Edit Your Comment

Discussion of the Forex Contest Arum Capital Forex Contest

會員從Jun 06, 2013開始

4帖子

會員從Mar 12, 2018開始

30帖子

會員從Jun 06, 2013開始

4帖子

Apr 20, 2018 at 17:26

會員從Jun 06, 2013開始

4帖子

ArumCapital posted:

Greetings everyone!

Don't panic, we're figuring out what'd happened and let you know as soon as there will be any information on it.

When after Contest end? Finally, you made all fool you are not A-Book broker, you are a Cheat-Book broker.

Money Money Money....

Apr 21, 2018 at 11:07

會員從Nov 26, 2012開始

5帖子

Staff posted:

Dear Traders, please note the use any methods of cheating, not limited to, such as arbitraging a demo feed or sending hundreds of orders to get off-quote prices will result in disqualification.

Are you a representative of the company? Why do you decide who to trade for ArumCapital?

forex_trader_480717

會員從Dec 07, 2017開始

24帖子

Apr 21, 2018 at 12:16

會員從Dec 07, 2017開始

24帖子

Dear Traders,

I have had enough watching the "theatre of insanity"... And I am not talking about the actual demo contest. In my humble opinion, this contest has been created to demonstrate to "profit-hungry" people what it can be achieved with the so called "High Frequency Trading" aka HFT and especially to a certain part of it which is latency arbitrage. Now, if these so called "profit-hungry" people will be penalised for their addiction or despair is not my job at all. I am writing this post for other reasons, and one of them is to express in writing my personal anger about the notion of "misleading". Hence, I will expand:

First thing first: Is "cheating":

1) being more informed than the others?

2) being more workaholic than the others?

3) being smarter than the others?

and at the end of the day...

4) being more geek than the others?

In the world we are living and since the ancient times of commerce / trading, profit was made out of a merchant's / trader's ability to understand the market he was(is) participating in. More specifically. to understand the structure of supply and demand and the most influencing parameters of them and then exploit his resulted competitive advantage.

Was he OR is he a cheater?

Organised society invented the concept of a general accepted and therefore "objective" regulator so to be appropriate to answer the billion dollar question of "cheating or not" and decide to enforce the appropriate actions. Former Securities and Exchange Commission Chairwoman Mary Schapiro stated that the onus for determining “whether the markets are functioning fairly” should fall on someone other than the investors themselves (Greg McFarlane, Investopedia).

Based on the above said:

Supply and demand makes a market. Human beings make a market. Is that market regulated? And if it is by whom? Should it be regulated at all? And finally, should, could, would we the traders-investors being able to exploit our co market participants (other traders, brokers etc), inability to follow and adopt to any dimension evolution?

Conclusion: Misleading for me is the result of the "A blind leads the blinds". And that is what makes me angry.

I have had enough watching the "theatre of insanity"... And I am not talking about the actual demo contest. In my humble opinion, this contest has been created to demonstrate to "profit-hungry" people what it can be achieved with the so called "High Frequency Trading" aka HFT and especially to a certain part of it which is latency arbitrage. Now, if these so called "profit-hungry" people will be penalised for their addiction or despair is not my job at all. I am writing this post for other reasons, and one of them is to express in writing my personal anger about the notion of "misleading". Hence, I will expand:

First thing first: Is "cheating":

1) being more informed than the others?

2) being more workaholic than the others?

3) being smarter than the others?

and at the end of the day...

4) being more geek than the others?

In the world we are living and since the ancient times of commerce / trading, profit was made out of a merchant's / trader's ability to understand the market he was(is) participating in. More specifically. to understand the structure of supply and demand and the most influencing parameters of them and then exploit his resulted competitive advantage.

Was he OR is he a cheater?

Organised society invented the concept of a general accepted and therefore "objective" regulator so to be appropriate to answer the billion dollar question of "cheating or not" and decide to enforce the appropriate actions. Former Securities and Exchange Commission Chairwoman Mary Schapiro stated that the onus for determining “whether the markets are functioning fairly” should fall on someone other than the investors themselves (Greg McFarlane, Investopedia).

Based on the above said:

Supply and demand makes a market. Human beings make a market. Is that market regulated? And if it is by whom? Should it be regulated at all? And finally, should, could, would we the traders-investors being able to exploit our co market participants (other traders, brokers etc), inability to follow and adopt to any dimension evolution?

Conclusion: Misleading for me is the result of the "A blind leads the blinds". And that is what makes me angry.

會員從Jan 08, 2016開始

276帖子

Apr 21, 2018 at 13:49

會員從Jan 08, 2016開始

276帖子

mkcell posted:Staff posted:

Dear Traders, please note the use any methods of cheating, not limited to, such as arbitraging a demo feed or sending hundreds of orders to get off-quote prices will result in disqualification.

Are you a representative of the company? Why do you decide who to trade for ArumCapital?

I guess this is not your business how myFXbook is conducting theirs !

All participants are free to open a real account with the broker and trade the way they want (until the broker does change his mind 😇), don't you think ?!

Complexity is expensive, inefficient, and ineffective > Crocodile trading

forex_trader_480717

會員從Dec 07, 2017開始

24帖子

Apr 22, 2018 at 06:11

會員從Dec 07, 2017開始

24帖子

Croco_Dile posted:mkcell posted:Staff posted:

Dear Traders, please note the use any methods of cheating, not limited to, such as arbitraging a demo feed or sending hundreds of orders to get off-quote prices will result in disqualification.

Are you a representative of the company? Why do you decide who to trade for ArumCapital?

I guess this is not your business how myFXbook is conducting theirs !

All participants are free to open a real account with the broker and trade the way they want (until the broker does change his mind 😇), don't you think ?!

Amen...

會員從Jun 06, 2013開始

4帖子

Apr 22, 2018 at 06:46

會員從Jun 06, 2013開始

4帖子

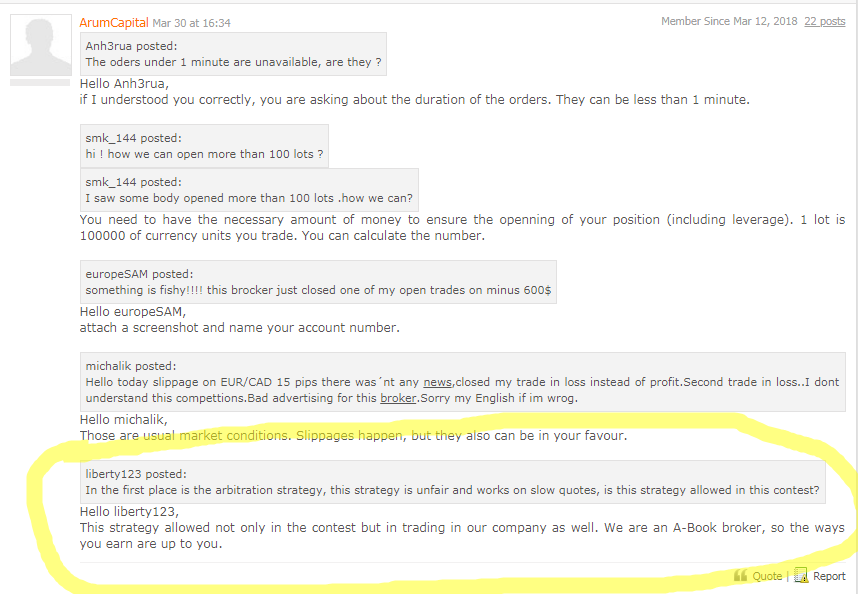

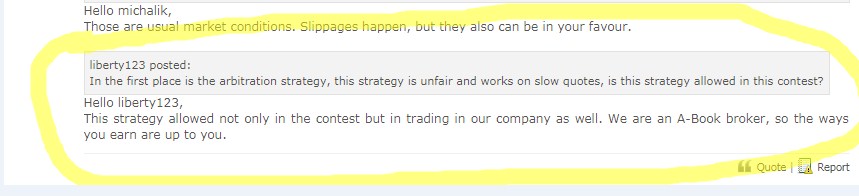

Staff posted:

Dear Traders, please note the use any methods of cheating, not limited to, such as arbitraging a demo feed or sending hundreds of orders to get off-quote prices will result in disqualification.

then why you told Arbitrage is allowed in starting, contest ending time why you telling Arbitration is cheating not allowed. Who is the cheater you or us? We are not cheating. You are using poor peoples for your company advertisement. We do not slave to you.

Money Money Money....

Apr 25, 2018 at 12:48

會員從Jul 31, 2009開始

1418帖子

Dear Traders,

Please note that the accounts were disqualified by us, not by the broker.

After further verification of disqualified accounts and discussion, broker confirmed that such trading methods correspond to the initial contest conditions and therefore all accounts have been restored.

We apologize for any inconvenience this may cause.

Please note that the accounts were disqualified by us, not by the broker.

After further verification of disqualified accounts and discussion, broker confirmed that such trading methods correspond to the initial contest conditions and therefore all accounts have been restored.

We apologize for any inconvenience this may cause.

Apr 25, 2018 at 13:10

會員從Jun 06, 2010開始

1帖子

DPG1968 posted:

Dear Traders,

I have had enough watching the "theatre of insanity"... And I am not talking about the actual demo contest. In my humble opinion, this contest has been created to demonstrate to "profit-hungry" people what it can be achieved with the so called "High Frequency Trading" aka HFT and especially to a certain part of it which is latency arbitrage. Now, if these so called "profit-hungry" people will be penalised for their addiction or despair is not my job at all. I am writing this post for other reasons, and one of them is to express in writing my personal anger about the notion of "misleading". Hence, I will expand:

First thing first: Is "cheating":

1) being more informed than the others?

2) being more workaholic than the others?

3) being smarter than the others?

and at the end of the day...

4) being more geek than the others?

In the world we are living and since the ancient times of commerce / trading, profit was made out of a merchant's / trader's ability to understand the market he was(is) participating in. More specifically. to understand the structure of supply and demand and the most influencing parameters of them and then exploit his resulted competitive advantage.

Was he OR is he a cheater?

Organised society invented the concept of a general accepted and therefore "objective" regulator so to be appropriate to answer the billion dollar question of "cheating or not" and decide to enforce the appropriate actions. Former Securities and Exchange Commission Chairwoman Mary Schapiro stated that the onus for determining “whether the markets are functioning fairly” should fall on someone other than the investors themselves (Greg McFarlane, Investopedia).

Based on the above said:

Supply and demand makes a market. Human beings make a market. Is that market regulated? And if it is by whom? Should it be regulated at all? And finally, should, could, would we the traders-investors being able to exploit our co market participants (other traders, brokers etc), inability to follow and adopt to any dimension evolution?

Conclusion: Misleading for me is the result of the "A blind leads the blinds". And that is what makes me angry.

ahahahahahahahahaah

*商業用途和垃圾郵件將不被容忍,並可能導致帳戶終止。

提示:發佈圖片/YouTube網址會自動嵌入到您的帖子中!

提示:鍵入@符號,自動完成參與此討論的用戶名。