- Accueil

- Communauté

- Traders Expérimentés

- What's the best way to trade Martingale Forex Trading

Advertisement

Edit Your Comment

What's the best way to trade Martingale Forex Trading

forex_trader_202879

Membre depuis Aug 07, 2014

posts 378

Dec 01, 2014 at 14:21

Membre depuis Aug 07, 2014

posts 378

The problem with topics like this is that involved to much "theory". The factor of IF is in aspect of our lives. Not any more in forex, then if you are driving your car. What if the person who is behind you is chatting while you are on the road? The reality is martingale fails not because of the system, but because of the user. Many people trade support and resistance which comes to a point in which you will be going against the start of a fresh new trend which no one could predict. Thus making your support and resistance system WRONG, and then leaving your account at higher risk if you use martingale.

In other words don't focus so much on martingale as you should focus on your actual system. Why not look at the best traders here n myfxbook and have a look at how many times they have lost in row. If a trader has a good system, then martingale will work.Esepcially if you are scalping.

In other words don't focus so much on martingale as you should focus on your actual system. Why not look at the best traders here n myfxbook and have a look at how many times they have lost in row. If a trader has a good system, then martingale will work.Esepcially if you are scalping.

Membre depuis Feb 22, 2011

posts 4573

Dec 01, 2014 at 14:23

(édité Dec 01, 2014 at 14:25)

Membre depuis Feb 22, 2011

posts 4573

Its quite easy.

Everyone who stands up for Martingale should put a link to real working account to prove his words.

I don't stand up for Martingale though I have such link:)

https://www.myfxbook.com/members/togr/str-79--81-/646724

Everyone who stands up for Martingale should put a link to real working account to prove his words.

I don't stand up for Martingale though I have such link:)

https://www.myfxbook.com/members/togr/str-79--81-/646724

forex_trader_202879

Membre depuis Aug 07, 2014

posts 378

Dec 01, 2014 at 14:33

(édité Dec 01, 2014 at 14:36)

Membre depuis Aug 07, 2014

posts 378

togr posted:

Its quite easy.

Everyone who stands up for Martingale should put a link to real working account to prove his words.

I don't stand up for Martingale though I have such link:)

https://www.myfxbook.com/members/togr/str-79--81-/646724

Simply look at some key stats of your system.

1) You have about a 50% win percentage

2) Your avg hold time is that of 2days

3) Your money management is very strick (which causes you to earn such little % change per month)

4) Your trades aren't accurate... Your avg pip drawdown (i assume because you are trading on the higher tf) is that of 90 pips or so. (Your pip-drawdown is higher then the daily trading range of most of the currencies which you are trading)

To sum it up martingale would work in that system ONLY because his first wager is so small, and if you look at the RISK OF RUIN you will see how many losses in a row it would take for him to lose a certain amount of %

I for one would love to load an account, and prove that martingale can work, but the reality is you stand to lose time trying to defend your position to the pessimistic people on this website instead of getting people to understand why you would use martingale in the first place. Most people use martingale as a form of money management to recover their losses quicker. Instead of using martingale to recover your losses based on the probability of your next trade being more in your favor. Which is why I say that it is unfair to say martingale doesn't work, if you aren't looking at the actual system which is traded along side it.

Membre depuis Feb 22, 2011

posts 4573

Dec 01, 2014 at 14:38

Membre depuis Feb 22, 2011

posts 4573

Cholipop posted:togr posted:

Its quite easy.

Everyone who stands up for Martingale should put a link to real working account to prove his words.

I don't stand up for Martingale though I have such link:)

https://www.myfxbook.com/members/togr/str-79--81-/646724

Simply look at some key stats of your system.

1) You have about a 50% win percentage

2) Your avg hold time is that of 2days

3) Your money management is very strick (which causes you to earn such little % change per month)

4) Your trades aren't accurate... Your avg pip drawdown (i assume because you are trading on the higher tf) is that of 90 pips or so. (Your pip-drawdown is higher then the daily trading range of most of the currencies which you are trading)

To sum it up martingale would work in that system ONLY because his first wager is so small, and if you look at the RISK OF RUIN you will see how many losses in a row it would take for him to lose a certain amount of %

I for one would love to load an account, and prove that martingale can work, but the reality is you stand to lose time trying to defend your position to the pessimistic people on this website instead of getting people to understand why you would use martingale in the first place. Most people use martingale as a form of money management to recover their losses quicker. Instead of using martingale to recover your losses based on the probability of your next trade being more in your favor. Which is why I say that it is unfair to say martingale doesn't work, if you aren't looking at the actual system which is traded along side it.

You dont get it at all.

The link i sent is showing martingale is actually working. With 6% profit mo and DD below 20%

My point is martingale is risky and there are better systems.

forex_trader_202879

Membre depuis Aug 07, 2014

posts 378

Dec 01, 2014 at 15:02

Membre depuis Aug 07, 2014

posts 378

togr posted:Cholipop posted:togr posted:

Its quite easy.

Everyone who stands up for Martingale should put a link to real working account to prove his words.

I don't stand up for Martingale though I have such link:)

https://www.myfxbook.com/members/togr/str-79--81-/646724

Simply look at some key stats of your system.

1) You have about a 50% win percentage

2) Your avg hold time is that of 2days

3) Your money management is very strick (which causes you to earn such little % change per month)

4) Your trades aren't accurate... Your avg pip drawdown (i assume because you are trading on the higher tf) is that of 90 pips or so. (Your pip-drawdown is higher then the daily trading range of most of the currencies which you are trading)

To sum it up martingale would work in that system ONLY because his first wager is so small, and if you look at the RISK OF RUIN you will see how many losses in a row it would take for him to lose a certain amount of %

I for one would love to load an account, and prove that martingale can work, but the reality is you stand to lose time trying to defend your position to the pessimistic people on this website instead of getting people to understand why you would use martingale in the first place. Most people use martingale as a form of money management to recover their losses quicker. Instead of using martingale to recover your losses based on the probability of your next trade being more in your favor. Which is why I say that it is unfair to say martingale doesn't work, if you aren't looking at the actual system which is traded along side it.

You dont get it at all.

The link i sent is showing martingale is actually working. With 6% profit mo and DD below 20%

My point is martingale is risky and there are better systems.

That's just it, and you have proved my point.... Martingale is NOT A SYSTEM! Martingale is money management. Martingale in no way shape or form tells you WHEN TO BUY OR SELL. Martingale only has to do with you doubling your wager after a loss.... So YOUR SYSTEM would determine if you use martingale or not.

Membre depuis Feb 22, 2011

posts 4573

Dec 01, 2014 at 15:19

Membre depuis Feb 22, 2011

posts 4573

Cholipop posted:togr posted:Cholipop posted:togr posted:

Its quite easy.

Everyone who stands up for Martingale should put a link to real working account to prove his words.

I don't stand up for Martingale though I have such link:)

https://www.myfxbook.com/members/togr/str-79--81-/646724

Simply look at some key stats of your system.

1) You have about a 50% win percentage

2) Your avg hold time is that of 2days

3) Your money management is very strick (which causes you to earn such little % change per month)

4) Your trades aren't accurate... Your avg pip drawdown (i assume because you are trading on the higher tf) is that of 90 pips or so. (Your pip-drawdown is higher then the daily trading range of most of the currencies which you are trading)

To sum it up martingale would work in that system ONLY because his first wager is so small, and if you look at the RISK OF RUIN you will see how many losses in a row it would take for him to lose a certain amount of %

I for one would love to load an account, and prove that martingale can work, but the reality is you stand to lose time trying to defend your position to the pessimistic people on this website instead of getting people to understand why you would use martingale in the first place. Most people use martingale as a form of money management to recover their losses quicker. Instead of using martingale to recover your losses based on the probability of your next trade being more in your favor. Which is why I say that it is unfair to say martingale doesn't work, if you aren't looking at the actual system which is traded along side it.

You dont get it at all.

The link i sent is showing martingale is actually working. With 6% profit mo and DD below 20%

My point is martingale is risky and there are better systems.

That's just it, and you have proved my point.... Martingale is NOT A SYSTEM! Martingale is money management. Martingale in no way shape or form tells you WHEN TO BUY OR SELL. Martingale only has to do with you doubling your wager after a loss.... So YOUR SYSTEM would determine if you use martingale or not.

Nevermind you dont get it.

Anyway I am going to repeat:

Anyone who says martingale is good - prove it by real account here on MFB.

forex_trader_202879

Membre depuis Aug 07, 2014

posts 378

Dec 01, 2014 at 15:33

Membre depuis Aug 07, 2014

posts 378

togr posted:Cholipop posted:togr posted:Cholipop posted:togr posted:

Its quite easy.

Everyone who stands up for Martingale should put a link to real working account to prove his words.

I don't stand up for Martingale though I have such link:)

https://www.myfxbook.com/members/togr/str-79--81-/646724

Simply look at some key stats of your system.

1) You have about a 50% win percentage

2) Your avg hold time is that of 2days

3) Your money management is very strick (which causes you to earn such little % change per month)

4) Your trades aren't accurate... Your avg pip drawdown (i assume because you are trading on the higher tf) is that of 90 pips or so. (Your pip-drawdown is higher then the daily trading range of most of the currencies which you are trading)

To sum it up martingale would work in that system ONLY because his first wager is so small, and if you look at the RISK OF RUIN you will see how many losses in a row it would take for him to lose a certain amount of %

I for one would love to load an account, and prove that martingale can work, but the reality is you stand to lose time trying to defend your position to the pessimistic people on this website instead of getting people to understand why you would use martingale in the first place. Most people use martingale as a form of money management to recover their losses quicker. Instead of using martingale to recover your losses based on the probability of your next trade being more in your favor. Which is why I say that it is unfair to say martingale doesn't work, if you aren't looking at the actual system which is traded along side it.

You dont get it at all.

The link i sent is showing martingale is actually working. With 6% profit mo and DD below 20%

My point is martingale is risky and there are better systems.

That's just it, and you have proved my point.... Martingale is NOT A SYSTEM! Martingale is money management. Martingale in no way shape or form tells you WHEN TO BUY OR SELL. Martingale only has to do with you doubling your wager after a loss.... So YOUR SYSTEM would determine if you use martingale or not.

Nevermind you dont get it.

Anyway I am going to repeat:

Anyone who says martingale is good - prove it by real account here on MFB.

Your the one who doesn't get it. Just as you don't get trading! Martingale is NOT A SYSTEM. It is only a form of wagering...

forex_trader_202879

Membre depuis Aug 07, 2014

posts 378

Dec 01, 2014 at 15:44

Membre depuis Aug 07, 2014

posts 378

Ok, I am going to prove that martingale works. Please follow this account... This is a new client which I have obtained today.

https://www.myfxbook.com/members/Cholipop/clientasof1stdec/1089695

https://www.myfxbook.com/members/Cholipop/clientasof1stdec/1089695

Membre depuis Feb 22, 2011

posts 4573

Dec 01, 2014 at 15:48

Membre depuis Feb 22, 2011

posts 4573

Cholipop posted:

Ok, I am going to prove that martingale works. Please follow this account... This is a new client which I have obtained today.

https://www.myfxbook.com/members/Cholipop/clientasof1stdec/1089695

And where is any proof?

1 day old account with hidden trades?

LOL

forex_trader_202879

Membre depuis Aug 07, 2014

posts 378

Dec 01, 2014 at 16:09

Membre depuis Aug 07, 2014

posts 378

togr posted:Cholipop posted:

Ok, I am going to prove that martingale works. Please follow this account... This is a new client which I have obtained today.

https://www.myfxbook.com/members/Cholipop/clientasof1stdec/1089695

And where is any proof?

1 day old account with hidden trades?

LOL

Do you lack the ability of READING... It says to PLEASE FOLLOW THIS ACCOUNT. meaning from here on out I will be using martingale money management to grow this account. This client has lost money, following managers like you who get hammered in trending markets. Which is why so many of your accounts have such high drawdowns.

forex_trader_202879

Membre depuis Aug 07, 2014

posts 378

Dec 01, 2014 at 16:15

Membre depuis Aug 07, 2014

posts 378

For the rest of you guys, don't be fooled by this custom date scammer called tgor. Look at one of his best accounts. https://www.myfxbook.com/members/togr/fxprimusc21/756902 custom start date, and if you click it and select ALL what do you see? Not to mention most of his accounts aren't verified nor are they from brokers which are even listed. I have already gotten several pm's from people who have deposited with him only to blow their accounts. Show a fresh account, and let us see what you have... Don't post these accounts AFTER you have run them up.

forex_trader_202879

Membre depuis Aug 07, 2014

posts 378

Dec 01, 2014 at 16:19

Membre depuis Aug 07, 2014

posts 378

Have a look at this account.... https://www.myfxbook.com/members/togr/caesar-400-eurusd/662462

1) Not verified

2) You can see he is putting block orders in in order to manipulate the amount of "trades"he is putting. Have a look at how he places .01 orders, and the next order is for the same lot size at the very same time. I am well aware of the tricks you scammers play, and the reality is your so called "performance" can never be repeated once everyone is looking, because you lack the skills and the ability of trading this market. Thus the reason for manipulating the stats in order to gain clients, when clearly on your wall some of those clients have said how you have blown their accounts.

1) Not verified

2) You can see he is putting block orders in in order to manipulate the amount of "trades"he is putting. Have a look at how he places .01 orders, and the next order is for the same lot size at the very same time. I am well aware of the tricks you scammers play, and the reality is your so called "performance" can never be repeated once everyone is looking, because you lack the skills and the ability of trading this market. Thus the reason for manipulating the stats in order to gain clients, when clearly on your wall some of those clients have said how you have blown their accounts.

Membre depuis Jun 28, 2011

posts 444

Dec 01, 2014 at 16:59

Membre depuis Jun 28, 2011

posts 444

" Martingale is NOT A SYSTEM. It is only a form of wagering...

Well not wagering, more like playing the odds. If the odds are against you, don't play. If the odds are 50 to 60 percent favorable, a Fibonacci recovery systems will improve the returns and above 60 - 65% either a Fibonacci or martingale will work.

But that isn't the real question about whether to use a recovery system, it is determining the correct direction. What we should be discussing is this, "is there a way to have the right direction 75% or more of the time".

Lets say we open a trade and intend to close it in 20 pips, either for a 20 pip profit or a 20 pip loss. And just to put us all on the same page, let's say the trade is for .01 lots. This means that we will make or lose 2 units of the first currency of the pair. For convenience sake, I will just say dollars $ but we understand that it is in the currency first listed in the trading pair.

I will start it off with a system that divides the total trading spectrum since 2001 into upper and lower prices. If the current price is below the center then we do buys, if it is above center, we do only sells. We expect the price to hang around center most of the time however, we would expect to be right only 50% 0f the time. How can we beat this?

Bob

Well not wagering, more like playing the odds. If the odds are against you, don't play. If the odds are 50 to 60 percent favorable, a Fibonacci recovery systems will improve the returns and above 60 - 65% either a Fibonacci or martingale will work.

But that isn't the real question about whether to use a recovery system, it is determining the correct direction. What we should be discussing is this, "is there a way to have the right direction 75% or more of the time".

Lets say we open a trade and intend to close it in 20 pips, either for a 20 pip profit or a 20 pip loss. And just to put us all on the same page, let's say the trade is for .01 lots. This means that we will make or lose 2 units of the first currency of the pair. For convenience sake, I will just say dollars $ but we understand that it is in the currency first listed in the trading pair.

I will start it off with a system that divides the total trading spectrum since 2001 into upper and lower prices. If the current price is below the center then we do buys, if it is above center, we do only sells. We expect the price to hang around center most of the time however, we would expect to be right only 50% 0f the time. How can we beat this?

Bob

where research touches lives.

Membre depuis Jun 28, 2011

posts 444

Dec 01, 2014 at 17:16

Membre depuis Jun 28, 2011

posts 444

@Cholipop

I don't trade the same way as Vontogr and as you can see from my membership date, I've been around awhile. If I didn't have the systems that I do, I would put money with Vontogr. However, showing your system as you have done, from the start is the preferred way to demonstrate a system. Kind of curious, what were you before you took up forex. Your instincts seem to say research, just wondering.

Bob

I don't trade the same way as Vontogr and as you can see from my membership date, I've been around awhile. If I didn't have the systems that I do, I would put money with Vontogr. However, showing your system as you have done, from the start is the preferred way to demonstrate a system. Kind of curious, what were you before you took up forex. Your instincts seem to say research, just wondering.

Bob

where research touches lives.

Membre depuis Feb 22, 2011

posts 4573

Dec 01, 2014 at 18:54

Membre depuis Feb 22, 2011

posts 4573

Cholipop posted:

Have a look at this account.... https://www.myfxbook.com/members/togr/caesar-400-eurusd/662462

1) Not verified

2) You can see he is putting block orders in in order to manipulate the amount of "trades"he is putting. Have a look at how he places .01 orders, and the next order is for the same lot size at the very same time. I am well aware of the tricks you scammers play, and the reality is your so called "performance" can never be repeated once everyone is looking, because you lack the skills and the ability of trading this market. Thus the reason for manipulating the stats in order to gain clients, when clearly on your wall some of those clients have said how you have blown their accounts.

and what? It is a great system which made hundreds of % of profit.

I did not use it as example of martingale so I do not understand why you comment on this in this topic.

Once again and last time.

Anyone has martingale system with decent profit for at least 1 year?

Membre depuis Jun 28, 2011

posts 444

Dec 01, 2014 at 19:40

Membre depuis Jun 28, 2011

posts 444

togr posted:

Anyone has martingale system with decent profit for at least 1 year?

Vontogr; what did you want it for?

You know I would be honored to work on a project with you but my recovery system isn't a true martingale as it uses the Fibonacci sequence. However, if you think that it could work for you, I guess you could use mine.

Bob

where research touches lives.

forex_trader_202879

Membre depuis Aug 07, 2014

posts 378

Dec 01, 2014 at 20:16

Membre depuis Aug 07, 2014

posts 378

ForexAssistant posted:

@Cholipop

I don't trade the same way as Vontogr and as you can see from my membership date, I've been around awhile. If I didn't have the systems that I do, I would put money with Vontogr. However, showing your system as you have done, from the start is the preferred way to demonstrate a system. Kind of curious, what were you before you took up forex. Your instincts seem to say research, just wondering.

Bob

Prior to taking up forex, I was simply a college student studying to major in business administration. Being one who likes to consider oneself a nerd, the learn to read into the numbers prior to making a decision is the best way to avoid being scammed. In the aforementioned case all we need to do is find a system which is efficient. So many people online speak negatively about martingale, when it isn't martingale to blame. It is the simple system which needs to be picked apart in order to figure out wither or not it will work or not with the system used.

forex_trader_202879

Membre depuis Aug 07, 2014

posts 378

Dec 01, 2014 at 22:50

Membre depuis Aug 07, 2014

posts 378

Consider how many accounts I have now obtained to follow the one which I started with. The second account which joined has already doubled in size, with no floating loss. The problem in forex is the FLOATING LOSS. You trade "MAY" end up hitting your tp, but if you spent 60 - 150 pips in red before you tp is hit, although it is low % of your account (Risking smaller capital with lower max leverage makes it favorable to the broker. As more funds is needed to be in an account to make that trade possible. The smaller the leverage the MORE MONEY REQUIRED to keep the trade open) you have given about 2 to 3 times the daily range of that currency. The market shifts at the drop of a dime. Which makes yesterday orders useless. Worthless lots.

No one is focusing on accuracy. If we can master accuracy and trade management, you will be able to risk more and gain an amount which would make anyone want to sign up for. 3% per day profit. No need to over leverage. Tgor has not one account with a very respectable pip draw down. To make fist over hand in forex you need to trade like a robot. Not like a bias human who says Ït can't go up any further. Have a look at UJ. How many times did you see lines pointing down. Price action creates the very lines you draw. I'm not impressed by the stats of any trader, as they all have high pip draw down. It is a very unproductive way of trading. Not to mention swap accounts..

No one is focusing on accuracy. If we can master accuracy and trade management, you will be able to risk more and gain an amount which would make anyone want to sign up for. 3% per day profit. No need to over leverage. Tgor has not one account with a very respectable pip draw down. To make fist over hand in forex you need to trade like a robot. Not like a bias human who says Ït can't go up any further. Have a look at UJ. How many times did you see lines pointing down. Price action creates the very lines you draw. I'm not impressed by the stats of any trader, as they all have high pip draw down. It is a very unproductive way of trading. Not to mention swap accounts..

Membre depuis Nov 21, 2011

posts 1601

Dec 01, 2014 at 23:16

Membre depuis Nov 21, 2011

posts 1601

Hey guys,

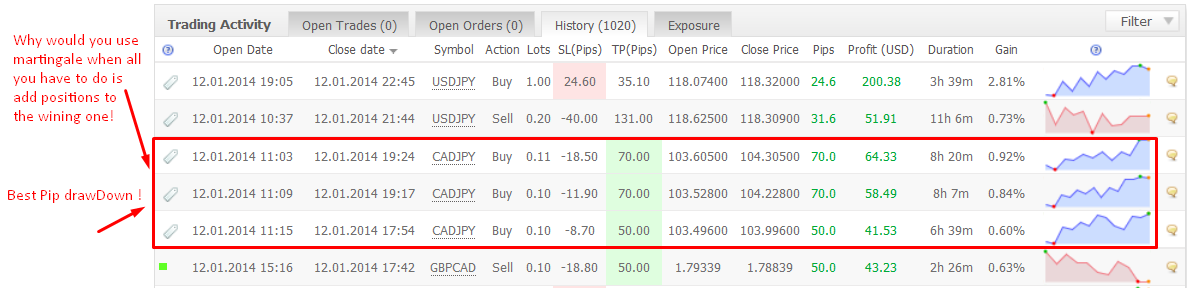

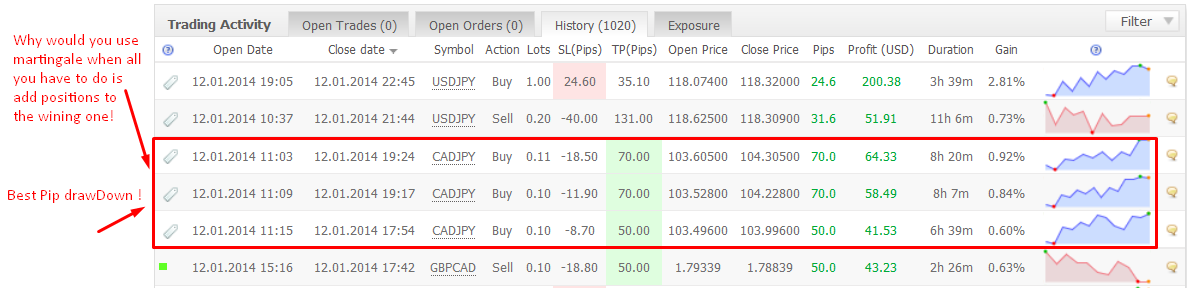

What is the difference between a good system and a very good system?

The good one may use martingale in some conditions to compensate bad management.

The very good system will never use martingale as entry set up are so accurate that there is no need to keep any longer a trade that doesn't provide pips quickly.

Also a very good system is able to add positions to a wining trade in order to maximize profit.

Example yesterday on CADJPY:

What is the difference between a good system and a very good system?

The good one may use martingale in some conditions to compensate bad management.

The very good system will never use martingale as entry set up are so accurate that there is no need to keep any longer a trade that doesn't provide pips quickly.

Also a very good system is able to add positions to a wining trade in order to maximize profit.

Example yesterday on CADJPY:

forex_trader_38771

Membre depuis Jun 10, 2011

posts 52

Dec 02, 2014 at 08:38

Membre depuis Jun 10, 2011

posts 52

Cholipop posted:

For the rest of you guys, don't be fooled by this custom date scammer called tgor. Look at one of his best accounts. https://www.myfxbook.com/members/togr/fxprimusc21/756902 custom start date, and if you click it and select ALL what do you see? Not to mention most of his accounts aren't verified nor are they from brokers which are even listed. I have already gotten several pm's from people who have deposited with him only to blow their accounts. Show a fresh account, and let us see what you have... Don't post these accounts AFTER you have run them up.

Mr Cholipop, with all due respect, you are full of it. Your first account was clearly a cent account. Your 2nd and 3rd accounts were failures. And anyone who has decided to be your 'client' is an absolute idiot.

I look forward to watching your demise....

*Lutilisation commerciale et le spam ne seront pas tolérés et peuvent entraîner la fermeture du compte.

Conseil : Poster une image/une url YouTube sera automatiquement intégrée dans votre message!

Conseil : Tapez le signe @ pour compléter automatiquement un nom dutilisateur participant à cette discussion.