Crude Pulls Back on Trade Uncertainty | 29th July 2025

WTI Dips, Bias Softens

Crude oil prices retreated on Tuesday, with WTI slipping below $66.50 as traders adopted a cautious stance amid lingering uncertainty surrounding US-China trade negotiations. Although talks are set to resume, lack of concrete progress kept risk appetite in check. Meanwhile, global demand concerns and anticipation ahead of the upcoming FOMC policy decision added to the subdued tone across energy markets.

Silver Price Forecast (XAG/USD)

Current Price and Context

Silver (XAG/USD) is trading just below $38.00, showing limited movement as market participants digest the recent softening of global trade tensions. The pause in aggressive rhetoric between the US and China has lifted some pressure off safe-haven assets, though silver remains supported by broader macroeconomic uncertainty. Despite signs of reduced risk aversion, the precious metal continues to hover near recent highs as traders weigh incoming macro data. Market focus now shifts to the upcoming FOMC decision, which could impact demand for non-yielding assets like silver.

Key Drivers

Geopolitical Risks: Cooling US-China trade tensions reduce demand for traditional safe-haven assets like silver.

US Economic Data: Investors await US economic reports this week to assess inflation and growth trends.

FOMC Outcome: Traders remain cautious ahead of the Fed’s rate decision, which could influence silver’s directional bias.

Trade Policy: Positive tone in global trade discussions has removed some upside pressure on precious metals.

Monetary Policy: The possibility of rate stability or cuts by major central banks could continue to support silver prices.

Technical Outlook

Trend: Silver maintains a moderately bullish tone, holding above key moving averages.

Resistance: Immediate resistance lies at $38.30, followed by a stronger cap at $38.90.

Support: Initial support is seen at $37.50, with a deeper floor near $37.00.

Forecast: XAG/USD may consolidate between $37.50–$38.30 until a catalyst breaks the range.

Sentiment and Catalysts

Market Sentiment: Sentiment remains cautiously optimistic as trade tension relief is met with FOMC uncertainty.

Catalysts: FOMC rate decision, US GDP data, and any sudden shift in trade negotiations could drive silver volatility.

Oil Forecast (WTI)

Current Price and Context

WTI crude oil is trading just below $66.50, extending its mild bearish bias amid softer market sentiment. Prices edged lower during early Tuesday trade as demand concerns resurface following weak global manufacturing data. However, downside pressure appears limited as supply constraints and potential OPEC+ actions remain supportive. Traders are now watching US inventory data and broader risk trends to determine short-term direction.

Key Drivers

Geopolitical Risks: Middle East tensions have eased slightly, softening risk premiums on crude.

US Economic Data: Recent PMI figures pointed to slowing US industrial activity, weighing on oil demand outlook.

FOMC Outcome: Expectations of a cautious Fed stance may cap downside in oil by weakening the USD.

Trade Policy: Calmer global trade conditions reduce fears of energy demand shocks.

Monetary Policy: Rate cut hopes persist, which could eventually support oil via improved economic sentiment.

Technical Outlook

Trend: Short-term trend is mildly bearish with a lower high pattern forming.

Resistance: Immediate resistance is seen at $66.80, then at $67.50.

Support: Key support lies at $65.80, followed by $65.20.Forecast: WTI may range between $65.80 and $66.80 pending fundamental catalysts.

Sentiment and Catalysts

Market Sentiment: Investors remain cautious amid mixed global growth signals and fading geopolitical fear.

Catalysts: API inventory report, FOMC decision, and Chinese demand updates may influence short-term price action.

US-Canada Forecast (USD/CAD)

Current Price and Context

USD/CAD is trading flat around 1.3750 as investors await clarity on ongoing US-Canada trade negotiations. The pair remains supported by a modestly stronger US Dollar but faces resistance from stable crude oil prices that underpin the Canadian Dollar. The lack of clear direction reflects the market’s wait-and-see stance on whether new tariffs will be imposed or avoided.

Key Drivers

Geopolitical Risks: Uncertainty over bilateral trade terms continues to weigh on CAD sentiment.

US Economic Data: Mixed US economic indicators offer modest support for the greenback.

FOMC Outcome: A dovish Fed outlook could limit USD upside against the Loonie.

Trade Policy: No breakthrough yet on the US-Canada tariff discussions, keeping traders cautious.

Monetary Policy: The BoC’s neutral stance keeps USD/CAD responsive to US policy moves.

Technical Outlook

Trend: Sideways to slightly bullish on higher lows above 1.3700.

Resistance: 1.3775 followed by 1.3800.

Support: Initial support lies at 1.3720, then 1.3685.

Forecast: Consolidation expected within 1.3720–1.3780 unless tariff talks spark a breakout.

Sentiment and Catalysts

Market Sentiment: Cautiously neutral as traders await concrete news on tariffs.

Catalysts: US-Canada trade deal updates, oil price moves, and US data releases will guide near-term flows.

NZD/USD Forecast

Current Price and Context

NZD/USD is trading just under the 0.6000 mark after rebounding from a one-week low. Despite the modest recovery, the Kiwi remains under pressure due to cautious sentiment ahead of the upcoming FOMC decision. Traders are hesitant to make aggressive moves as they await guidance on the Federal Reserve’s policy direction and its implications for global risk appetite.

Key Drivers

Geopolitical Risks: Market tone is cautious amid global uncertainty and central bank divergence.

US Economic Data: Resilient US figures keep the Dollar supported near-term.

FOMC Outcome: Wednesday’s Fed announcement is the main event risk driving Kiwi’s hesitation.

Trade Policy: No fresh catalysts from China or US-NZ relations impacting flows.

Monetary Policy: Divergence between Fed tightening bias and RBNZ’s neutral stance weighs on NZD.

Technical Outlook

Trend: Slightly bearish while below the 0.6000 threshold.

Resistance: 0.6000 and 0.6030.

Support: 0.5950 and 0.5915.

Forecast: Consolidation likely with bearish tilt unless Fed surprises with dovish tone.

Sentiment and Catalysts

Market Sentiment: Neutral-to-bearish as traders reduce risk exposure ahead of FOMC.

Catalysts: FOMC statement, US job market data, and risk trends will determine short-term direction.

US-China Forecast

Current Price and Context

Markets remained steady after US-China trade negotiations concluded without major breakthroughs, with discussions set to resume on Tuesday. The lack of escalatory rhetoric has provided a stabilizing effect on global risk sentiment. While no concrete deals have emerged, the ongoing dialogue signals a willingness from both sides to continue cooperation, easing immediate market anxiety.

Key Drivers

Geopolitical Risks: Reduced tensions between the US and China support risk assets.

US Economic Data: Strong fundamentals continue to back US market resilience.

FOMC Outcome: Looming Fed decision caps major moves until clarity emerges.

Trade Policy: Continuation of dialogue supports global trade outlook.

Monetary Policy: Policy divergence remains in focus pending Fed outcome.

Technical Outlook

Trend: Neutral across major indices amid wait-and-see mode.

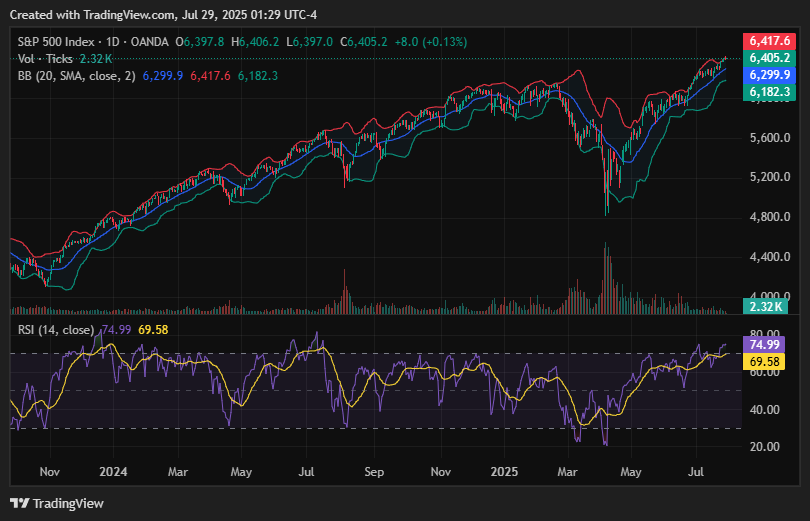

Resistance: S&P 500 faces resistance near 5,625; Nasdaq near 19,900.

Support: S&P 500 at 5,550; Nasdaq at 19,720.

Forecast: Consolidation likely ahead of further trade headlines and Fed commentary.

Sentiment and Catalysts

Market Sentiment: Cautious optimism as tensions ease without resolution.

Catalysts: Next round of US-China talks and FOMC decision midweek.

Wrap-up

WTI’s pullback reflects broader market hesitation as investors weigh geopolitical developments and upcoming US economic data. With US-China negotiations ongoing and the Federal Reserve poised to release its rate decision, volatility may increase in the short term. Until a clear direction emerges, crude prices are likely to remain confined within a narrow range.

Ready to trade global markets with confidence? Join Moneta Markets today and unlock 1000+ instruments, ultra-fast execution, ECN spreads from 0.0 pips, and more! Start now with Moneta Markets!