Oil seeks to accelerate growth

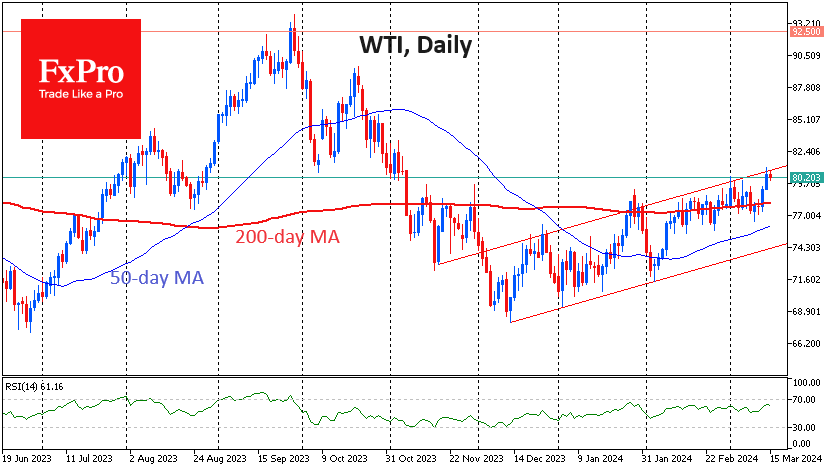

Oil hit 4-month highs on Thursday, closing the day above $80 per barrel WTI. The indicative smooth uptrend suggests that the wildest part of the rally is yet to come.

The medium-term uptrend in oil began at the December lows. At that time, oil was actively bought in attempts to break below the 200-week moving average. Touching this mark was also a turning point in 2023, kicked off a strong rally in 2020, and provided crucial support in 2019.

It's important to note that this isn't just a technical level, as OPEC and Russia have increased support for the price over the past five years by announcing quota cuts to break through it. The collapse in 2020 was not only the result of the cut. Still, it was preceded by a moment of open competition between Saudi Arabia and Russia for market share, coinciding with the peak in US production.

Although the rally in January did not quickly gain momentum, it gradually took hold in the markets. The 200-day moving average is more indicative of trader sentiment than producer sentiment. For almost a month now, the price has been hovering around this mark. This week has seen the most significant attempts by the bulls to shake up the market.

At levels just above $80, the price of WTI is approaching the upper boundary of the bullish corridor seen in late January and late February.

If oil really manages to accelerate, the price could rise to $88-90 within 2-3 weeks. Resistance at $92.5, where selling has intensified since August 2022, is where it could meet bolder resistance.

A pullback within the rising channel to the $75 area is an alternative short-term scenario.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)