Yen hopes for FX intervention

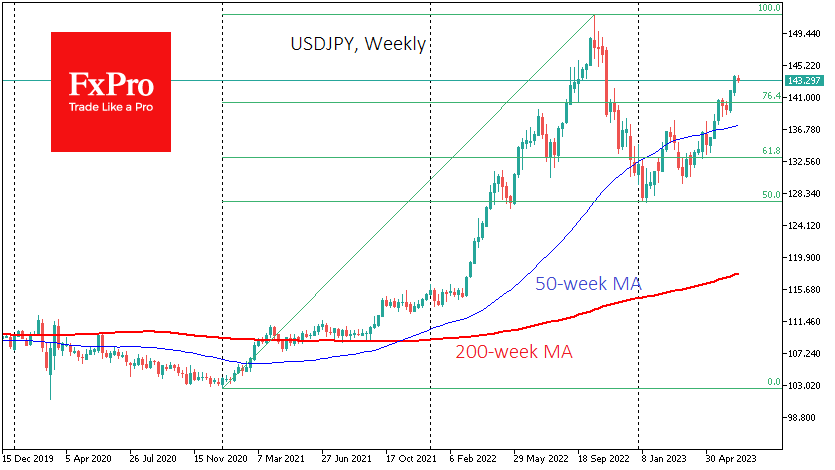

The Yen has been under pressure, losing 3.5% against the Dollar and over 5.6% against the Euro since the beginning of the month. The EURJPY has risen to its highest level since September 2008. The USDJPY is trading above 143.50, where the intervention took it in October and November last year, and close to the 1998 turning point.

The yen's sharp weakness and proximity to historical highs have traders pricing in the likelihood that the central bank will intervene at the behest of the Ministry of Finance to strengthen the exchange rate. However, the nominal exchange rate means little to the government and the central bank, so the focus is on economic indicators.

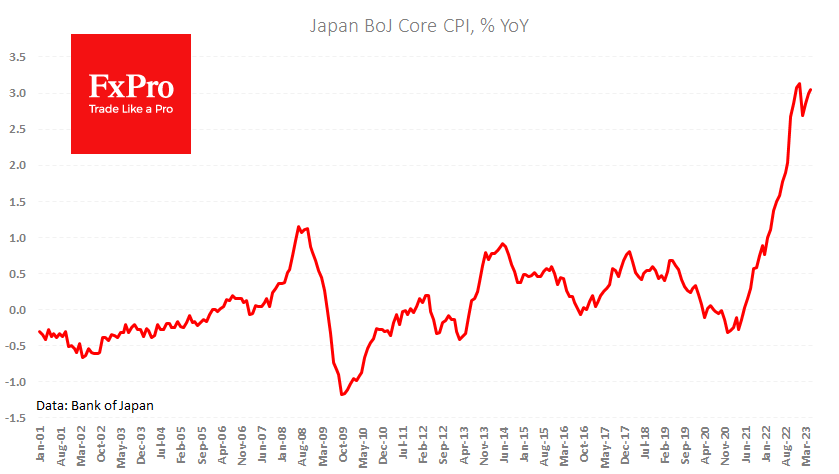

The most important of these is the Bank of Japan's core CPI. Here we see an acceleration to 3.1% y/y from 3.0% the previous month and a low of 2.7% in February. Although the rate of price increases in Japan is significantly lower than in the US and Europe, there are no signs of a peak.

For the economy, this means that inflation expectations are becoming more firmly anchored. On the one hand, higher inflation is in line with central bank targets of previous decades. Hence the comparative apathy of the BoJ, which has yet to take the slightest step to tighten policy in the fight against rising prices.

There is a belief that exchange rate depreciation improves export competitiveness. However, it is worth noting that this rule only really applies when it is certain that the exchange rate will stay the same.

Therefore, the case for intervention to support the yen is growing, but it isn’t easy to foresee when it will occur. It could be the current USDJPY level of 143, where the pair has been stuck for a third day, or the 150 area, where the USD climbed in October 2022.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)