Gold sets a record

Markets await Christmas, central banks await data. As expected, the Bank of Japan raised its overnight rate to 0.75%, the highest level in three decades. However, the yen weakened sharply against major global currencies due to the implementation of the ‘buy the rumour, sell the fact’ principle and the BoJ's reluctance to use hawkish rhetoric. Kazuo Ueda noted that there is room to continue the normalisation cycle, but further actions by the regulator will depend on data.

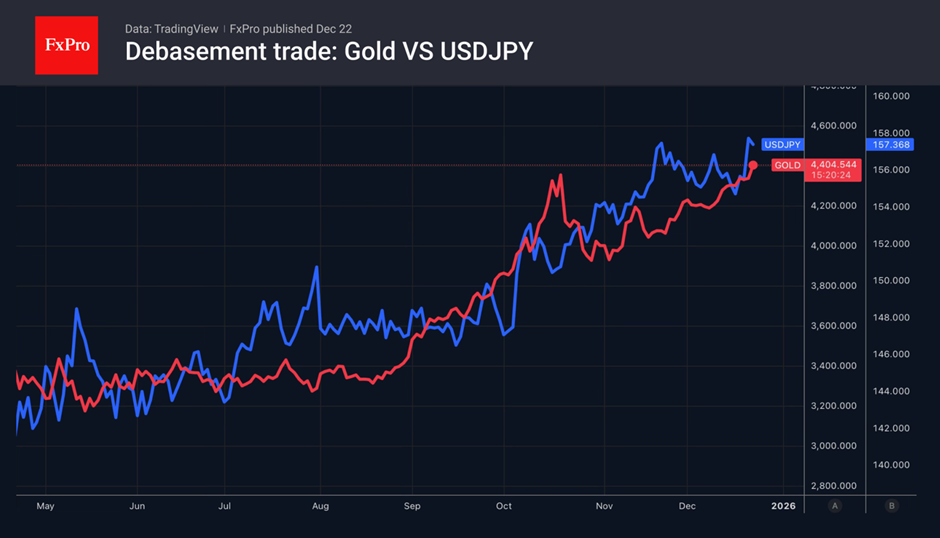

The futures market gives only a 20% probability of a cut in the federal funds rate in January and a 54% chance in March. Most likely, the Fed will wait until spring to ease monetary policy. The rate differential with the Bank of Japan will remain wide. This will be a strong argument in favour of intensifying carry trade and continuing the USDJPY rally.

The same applies to other low-yielding currencies. The US dollar is becoming a risky asset due to its still high interest rates. It may rise against the backdrop of the traditional Christmas rally in US stock indices. The presidents of the Federal Reserve Banks of New York, John Williams, and Cleveland, Beth Hammack, spoke in favour of keeping the Fed's monetary policy unchanged, at least until spring. According to the latter, rates are slightly below neutral. Therefore, the risks of stimulating the economy and accelerating inflation are still high.

The weakening of major global currencies and the rise in bond yields around the world, led by Japan, as prices fall, are bringing back investor interest in so-called debasement trading. This has allowed gold to break above $4,400 per ounce for the first time in history and reach a new record high. The rally is being fuelled by rising geopolitical risks, including the US blockade of oil supplies from Venezuela and Ukraine's first attack on a Russian shadow fleet tanker in the Mediterranean.

Capital inflows into specialised exchange-traded funds have been flowing for five consecutive weeks. Precious metal-focused ETFs increased their reserves every month in 2025 except May. According to Goldman Sachs, investors are beginning to compete with central banks for a limited number of bullion bars. This will allow gold to reach $4,900 in 2026.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)