Advertisement

Edit Your Comment

USD/JPY

Membre depuis Dec 11, 2015

posts 1462

Mar 09, 2016 at 11:26

Membre depuis Dec 11, 2015

posts 1462

The trend is bearish in general, but that won't be confirmed before it breaks below the previous low at 110.97.

Membre depuis Nov 19, 2014

posts 157

Mar 10, 2016 at 05:14

Membre depuis Nov 19, 2014

posts 157

Hey all,

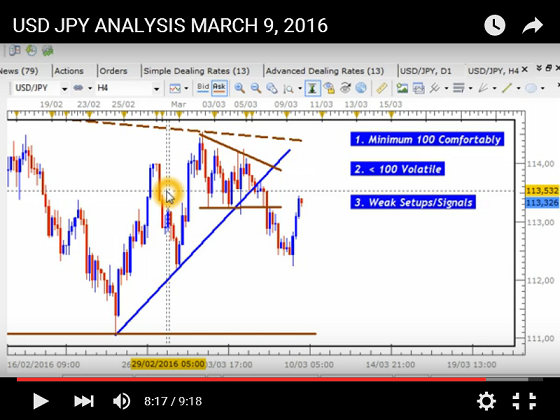

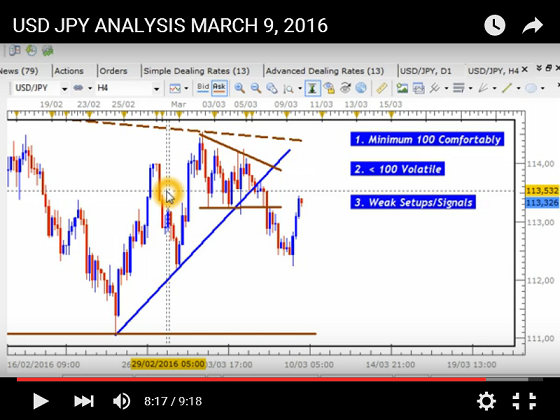

This Sharp Reversal on the USD JPY yesterday would have taken my Stop Loss had I traded it..

It was a tempting setup but there were some important reasons that caused this reversal and led me to avoid this one

/MARCH_2_2016_USD_JPY_YOUTUBE_DAILY.png" target="_blank" rel="noopener noreferrer nofollow"> /MARCH_2_2016_USD_JPY_YOUTUBE_DAILY.png"/>

/MARCH_2_2016_USD_JPY_YOUTUBE_DAILY.png"/>

As you can see, the last Bearish Candle was fairly weak compared to those that normally lead to strong moves such as those that led to the strong downtrend on the left hand side of the chart.

Key is to always keep an eye on the Daily Chart despite how strong the signals on the 4 H Chart maybe.

This Sharp Reversal on the USD JPY yesterday would have taken my Stop Loss had I traded it..

It was a tempting setup but there were some important reasons that caused this reversal and led me to avoid this one

/MARCH_2_2016_USD_JPY_YOUTUBE_DAILY.png" target="_blank" rel="noopener noreferrer nofollow">

As you can see, the last Bearish Candle was fairly weak compared to those that normally lead to strong moves such as those that led to the strong downtrend on the left hand side of the chart.

Key is to always keep an eye on the Daily Chart despite how strong the signals on the 4 H Chart maybe.

Trade Less, Earn More

Membre depuis Dec 11, 2015

posts 1462

Mar 16, 2016 at 10:29

Membre depuis Dec 11, 2015

posts 1462

Right now it's just a tight range, I'm not opening new positions before a proper break out in either direction.

Membre depuis Oct 02, 2014

posts 905

Mar 21, 2016 at 07:11

Membre depuis Sep 20, 2012

posts 14

Usdjpy plays the range, consolidation pattern 110.80-114.60

Strong resistance at 120.40

Support level below the lowest price will target level at 106.00 area, as long as the usdjpy stay above 106 meaning the bullish trend didn’t over yet, but keep staying below 114.60 is not a good sign

Moving above 114.60 will lead to 116.40 resistance while crossing this level could give us the 118.20 area

Strong resistance at 120.40

Support level below the lowest price will target level at 106.00 area, as long as the usdjpy stay above 106 meaning the bullish trend didn’t over yet, but keep staying below 114.60 is not a good sign

Moving above 114.60 will lead to 116.40 resistance while crossing this level could give us the 118.20 area

Membre depuis Dec 11, 2015

posts 1462

Mar 22, 2016 at 10:00

Membre depuis Dec 11, 2015

posts 1462

It's still consolidating around that level, but it will break above it, I think.

Membre depuis Oct 02, 2014

posts 905

Membre depuis Mar 28, 2016

posts 94

Mar 29, 2016 at 06:11

Membre depuis Mar 28, 2016

posts 94

The USDJPY had a bullish momentum last week after a failure to make a clear break below 110.96 as you can see on my daily chart below, topped at 113.32 and hit 113.55 earlier today. The bias remains bullish in nearest term testing 114.50, which is a good place to sell with a tight stop loss as a clear break and daily close above 114.50 could trigger further bullish scenario testing 116.00 or higher. Immediate support is seen around 113.00. A clear break below that area could lead price to neutral zone in nearest term testing 112.50/35 area.

Membre depuis Oct 02, 2014

posts 905

Membre depuis Oct 02, 2014

posts 905

Apr 05, 2016 at 10:25

Membre depuis Sep 20, 2012

posts 14

let's check usdjpy technical analysis

USD/JPY's recuperation was constrained at 113.81 a week ago, just underneath specified 113.81 resistance, and switched. Further, fall would be seen for this present week for retesting 110 first and then to 108 area

my viewpoint will stay bearish as long as the usdjpy stay below 113.81. In any case, break of this resistance will show close term inversion and turn viewpoint bullish.

In the master plan, value activities from 125.85 medium term top are forming into a more profound revision. Break of 106 resistance is should have been the primary indication of fruition of the trend.

pattern consolidation suggests also that break of 110.50 will bring the next level to 108 area

USD/JPY's recuperation was constrained at 113.81 a week ago, just underneath specified 113.81 resistance, and switched. Further, fall would be seen for this present week for retesting 110 first and then to 108 area

my viewpoint will stay bearish as long as the usdjpy stay below 113.81. In any case, break of this resistance will show close term inversion and turn viewpoint bullish.

In the master plan, value activities from 125.85 medium term top are forming into a more profound revision. Break of 106 resistance is should have been the primary indication of fruition of the trend.

pattern consolidation suggests also that break of 110.50 will bring the next level to 108 area

*Lutilisation commerciale et le spam ne seront pas tolérés et peuvent entraîner la fermeture du compte.

Conseil : Poster une image/une url YouTube sera automatiquement intégrée dans votre message!

Conseil : Tapez le signe @ pour compléter automatiquement un nom dutilisateur participant à cette discussion.