Dollar fails to benefit from muted risk-off sentiment

Risk sentiment was in retreat on Monday

Risk appetite took a hit yesterday, as US stock indices and the cryptocurrency market suffered losses. The S&P 500 index lost around 40 points and the Nasdaq 100 index led the correction. With most stock indices recording significant gains in November, particularly after Trump’s reelection, red sessions like yesterday’s are pretty useful in reining in expectations of a perpetual rally.

Interestingly, despite the negative newsflow, the domestic political shenanigans and Trump’s probable tariffs on eurozone products, both the German and French stock markets are among the best performing indices in December. Apart from the expected ECB rate cut on Thursday, there is likely a valuation factor favouring European stocks at this stage, compared to their US counterparts.

Short-term correlation between gold and bitcoin remains negative

Gold and bitcoin reversed directions yesterday, with the precious metal finally taking advantage of developments on the geopolitical landscape and testing the upper boundary of its recent $2,600-$2,670 range. On the flip side, the king of cryptos failed again to maintain the $100k threshold, confirming the importance of this level. The overall trend remains bullish, but profit-taking could continue to act as a strong headwind.

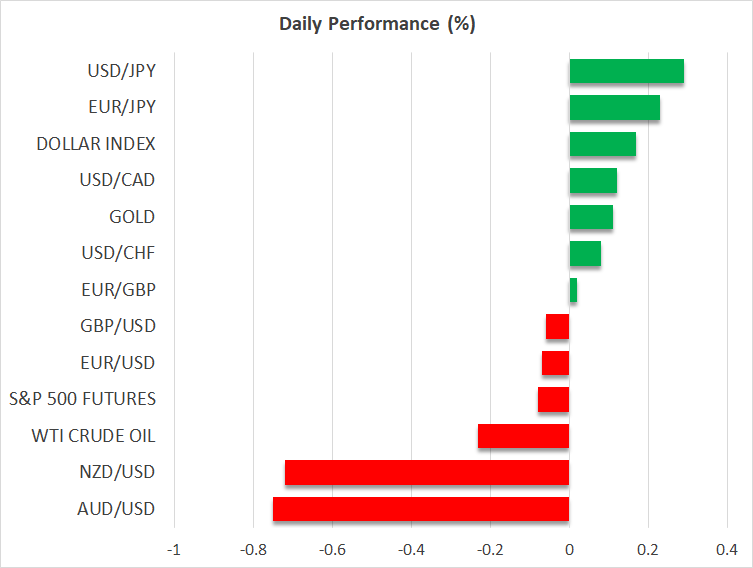

Mixed moves in FX space

Low volatility dominated FX markets on Monday, with the US dollar having a mixed session. It is recording some muted gains today against the yen, but there is an evident lack of appetite for more aggressive trading. Following last week's US labour market data and the commencement of the Fed’s blackout period, the market’s focus has shifted to incoming US data.

Tomorrow’s inflation report for November is the most critical input in the Fed’s decision process, with the market appearing to be more confident about a 25bps rate cut. This means that confirmation of the current forecasts for 2.7% and 3.3% prints in the headline and core inflation indicators, respectively, would cement next week’s rate move, likely causing a muted market reaction. The same cannot be said for the possibility of an upside surprise tomorrow, especially regarding core inflation.

RBA softens stance

The first central bank meeting of the week produced some interesting headlines. While the RBA kept its rates unchanged at 4.35%, as widely expected, there has been an evident softening in the prevailing hawkish rhetoric. The RBA statement mentioned that inflation remains too high, but the board is gaining some confidence that inflationary pressures are declining in line with the November forecasts. Additionally, it acknowledged the recent weakening in key data releases, including wage pressures.

The aussie is on the back foot today, but the market has not been shocked by this rhetoric shift. Apart from strong expectations in favour of this change in the RBA’s stance, the chances of a 25bps rate cut in February are split, with just a 56% probability assigned to such a move. Looking ahead, the official inauguration of President Trump’s second term on January 20 and the end-January 2025 quarterly Australian CPI will most likely determine the February rate decision.

Finally, the positive commentary from China continues, potentially playing its role in the measured underperformance of the aussie today, creating a feel-good factor in the market. However, actions speak louder than words at this juncture, and the current market satisfaction could quickly turn sour.