EBC Markets Briefing | Chinese stocks are great again

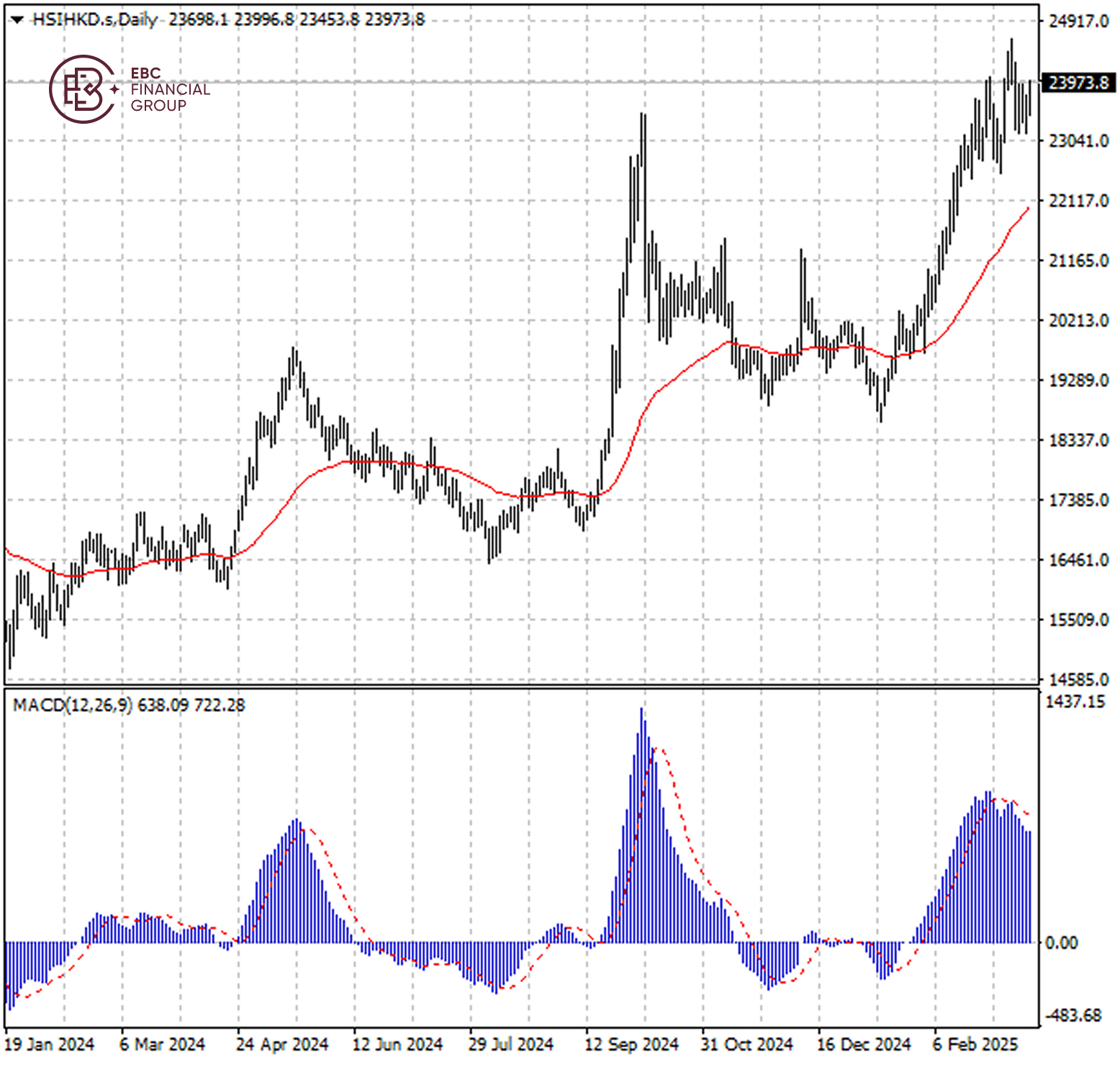

The Hang Seng Index rallied on Friday, but was heading for a weekly loss. A blistering rally in Chinese tech megacaps this year has left their once-unbeatable US peers in the dust, which is widely expected to continue.

Before DeepSeek cause a splash, the Nasdaq 100 had notched yet another record, while Chinese stocks were still marred by years of regulatory crackdown and a tepid consumption recovery.

A multi-year run in US big tech stocks, led by Nvidia, has hit a stumbling block as investors question the validity of their sky-high valuations and demand ever more in earnings surprises.

Still the benchmark index is priced at 7 times its projected 12-month earnings, compared to 20 times for the S&P 500, according to LSEG data. Beijing has planned to step up support for tech companies.

JP Morgan has seen a record amount of US dollars and Chinese yuan being converted into Hong Kong dollars over the past few weeks, pointing to the force of money flowing into Hong Kong stocks.

A broad selloff sent all three major US stock indexes tumbling overnight. A fresh Reuters/Ipsos poll of Americans showed that 57% of poll participants believe Trump's moves to shake up the economy are too erratic.

Goldman Sachs reduced S&P 500 targets this week. Morgan Stanley expects it to drop to 5,500 in H1, but JPMorgan noted the market overplays recession risks, leaving room for a positive surprise.

The Hang Seng Index sat comfortably above 50 EMA, but a bearish MACD divergence signalled a pullback towards the support below 23,200.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.