Will the S&P 500’s record run power on to 6,500?

The S&P 500 is on a roll - again. It recently burst through the 6,350 level, brushing it aside like a mere formality. For market watchers, it’s another high-water mark in a year defined by relentless momentum, tech-fuelled optimism, and the ever-present fear of missing out (FOMO).

With the earnings season in full swing and trade tensions simmering, investors are wondering: Is there still fuel in the tank to push toward 6,500, or are we getting too close to the sun?

Tech titans keep the rally on track

Once again, Big Tech is in the driver’s seat. Alphabet and Tesla are kicking off the Magnificent Seven’s earnings parade, and markets are watching every tick. So far, it’s going well - Alphabet surged ahead of its results, and Apple and Amazon are doing their part to keep the rally alive.

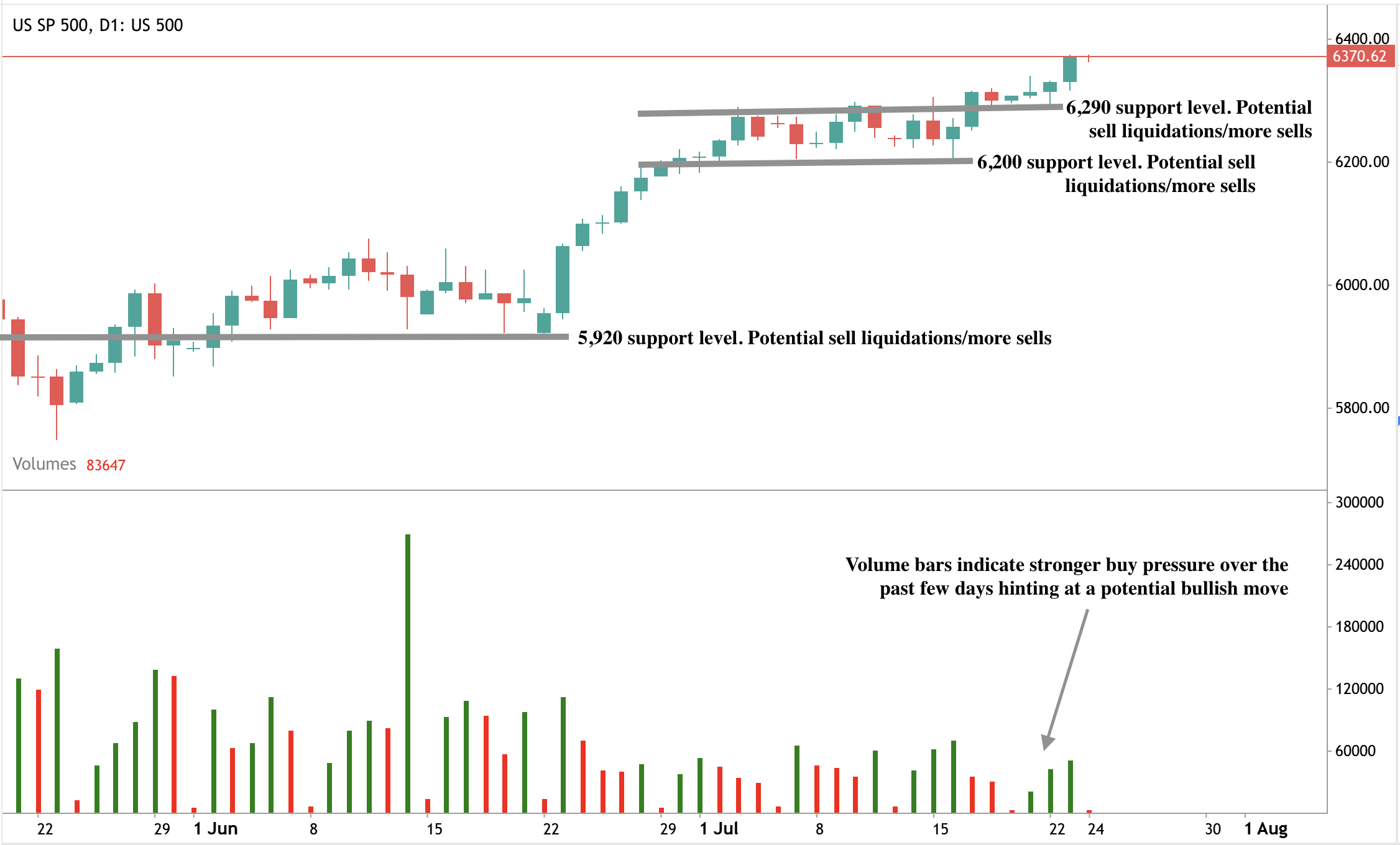

Source: Deriv MT5

Source: Deriv MT5

Source: Deriv MT5

Source: Deriv MT5

According to LSEG I/B/E/S, Q2 earnings are projected to rise 6.7%, largely due to these mega-cap players. Despite inflation staying sticky and global tensions bubbling, investors are trusting the usual suspects to keep the growth story going.

Tariff trouble ahead?

But there’s a catch. President Trump’s looming 1 August tariff deadline could throw a wrench in the works.

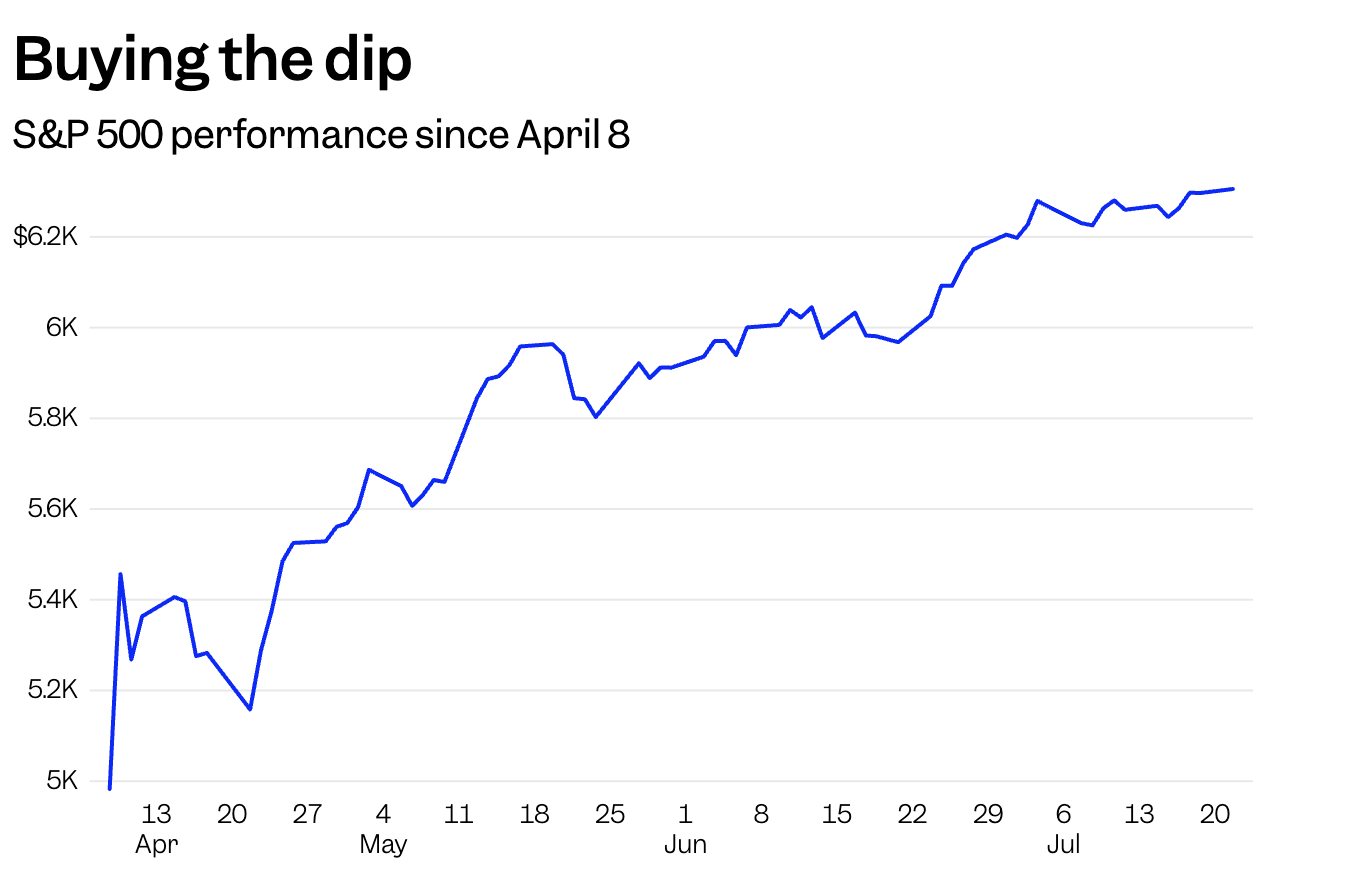

His threat? Up to 30% duties on EU and Mexican imports, and even harsher penalties for Canada, Japan, and Brazil. It’s a rerun of April’s “Liberation Day” tariff drama, which sent the S&P 500 tumbling to its lowest point in over a year.

Source: Deriv MT5

Source: Deriv MT5

Since then, the market has bounced back with astonishing strength - nearly 27% up from the lows. But the question remains: Can it withstand another tariff-induced gut check?

Source: Google Finance, AOL

Source: Google Finance, AOL

So far, sentiment suggests markets believe cooler heads will prevail. Investors are betting that negotiation trumps escalation - but it’s a high-stakes gamble.

Retail traders take centre stage

Another surprising force behind this rally? Retail investors.

Barclays reports that more than $50 billion has flowed into global equities from individuals in the past month alone. That’s a staggering amount - and a signal that the public is driving this latest leg higher while institutions proceed with caution.

Momentum indicators support the surge. The Nasdaq 100 has held above its 20-day moving average for 62 consecutive sessions - the second-longest streak since 1999. It’s the kind of stat that makes even the most sceptical traders sit up.

Still, momentum can be fickle. It lifts markets… until it doesn’t.

A few cracks beneath the surface

Despite the bullish vibe, not everything is as solid as it seems.

- The US dollar has lost nearly 11% since Trump’s return to office.

- Gold and silver are both up sharply - 30% and 35%, respectively - hinting that some investors are quietly hedging against future shocks.

- Consumer data is mixed, and this week’s jobless claims could shift sentiment fast.

- All eyes are on Jerome Powell. His Tuesday speech may reshape expectations around rate cuts - and markets haven’t moved more than 1% in either direction since late June. That kind of calm can be reassuring… or foreboding.

Is 6,500 a stretch - or just the next stop?

So, what’s the outlook? The road to 6,500 is wide open - but it’s not without hazards. If Big Tech keeps outperforming and Powell stays dovish, analysts say the index could climb that final 150 points sooner than many think.

But if earnings miss or tariffs hit hard, this rally could stall in dramatic fashion.

For now, investors are clinging to hope - and, in many cases, pure momentum. As one strategist quipped, this market is simply “too lucrative to leave.”

Still, the S&P 500 doesn’t rise on good vibes alone. While the current rally might feel unstoppable, history reminds us that markets can turn—often when confidence is at its peak.

S&P 500 technical outlook

At the time of writing, prices are on price discovery mode with bulls evidently in control. The volume bars also indicate bullish dominance, adding credence to the bullish narrative. If the charge towards new highs stalls, we could see sellers move with more conviction, pushing prices lower. If we see a slump, prices will be held at the $6,290, $6,200, and $5,920 support levels.

Disclaimer:

The information contained within this article is for educational purposes only and is not intended as financial or investment advice. We recommend you do your own research before making any trading decisions.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

The performance figures quoted are not a guarantee of future performance.