Eurozone Avoids Recession despite German Weakness

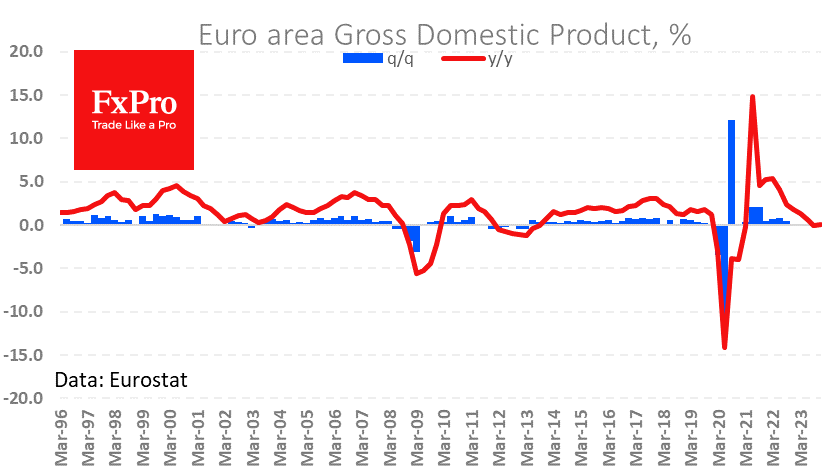

It’s not often that Europe produces better-than-expected economic data these days, and today was a rare exception. According to preliminary estimates, eurozone GDP was virtually unchanged in the final quarter of last year, compared with an expected contraction of 0.1%.

In the same period a year earlier, growth was a more than modest 0.1%, reminiscent of the period of economic stagnation 22 years ago — at the dawn of the eurozone. Similarities with those times are also evident in Germany’s weakness. The region’s largest economy contracted by 0.3% q/q and 0.4% y/y. Meanwhile, France added 0.7% y/y (expected +0.2%) and Spain 2.0% (expected 1.5%).

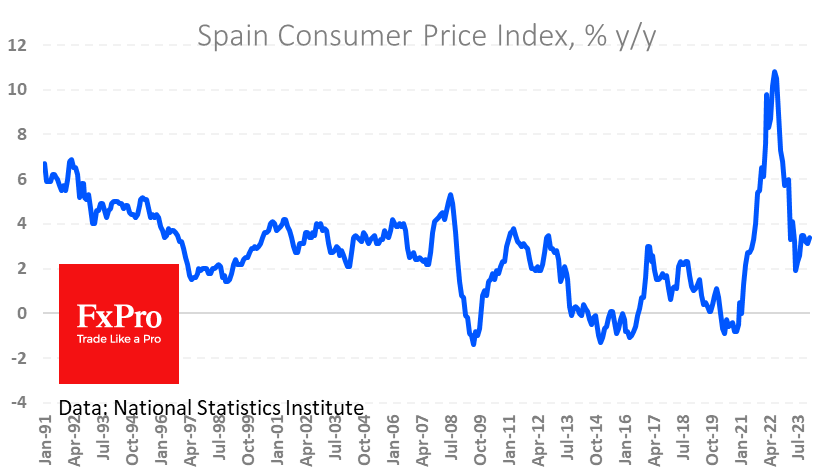

In a separate report, Spanish inflation accelerated to 3.4% y/y from 3.1% y/y, against expectations for a slowdown to 3.0%. This is the first reason to be wary of a slowdown in inflation, as Spain was the first to release its estimates. German CPI estimates will be released on Wednesday, followed by other major economies and the entire euro region on Thursday.

Stronger-than-expected data helped to push the EURUSD back to 1.0850 despite the general tone of dollar strength on Tuesday. The European statistics are still being watched but are not acting as a market driver, as all attention is on the outcome of the FOMC meeting and employment data.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)