to be crucial for gaining economic insights, with several key reports and decisions lined up. In Wednesday night we will see the release of the May Consumer Price Index (CPI) report, followed by the June Federal Open Market Committee (FOMC) meeting in the Thursday morning. Additional data on the Producer Price Index (PPI), import prices, and the University of Michigan's consu

ACY Securities

|

hace 552

Daily Global Market Update

Euro dipped slightly, gold and oil rose, Bitcoin and pound flat. Investors cautious ahead of key economic data and Fed meeting. Upcoming events include Japan PPI, UK employment data, and US business optimism index.

Moneta Markets

|

hace 552

ECB Trims Rates, Euro Climbs on Short-Covering; US Payrolls Next

The Euro (EUR/USD) edged 0.15% higher to 1.0890 (1.0875) after the ECB trimmed rates by 25 basis points to 4.25%, which was widely expected.

ACY Securities

|

hace 552

European Central Bank Cuts Rates by 25 bps as Expected, Despite Higher Inflation Projections for 2024 and 2025

The European Central Bank (ECB) has reduced its benchmark interest rates by 25 basis points, aligning with market expectations. This adjustment lowers the primary refinancing rate to 4.25% and the deposit rate to 3.75%. It marks the ECB's first rate cut since 2019, prompted by revised inflation forecasts for 2024 and 2025.

ACY Securities

|

hace 552