FXCharger (de forexstore )

The user has made his system private.

Edit Your Comment

Discusión FXCharger

Mar 20, 2020 at 14:56

Miembro desde Oct 28, 2018

posts 21

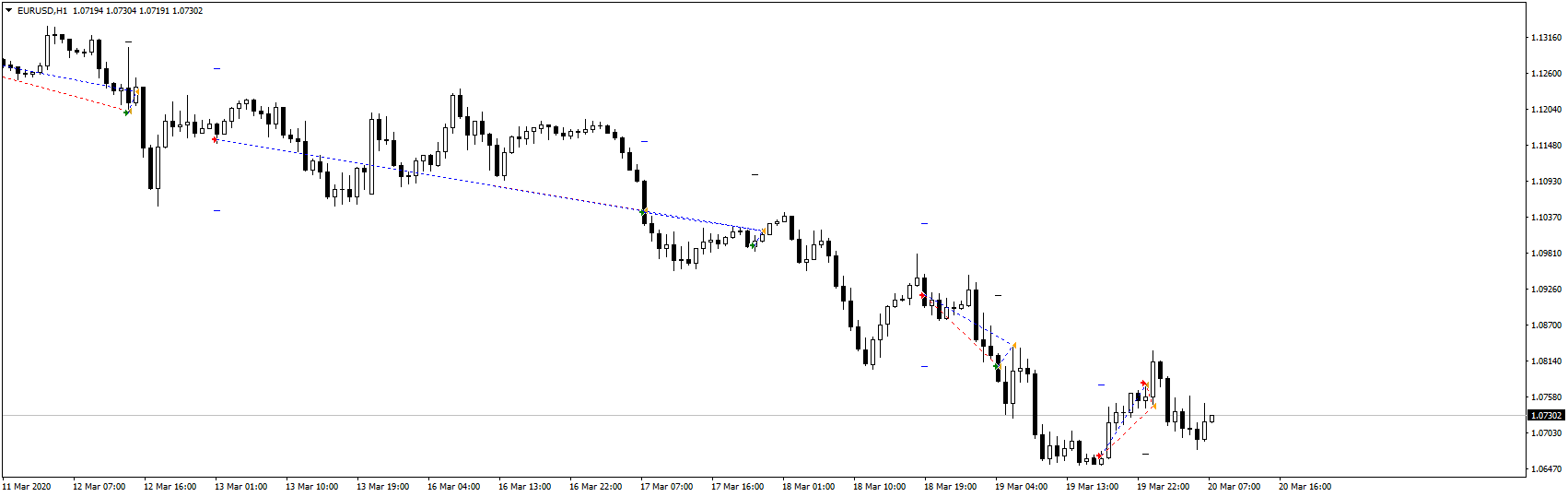

The key questions are NOT what you think.

The most important conditions do not apply in this strategy, unfortunately.

It's all about timing of when do you open another martingale position and when you close all positions at once.

Hint: "1% of equity is hit" is not the right target to close all positions.

Look at this:

https://www.myfxbook.com/community/trading-systems/fxcharger/1247157,36#postRow350614

No losses in the outcome in this critic period.

The most important conditions do not apply in this strategy, unfortunately.

It's all about timing of when do you open another martingale position and when you close all positions at once.

Hint: "1% of equity is hit" is not the right target to close all positions.

Look at this:

https://www.myfxbook.com/community/trading-systems/fxcharger/1247157,36#postRow350614

No losses in the outcome in this critic period.

Mar 20, 2020 at 15:03

Miembro desde Oct 28, 2018

posts 21

Miembro desde Mar 03, 2020

posts 9

Apr 19, 2020 at 01:07

Miembro desde Oct 28, 2018

posts 21

3165 posted:

Option B: SL is hit, account will have a huge drawdown and the first initial trades' size will be modified from 0.1 lot to 0.4 lot until drawdown is covered. So lot sizes will be: 0.4, 1.6, 6.4, 25.6....

It should take a few months to recover if at all.

Good luck!

I am right again.

fxcharger modified initial lots after SL hit. It begins now with initial 0.5 lot (instead of 0.1 lot) - Huge risk!

Apr 21, 2020 at 07:55

Miembro desde Nov 26, 2016

posts 93

3165 posted:3165 posted:

Option B: SL is hit, account will have a huge drawdown and the first initial trades' size will be modified from 0.1 lot to 0.4 lot until drawdown is covered. So lot sizes will be: 0.4, 1.6, 6.4, 25.6....

It should take a few months to recover if at all.

Good luck!

I am right again.

fxcharger modified initial lots after SL hit. It begins now with initial 0.5 lot (instead of 0.1 lot) - Huge risk!

That's what he said. Lightning strike theory ;-)

He's very transparent here.

Apr 21, 2020 at 10:57

Miembro desde Oct 28, 2018

posts 21

MicF posted:3165 posted:3165 posted:

Option B: SL is hit, account will have a huge drawdown and the first initial trades' size will be modified from 0.1 lot to 0.4 lot until drawdown is covered. So lot sizes will be: 0.4, 1.6, 6.4, 25.6....

It should take a few months to recover if at all.

Good luck!

I am right again.

fxcharger modified initial lots after SL hit. It begins now with initial 0.5 lot (instead of 0.1 lot) - Huge risk!

That's what he said. Lightning strike theory ;-)

He's very transparent here.

Can you please refer me to that?

Apr 23, 2020 at 21:37

Miembro desde Nov 26, 2016

posts 93

Here

fxcharger posted:RoboFX123 posted:

Yes it is same account as is in signalstart. Now the vendor changed the risk. Start firts lot is from 0.10 to 0.35 lots. He wants to quickly catch up with the loss and hence stopped tracking on myfxbook. He is desperate.

Hello!

We always said, that there are no systems that never get loss. I told that it will happen someday with our robot but it's not so scary. Sooner or later the loss will be anyway 😄. That is why we recommend to use drawdown control in our EA.

Yes, you are right, we changed risks, to be able to recover deposit fast. And this idea is damn good because of two factors:

1. As you can see FXCharger has no losess from 2013 year at backtests. And this also proves by live trading from very begining of 2016 year. So we can co we can conclude that losess is a very rare thing for our system. And what is the chance that it will have second loss in near period? It's very and very small chance of that. This couple of months is the best moment to have larger risks and greater profitability.

2. Nobody like drawdowns and then recover the deposit for long time. But with our system risk of second loss is so very low, that we can recover our profits for very quick period of time.

"He is desperate" - It is not so 😁 Everything is fine. We have low drawdown.

Apr 23, 2020 at 21:39

Miembro desde Nov 26, 2016

posts 93

And Here

fxcharger posted:MicF posted:So we can co we can conclude that losess is a very rare thing for our system. And what is the chance that it will have second loss in near period? It's very and very small chance of that. This couple of months is the best moment to have larger risks and greater profitability.

2. Nobody like drawdowns and then recover the deposit for long time. But with our system risk of second loss is so very low, that we

That's obviously statistically not valid.

If you roll a dice and score a 6, the chance to get a 6 on the second roll is exactly the same like the first time, 1/6.

If you do not take into account all the factors, then you are right. But in our situation you need to take into account history. Simple example: What is the chance of eagle side of the coin, when you toss it? It's easy, the chance of each side is 50/50%. If we toss coin 100 times, approximately we will get 50 eagles and 50 tails. But if will be the situation, that we toss the coin 50 times, and get eagle side only 10 times and 40 times of another side of the coin. For the next 50 times of tosses, chance will be the same 50/50? Or we understand that now probability theory will "try" to balance the scales of probability and next 50 times of tosses, will have approximately 40 eagles and 10 another side of coin.

This is a primitive (rough) example, but it shows approximately what I mean. There are many factors that make effect on probability. We can't get guaranty from probability, but we can get it on our side and use it.

I hope this is an interesting food for thoughts 😄

Miembro desde Mar 03, 2020

posts 9

May 08, 2020 at 04:22

Miembro desde Mar 03, 2020

posts 9

MicF posted:

And Herefxcharger posted:MicF posted:So we can co we can conclude that losess is a very rare thing for our system. And what is the chance that it will have second loss in near period? It's very and very small chance of that. This couple of months is the best moment to have larger risks and greater profitability.

2. Nobody like drawdowns and then recover the deposit for long time. But with our system risk of second loss is so very low, that we

That's obviously statistically not valid.

If you roll a dice and score a 6, the chance to get a 6 on the second roll is exactly the same like the first time, 1/6.

If you do not take into account all the factors, then you are right. But in our situation you need to take into account history. Simple example: What is the chance of eagle side of the coin, when you toss it? It's easy, the chance of each side is 50/50%. If we toss coin 100 times, approximately we will get 50 eagles and 50 tails. But if will be the situation, that we toss the coin 50 times, and get eagle side only 10 times and 40 times of another side of the coin. For the next 50 times of tosses, chance will be the same 50/50? Or we understand that now probability theory will "try" to balance the scales of probability and next 50 times of tosses, will have approximately 40 eagles and 10 another side of coin.

This is a primitive (rough) example, but it shows approximately what I mean. There are many factors that make effect on probability. We can't get guaranty from probability, but we can get it on our side and use it.

I hope this is an interesting food for thoughts 😄

what's your point?

Miembro desde Jan 25, 2010

posts 1288

May 12, 2020 at 06:09

Miembro desde Jan 25, 2010

posts 1288

MicF posted:

The question was ...Can you please refer me to that?

... and I did.

Trading is not guaranteed. There is no system that gives 100% win / 0% loss.

Your advice given is honest and welcome by those that want to understand and grow.

Thank you sir. 😎

May 18, 2020 at 08:14

Miembro desde Nov 26, 2016

posts 93

BluePanther posted:MicF posted:

The question was ...Can you please refer me to that?

... and I did.

Trading is not guaranteed. There is no system that gives 100% win / 0% loss.

Your advice given is honest and welcome by those that want to understand and grow.

Thank you sir. 😎

I didn't give any advice, I just referred to an answer of the creator of FXCharger.

Nothing less, nothing more.

Miembro desde Jan 25, 2010

posts 1288

May 18, 2020 at 09:02

Miembro desde Jan 25, 2010

posts 1288

MicF posted:BluePanther posted:MicF posted:

The question was ...Can you please refer me to that?

... and I did.

Trading is not guaranteed. There is no system that gives 100% win / 0% loss.

Your advice given is honest and welcome by those that want to understand and grow.

Thank you sir. 😎

I didn't give any advice, I just referred to an answer of the creator of FXCharger.

Nothing less, nothing more.

Well done. Thank you. 😎

Miembro desde Apr 29, 2020

posts 31

May 19, 2020 at 19:02

Miembro desde Nov 26, 2016

posts 93

forexheistea posted:

57% DD is high, how does system works? by averaging trades? I am unable to understand the logic of taking trades and then holding them for weeks instead closing at SL.

there is a certain SL up to 100%, depending on the risk setting.

all 4 Trades will be closed at this SL.

each new trade quadruples the lot size, to catch up with losses from the current trades.

forex_trader_305974

Miembro desde Feb 16, 2016

posts 71

Jun 04, 2020 at 15:11

Miembro desde Feb 16, 2016

posts 71

Hello everyone!

Yes, it's very sad, but our account is gone. Unfortunately Covid-19 period was too complex for FXCharger. Our Forex robot successfully traded for more than 4 years. We are working on some good update and I hope we will back with even better results in the future.

We are really sorry and upset about the loss that our clients got. We tried to do all we can from our side to avoid this. Anyway, it's Forex and unfortunately, no one is completely safe 😞

Yes, it's very sad, but our account is gone. Unfortunately Covid-19 period was too complex for FXCharger. Our Forex robot successfully traded for more than 4 years. We are working on some good update and I hope we will back with even better results in the future.

We are really sorry and upset about the loss that our clients got. We tried to do all we can from our side to avoid this. Anyway, it's Forex and unfortunately, no one is completely safe 😞

Miembro desde Apr 06, 2018

posts 242

Jun 04, 2020 at 18:19

Miembro desde Apr 06, 2018

posts 242

Afron posted:Drolph posted:

Based on the 100% risk this account is currently running at the moment ...

.. it is likely gone now.

www.forexpeacearmy.com/forex-strategies/1358/fx_charger

Yes this is END. Update is off.

This is true for every martingale system sooner or later only blown account.

The market will trade through it’s path of least resistance .

Miembro desde Jul 20, 2019

posts 338

Jun 05, 2020 at 08:24

Miembro desde Jul 20, 2019

posts 338

LongVision posted:Afron posted:Drolph posted:

Based on the 100% risk this account is currently running at the moment ...

.. it is likely gone now.

www.forexpeacearmy.com/forex-strategies/1358/fx_charger

Yes this is END. Update is off.

This is true for every martingale system sooner or later only blown account.

At the end martingale-strategies are not that bad, they're only bad if there are no good SL's on it compared to the risk-reward-ratio. If the max. SL with 0.50lot is 100pips then I can't just use the same max. SL with 5.00lot, you'd have to use an SL at around 10pips then (5lot/0.5lot=10x; 100pips/10x=10pips) to stay close to the same RR. Just my thought about it; it is really close to gambling.

patience is the key

Miembro desde Jan 25, 2010

posts 1288

Jun 05, 2020 at 09:06

Miembro desde Jan 25, 2010

posts 1288

fxcharger posted:

Anyway, it's Forex and unfortunately, no one is completely safe 😞

No one? The Big Banks are still trading - why would they if they lost money also?

It is not that forex is completely unsafe. It is that the strategy employed is not safe, or rather, has a “fail safe” to prevent this such catastrophic account loss.

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.