Edit Your Comment

Avoid trading on macroeconomic data(brexit)

Jun 22, 2016 at 11:58

會員從Jan 14, 2011開始

34帖子

Have you just started your trading journey? Avoid trading on macroeconomic data. It is tempting, as rising volatility always makes the market more interesting at the time of publishing new economic data, but in real trading it is more gambling than investing. Trading is not about taking chances, and it is crucial that you first understand the market and treat macroeconomic data only as a filter to your trading. There are certain tools for trading on macroeconomic data, but you shouldn't do that unless you are a skilled professional - otherwise you are just going to become another money donor for the Market Makers.

Correct

Incorrect

Correct

Incorrect

Jun 23, 2016 at 06:42

會員從Jun 07, 2015開始

92帖子

After paper trading for the last 18 months, it took only six months of nfp gambles to realize it was simply not worth my time or effort to roll the dice on large volatile fundamentals .

Everything in the market is like a fart, if you have to force it, it is probably shit

Jun 23, 2016 at 08:41

(已編輯Jun 23, 2016 at 08:51)

會員從Sep 20, 2014開始

342帖子

Then you guys have poorly designed systems. I'm going into BREXIT with 18 systems running.

A well designed system doesn't feel much for these events. And of course I wouldn't attempt it on MT, just to slow. I don't know how much I'm going to make tonight, but it's going to be a lot. You only get 1 or 2 of these a year. Really looking forward to it. Not that I'll be watching, Asia Pacific region, so I'll peer at the results over a steaming cup of java tomorrow morning.

It's really a question of if it's going to be a bunch of whips, or if we're going to get a move out of it. I'm hoping for a move.

@dkilmer

The NFP's have been pretty useless for a few years now. I call it dead fish events. Flip, flop, flip, flop...dead. Been a very long time since we've had a decent move from it.

A well designed system doesn't feel much for these events. And of course I wouldn't attempt it on MT, just to slow. I don't know how much I'm going to make tonight, but it's going to be a lot. You only get 1 or 2 of these a year. Really looking forward to it. Not that I'll be watching, Asia Pacific region, so I'll peer at the results over a steaming cup of java tomorrow morning.

It's really a question of if it's going to be a bunch of whips, or if we're going to get a move out of it. I'm hoping for a move.

@dkilmer

The NFP's have been pretty useless for a few years now. I call it dead fish events. Flip, flop, flip, flop...dead. Been a very long time since we've had a decent move from it.

會員從Jun 08, 2016開始

4帖子

Jun 23, 2016 at 08:55

會員從Jun 08, 2016開始

4帖子

theHand posted:fi

Then you guys have poorly designed systems. I'm going into BREXIT with 18 systems running.

A well designed system doesn't feel much for these events. And of course I wouldn't attempt it on MT, just to slow.

Don't foget to share your results.

I don't trust to fixe profit during Brexit

Jun 23, 2016 at 09:00

(已編輯Jun 23, 2016 at 09:29)

會員從Sep 20, 2014開始

342帖子

The results will be mixed as always. Some will win, some will takes losses. This is not a 1 day game, as long as I come out with my shirt on my back on the other side I'm happy. On average I should do well. How well remains to be seen.

If you can trade through this and come out smelling like roses you can trade through anything. This will be the biggest event for a while, very good test for my methods.

If you can trade through this and come out smelling like roses you can trade through anything. This will be the biggest event for a while, very good test for my methods.

Jun 23, 2016 at 09:53

會員從May 11, 2011開始

219帖子

theHand posted:

I call it dead fish events. Flip, flop, flip, flop...dead.

Description of the year, ROFL!

You made my day, thank you. I can think of a few situations where this term will be useful to use in everyday life.

For every loss there should be at least an equal and opposite profit.

會員從Jun 23, 2016開始

1帖子

Jun 23, 2016 at 11:05

會員從May 11, 2011開始

219帖子

Scrooge_McDuck posted:

I also think it's better not to trade today - one day of not trading doesn't make a difference anyway.

There will be "aftershocks" as they adjust to the outcome (may last a few months) - Out = renegotiating trade terms for example, In = gaining renewed trust within the EU (just like announcing your intent to quit your job, and then deciding to stay), these are just one change per outcome out of many.

Every trader must decide - "Do I see this risk and volatility as fear (not trade) or opportunity (trade)?" then do whatever is in their best interest.

For every loss there should be at least an equal and opposite profit.

Jun 23, 2016 at 11:24

會員從Sep 20, 2014開始

342帖子

Scrooge_McDuck posted:

I also think it's better not to trade today - one day of not trading doesn't make a difference anyway.

It makes a very big difference. I know from my stats when I use to track them most of the moves are on Wednesdays and Thursdays. Miss it and you miss your week. Most of the time nothing happens.

FX wasn't like this years ago, you bugger off 1000 pips this way just to go 1000 pips that way 2 days later. It rarely happens now. So ja, the days it moves are important, you have to be there when it moves.

Jun 23, 2016 at 11:39

會員從Sep 20, 2014開始

342帖子

Let me put it like this, better to be out is to be there with a system that was designed from scratch knowing these kind events are part of the task.

Correct trades sizes, functions handling the various problems this can cause, like spikes and wide spread events. Kick outs on major NAV events etc. Just proper global risk control.

Correct trades sizes, functions handling the various problems this can cause, like spikes and wide spread events. Kick outs on major NAV events etc. Just proper global risk control.

Jun 23, 2016 at 13:57

會員從Jun 07, 2015開始

92帖子

theHand posted:

This is a coin toss. You have no idea when you go into it if it will work for your or not. Over time it's a 50/50 thing.

Let it run when it goes for you, cut it short when it doesn't.

no shit sherlock. glad you are doing good, luckly for us, there is a million ways to skin a cat

Everything in the market is like a fart, if you have to force it, it is probably shit

會員從Jun 08, 2016開始

4帖子

Jun 24, 2016 at 10:35

(已編輯Jun 24, 2016 at 11:02)

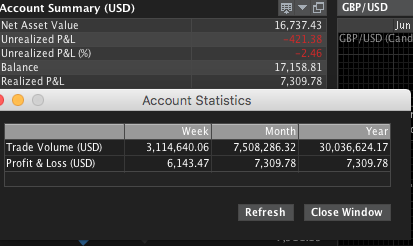

會員從Sep 20, 2014開始

342帖子

Jun 24, 2016 at 12:26

會員從May 11, 2011開始

219帖子

Next move to look out for: "Referendum on Scottish independence" announced to be held before UK leaves the bloc. I'm up just over 35% since yesterday... congratulations on the 61% theHand, keep 'em coming.

For every loss there should be at least an equal and opposite profit.

Jun 24, 2016 at 23:45

會員從Sep 20, 2014開始

342帖子

Probably just luck @xgavinc .

I don't get too many BREXIT's to try my luck on. Sadly. So very hard to build a statistical picture on how I really do on these events. Few more events like this a year be nice, but I guess that would be too easy...

Point is though, that I'm trying to make to the rest of the posters here, that if one can trade through an event like this and come out smelling like roses, then NFP and the rest of them just doesn't matter. All you need is well thought out and well designed system. If you can't even handle NFP then there's something wrong with your methods.

I don't get too many BREXIT's to try my luck on. Sadly. So very hard to build a statistical picture on how I really do on these events. Few more events like this a year be nice, but I guess that would be too easy...

Point is though, that I'm trying to make to the rest of the posters here, that if one can trade through an event like this and come out smelling like roses, then NFP and the rest of them just doesn't matter. All you need is well thought out and well designed system. If you can't even handle NFP then there's something wrong with your methods.

會員從May 16, 2014開始

7帖子

*商業用途和垃圾郵件將不被容忍,並可能導致帳戶終止。

提示:發佈圖片/YouTube網址會自動嵌入到您的帖子中!

提示:鍵入@符號,自動完成參與此討論的用戶名。