Market wiped out Tuesday's gains; down-trend asserted in BTC

Market picture

The crypto market lost 3.5% in 24 hours, again falling below $1.05 trillion. The formal start of the sell-off was the news that the SEC had delayed its review of bitcoin ETF applications, said Alex Kuptsikevich from FxPro. The decline paused, anticipating further triggers, completely erasing Tuesday's upswing.

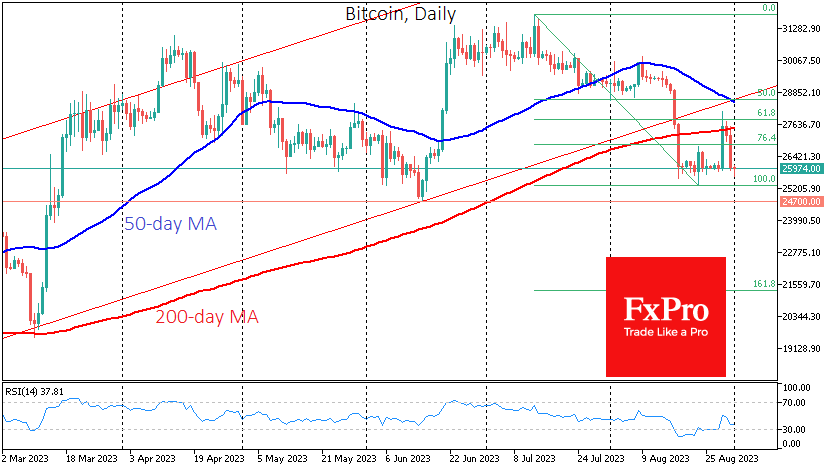

Bitcoin ended August down 11% at $26K, its worst performance since last November and the second consecutive month of declines. Technically, the recent pullback has confirmed that BTC's 200-day average is now acting as a resistance. According to the Fibonacci pattern, the potential downside target is the $21.3K area. However, a drop to $24.7K also looks like an impressive short-term target for the bears.

News Background

JPMorgan notes that the crypto market has reached fundamentals because of a large liquidation of positions, predicting a gradual easing of pressure on digital currencies.

Bloomberg raised the odds of a spot bitcoin ETF being approved in 2023 to 75%, and to 95% by the end of 2024, following the Grayscale court ruling. Grayscale said it was unsure whether it would refile to convert its GBTC ETF into a spot bitcoin ETF.

A New York district court dismissed a class action lawsuit against decentralised exchange Uniswap, stating that the platform was not liable for fraudulent tokens traded on it.

Regarding seasonality, September is considered the worst month of the year for BTC. Over the past 12 years, Bitcoin has only ended the month up three times and down nine times. The average decline was 13%, and the average gain was 11%. In the first case, BTC could end September at around $22.6K and at around $28.9K in the second.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)