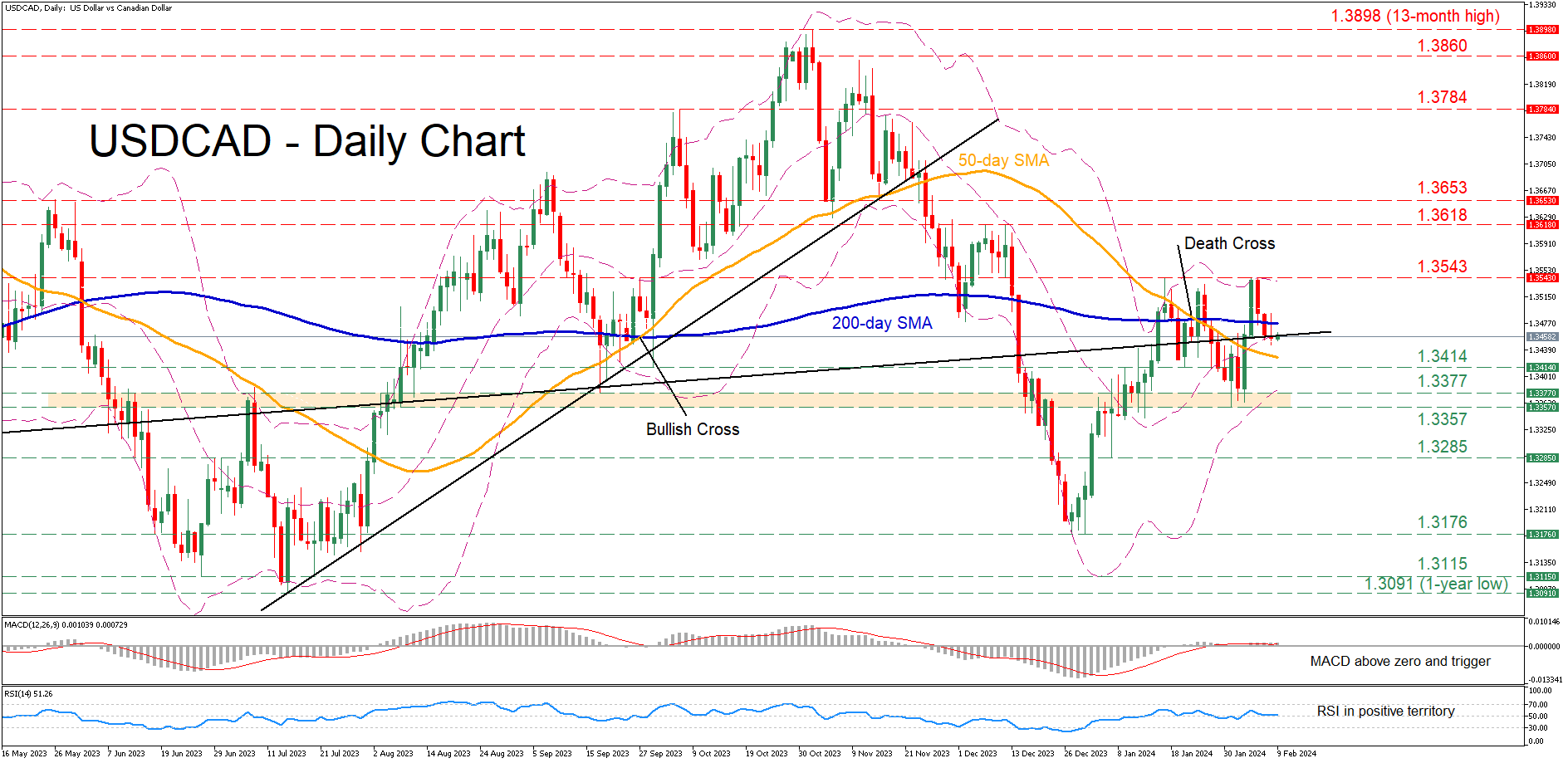

USD/CAD retreats towards crucial trendline

USDCAD had been staging a solid recovery from its December low of 1.3176, but its advance was rejected twice at the 2024 peak of 1.3543. The persistent inability to claim that hurdle resulted in a retreat below the 200-day simple moving average (SMA) this week, with the pair currently testing a crucial ascending trendline.

Should the pair bounce off the trendline and reverse higher, initial resistance could be found at the recent rejection region of 1.3543. Conquering that hurdle, the bulls could attack 1.3618, which held strong multiple times in December. Further advances may then cease at the April-May resistance of 1.3653.

On the flipside, if the decline resumes, the January support of 1.3414 could act as the first line of defense. Violating that zone, the pair may descend to challenge the 1.3377-1.3357 range defined by the September low and the most recent bottom. Even lower, the 1.3285 support region could provide downside protection.

In brief, USDCAD has been on the retreat again after forming a double top pattern. Hence, a decisive break below both the crucial trendline and 50-day SMA could accelerate the decline.

.jpg)