Gold temporarily ignores negative news

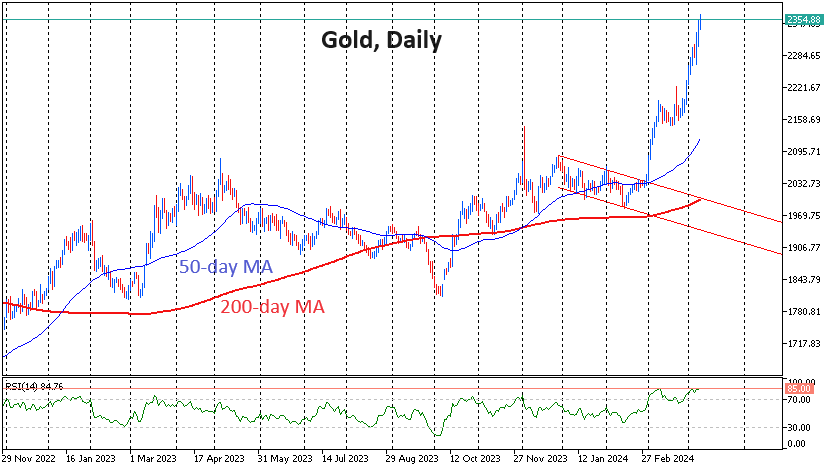

Gold has been hitting all-time highs almost daily for the past two weeks, reaching $2365 in the spot market on Tuesday before the start of US trading. The ability to rise above $2070 per ounce, which gold found in late February, has signalled a break of resistance that has kept gold above since August 2020.

Gold is now rising more actively than it did in the previous long-term bull cycle. In 2011, years of gains were followed by a two-year consolidation, which was replaced by a three-year bear market.

Gold has been increasing, reacting to positive news and mostly ignoring the negative. The price reversed sharply to the upside in the final quarter of last year on signals from the Fed that the next step would be a rate cut, not a rate hike. At the same time, the revision of expectations from six or seven to two rate cuts in 2024 did not hinder the rise at all.

It seems that any news on the US is a reason to buy. Signals of a strong economy and inflation - highlight gold's property of retaining value. Weakness in inflation - fuels expectations that the Fed will be cutting rates soon, which favours demand for risk assets.

There are risks that bulls are now ignoring the commodity mix looming over them in the form of US bond yields. 10-year treasuries have seen yields rise from 3.8% at the end of January to 4.45% on Monday. The reversal came from the lower boundary of the long-term rising channel, indicating that the smart money is wagering on a high rate scenario for the long haul.

Other markets can't ignore what's going on in the government debt market for long. Stock indices are already starting to notice it, forming a smooth downtrend in early April and repeatedly testing previous trading channels.

Meanwhile, gold has been overbought, according to RSI, in daily and weekly timeframes to the maximum since early August 2020. Back then, an eight-week rise was followed by a multi-month pullback.

The US inflation report scheduled for Wednesday has a chance to hurt gold soon. If the outcome for the markets is a further rise in government bond yields, global markets could become more synchronised, triggering a more active sell-off in equity markets and affecting gold and other commodities. In this case, it could take months before we see further price retracement of historical highs.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)