US labour data awaited after strong ADP report

OVERNIGHT

Asian equities followed their US and European counterparts lower overnight, weighed down by the sharp rise in US Treasury yields yesterday. That was in response to a surprisingly strong rise of 497k in US private sector jobs in June, according to the ‘unofficial’ ADP report. The report has not been a particularly reliable gauge of the official data due later today but, taken at face value, it suggests the labour market remains very strong reinforcing the ‘higher for longer’ theme for global interest rates as central banks battle with inflation.

THE DAY AHEAD

Today’s focus is on the monthly US labour market report as markets assess the likelihood of a resumption of Federal Reserve interest rate increases later this month (26th) after the pause in June. As it stands, it looks like the Fed will raise rates by 25bp in July unless it sees compelling reasons not to do so. We expect the labour market data to show the US economy added 225k jobs in June, lower than 339k in May but nevertheless still a good outcome, while the unemployment rate is forecast to fall to 3.6% from 3.7%. On the other hand, a predicted 0.3%m/m rise in average hourly earnings would bring the annual rate down to 4.2% from 4.3%. Overall, the report is not expected to deter the Fed from hiking in July.

UK attention switches to next week’s labour market and monthly GDP releases (see “The Wire: Economics”, our weekly report, later today for details of our forecasts and themes). The Mansion House dinner also takes place on Monday, with BoE Governor Bailey and Chancellor Hunt scheduled to speak. This afternoon, MPC member Mann is due to speak on a panel about policy challenges.

In the Eurozone, German industrial production figures were released earlier this morning and surprised on the downside for a third month running. Output in the sector (including construction) fell by 0.2%m/m compared with consensus expectations for a flat outturn. Recent survey data point to further deceleration in manufacturing activity. There are otherwise no major Eurozone releases today, but several ECB speakers will likely attract attention, including Vice President Guindos and Bundesbank President Nagel.

MARKETS

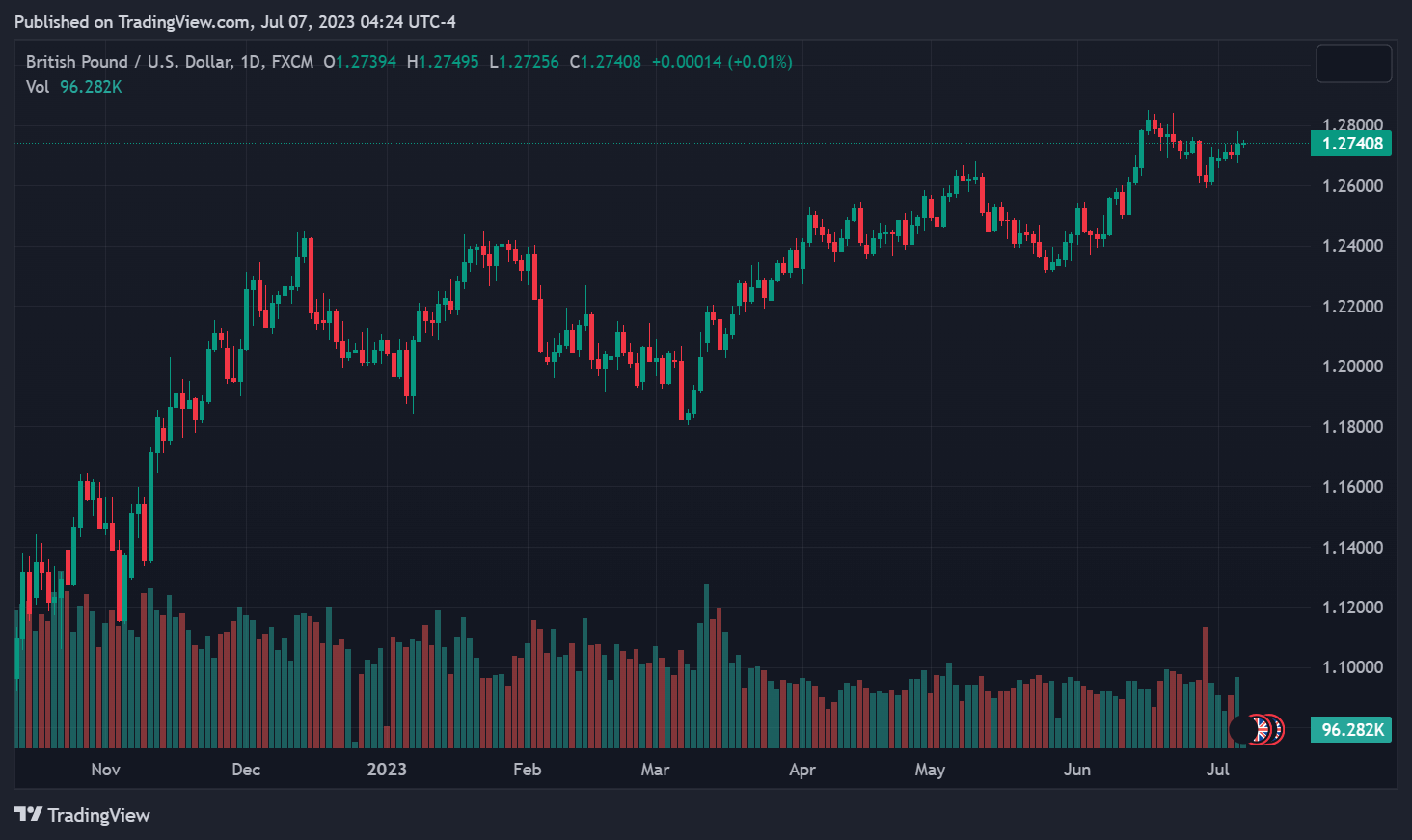

US Treasury yields jumped up yesterday after the surprisingly strong ADP figures signalling the labour market remains hot. The 10-year Treasury yield rose above 4% for the first time since March. UK 2- and 10-year gilt yields were pulled higher, closing at 5.50% and 4.66%, respectively, levels last seen in 2008. Currency markets were mixed, with initial post-data support for the US dollar appearing to subsequently fade.