Gold moves at a steady boring clip

Gold remained indecisive within its ten-day tight range on Monday, unable to close above $2,650 despite Friday’s upbeat US jobs data and the recent geopolitical turmoil in the Middle East and South Korea.

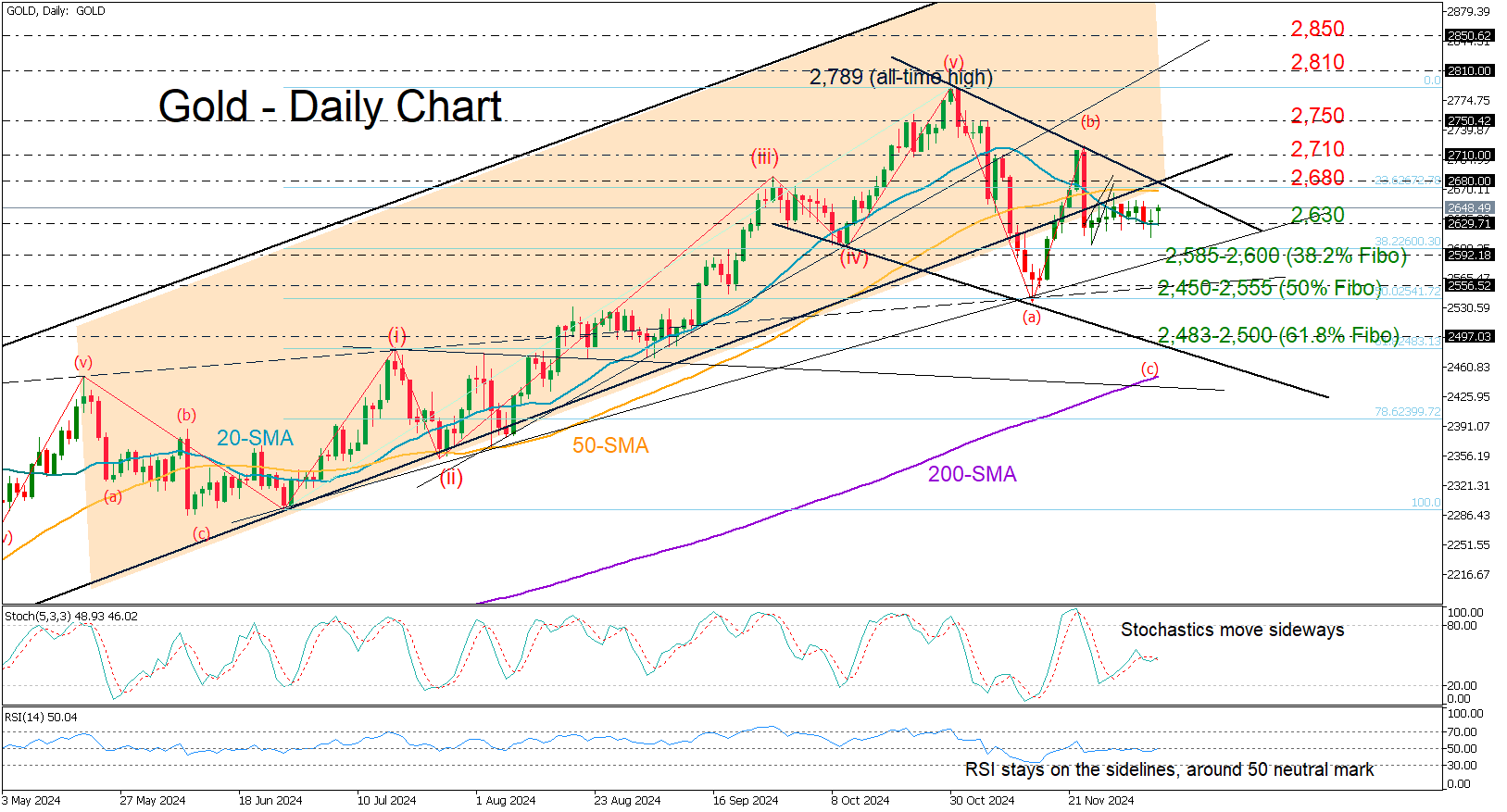

Technically, the safe-haven metal survived another drop below its 20-day simple moving average (SMA) at $2,630, but downside risks have not evaporated yet.

For a clear bullish signal, the price must re-enter its broken broad bullish channel above the 50-day SMA and the resistance line at $2,680. In this case, the recovery phase could extend to $2,710 or even to $2,750. Then, if the all-time high of $2,789 proves easy to pierce through, the bulls could target the $2,810 area.

On the flip side, if the price closes below $2,630, support could immediately come around $2,590-$2,600. The $2,450-$2,555 territory could prevent an aggressive downfall toward the $2,483-$2,500 region.

In summary, gold is in a neutral mode ahead of a busy period of central bank meetings and uncertain geopolitical developments and could retain the status quo unless the price jumps above $2,680 or falls below $2,630.

.jpg)