GBPUSD accelerates to fresh 2-month high

- GBPUSD overcomes 1.2500 key barrier

- RSI and MACD continue bullish bias

- The 20- and 50-day SMAs posted positive cross

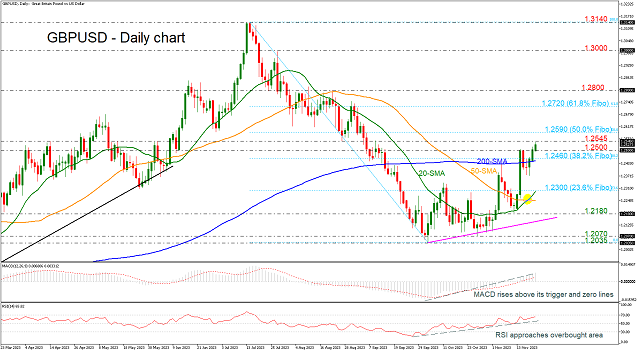

GBPUSD is looking to resume its bullish trend as the price is creating the third consecutive green day, surpassing the 200-day simple moving average (SMA) and the 1.2500 psychological mark. Also, the pair rose to its highest level of the last two months, with the technical oscillators suggesting strengthening upside momentum.

The RSI is above its 50 neutral mark and is approaching the overbought region, continuing the uptrend after it bottomed on September 27, while the MACD is keeping its footing above its trigger line within the positive area, both reflecting that buyers are still active.

If buyers stay in control, the door will open for the 1.2545 resistance level and the 50.0% Fibonacci retracement of the down leg from 1.3140 to 1.2035 at 1.2590. Running higher, the pair will have to face the 61.8% Fibonacci at 1.2720.

Should the bears press the price below the 38.2% Fibonacci of 1.2460 and the 200-day SMA, this may result in an aggressive downfall towards the 23.6% Fibonacci of 1.2300. If the latter gives away too, the decline could continue towards the bullish crossover between the 20- and the 50-day SMAs at 1.2250.

In a nutshell, despite the latest exciting rally in GBPUSD, there are some obstacles to consider before a real bullish trend reversal takes place with regards to the medium-term outlook.

.jpg)