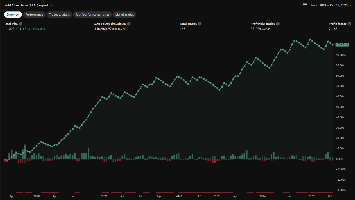

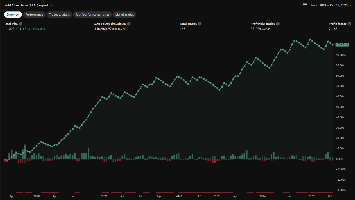

VoidFiller BaseVoidFiller Base is a proprietary quantitative model designed to operate on major U.S. equities, exploiting price inefficiencies that arise from opening gaps, liquidity imbalances, and intraday volatility transitions. The operational logic is based on the same structural principle as the Gap Hunter series, adapted to the more complex and fragmented behavior of the stock market, where gap-filling dynamics (“void filling”) provide systematic profit opportunities.

The algorithm simultaneously analyzes multiple stocks within the main S&P 500 sectors, executing parallel mean-reversion and momentum strategies to ensure internal diversification and reduce single-stock specific risk. All position management parameters have been optimized by independent testers to maintain a maximum drawdown below 10%, making the model compliant with the strict risk standards required by top proprietary trading firms.

Through the combination of an extensive historical data set and rigorous algorithmic risk management, VoidFiller Base positions itself as a stable, scalable strategy suitable for institutional capital or prop accounts, delivering consistent capital growth aligned with professional risk management principles.

⚠️ Disclaimer: The performance results presented are based on historical tests and do not guarantee future outcomes. Equity trading involves significant risks of capital loss and should only be undertaken with full awareness and appropriate risk management.

Trade smart. Trade with Pinealgos.