Edit Your Comment

"Just Oil"

Jul 20, 2012 at 08:32

(編集済みのJul 20, 2012 at 08:32)

Jan 14, 2010からメンバー

2299 投稿

Jul 20, 2012 at 09:02

Jan 14, 2010からメンバー

2299 投稿

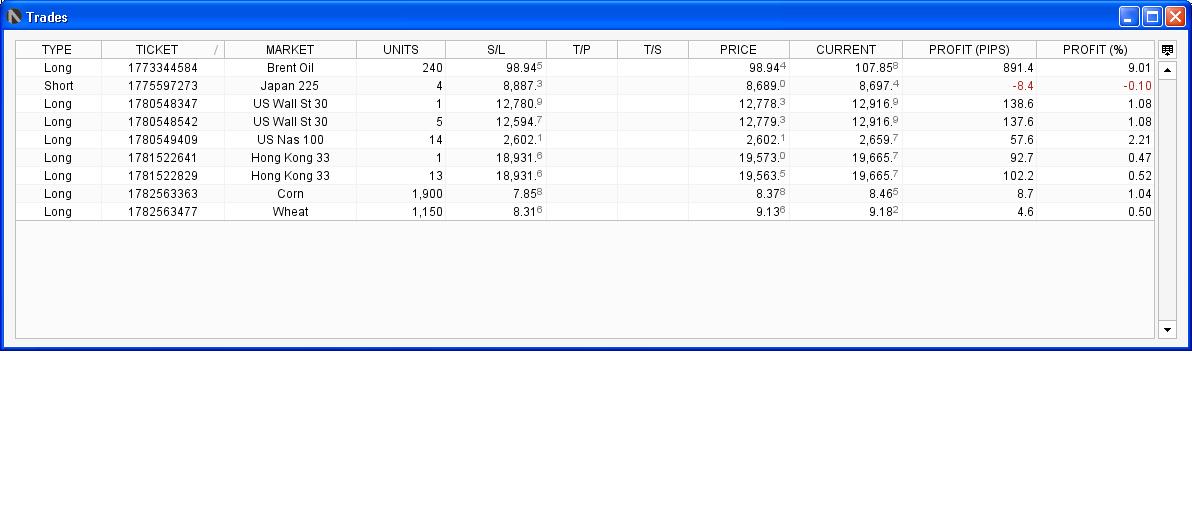

bought wheat and corn yesterday. all trades but one turned green and floating equity is more than I lost. not taking no profits of course. if things go my way will lock full size profits.

biggest worry are NZD trades. stuck there

better not to think. i am taking signals and do not worry, cut losers, let profits run.

biggest worry are NZD trades. stuck there

better not to think. i am taking signals and do not worry, cut losers, let profits run.

Jul 21, 2012 at 08:13

(編集済みのJul 21, 2012 at 08:14)

Jan 14, 2010からメンバー

2299 投稿

Could not sleep tonight. Thoughts of trade management mistakes taking partials and closing trades manually and not taking few signals which turned big winners. Eur/Aud is the biggest would be winner. 1200 pips now from my entry. Did not take aud/nzd thinking there is triangle on weekly. I already got it. in this kind of trading all signals must be taken without any thought. Stop loss is ATR based which is smaller, more losses but R:R is drastically improved for winners. All trades are taken out by market which means I move stop and let market decide. The case in point I closed e/u short. Good that only closed this one trade. it did not hit my stop then. On the other hand gbp/jpy my stop was approached but never triggered. Now it is going down. from my calculations with full size I should have locked around 15% in profit by now by just moving stops. It has been a learning experience for me and overall I feel good but should avoid making same mistakes again. It is trend trading and my goal is to get on as many trades as possible and run them as long as possible.

Jul 21, 2012 at 09:35

(編集済みのJul 21, 2012 at 09:56)

Jan 02, 2012からメンバー

44 投稿

In my opinion a trader always makes mistakes, it's his job to make more good decisions than bad ones! Bad decisions are unavoidable! Thinking about past trades that you should've kept open is just looking at the wrong problem..those were winners and you had to close them to take profit! Of course I understand you want to make to most out of all trades but that's simply impossible, otherwise you will be the richest man on earth within 10 years, just try to imagine the probability of that happening...also, don't overly rely on a system to trade and not think, very trade is different and the fx market changes all the time, so I think it's better to increase your experience by thinking all the time, measuring the pro's and contra's, R:R, resistance, support, ect. A system can be a tool, not THE tool

Anyway I think you have been trading very well this last weeks, so there is nothing to regret, it's important to sleep well ;)

Every day gives us new trading opportunities, it's our job to recognize them and to take the opportunities!

Momentarily I am short the EUR/CAD with my first demo because the chart is just so weak! Even on a EUR/$ bounce of 100 pips it hardly goes up so I think it can go even lower newt week, on the second demo I am long the $/CHF based on EUR weakness and chart support between 0.9760 and 0.9860

Anyway I think you have been trading very well this last weeks, so there is nothing to regret, it's important to sleep well ;)

Every day gives us new trading opportunities, it's our job to recognize them and to take the opportunities!

Momentarily I am short the EUR/CAD with my first demo because the chart is just so weak! Even on a EUR/$ bounce of 100 pips it hardly goes up so I think it can go even lower newt week, on the second demo I am long the $/CHF based on EUR weakness and chart support between 0.9760 and 0.9860

forex_trader_79941

Jun 06, 2012からメンバー

1439 投稿

Jul 21, 2012 at 12:35

Jun 06, 2012からメンバー

1439 投稿

Chikot

I told you about that. as much as you make desecion as much as you make mistakes. desecion should be at min level. on entry side or on exit side. when in both side you basicly double you wrong desecion poss.

I am always saying that 'coded too much, when someting good for long now will be good for short after bars/hours/days/weeks depending your period.'

I told you about that. as much as you make desecion as much as you make mistakes. desecion should be at min level. on entry side or on exit side. when in both side you basicly double you wrong desecion poss.

I am always saying that 'coded too much, when someting good for long now will be good for short after bars/hours/days/weeks depending your period.'

Chikot posted:

Could not sleep tonight. Thoughts of trade management mistakes taking partials and closing trades manually and not taking few signals which turned big winners. Eur/Aud is the biggest would be winner. 1200 pips now from my entry. Did not take aud/nzd thinking there is triangle on weekly. I already got it. in this kind of trading all signals must be taken without any thought. Stop loss is ATR based which is smaller, more losses but R:R is drastically improved for winners. All trades are taken out by market which means I move stop and let market decide. The case in point I closed e/u short. Good that only closed this one trade. it did not hit my stop then. On the other hand gbp/jpy my stop was approached but never triggered. Now it is going down. from my calculations with full size I should have locked around 15% in profit by now by just moving stops. It has been a learning experience for me and overall I feel good but should avoid making same mistakes again. It is trend trading and my goal is to get on as many trades as possible and run them as long as possible.

Jul 21, 2012 at 14:55

Jan 14, 2010からメンバー

2299 投稿

guys, the point is that it is trend following. Taking few pips is not a goal, the goal is to get on big trend and ride it. You are right though. I have to learn lessons and avoid same mistakes in the future. it also comes to taking trades as signal generated. i missed a few last month because had doubts about pairs I had never traded before. They are in big trends now.

Jul 22, 2012 at 23:10

Jan 14, 2010からメンバー

2299 投稿

Steve, the more the better. you do not know how far the market can go. Trend trading in this regard has complete sense. what i am doing is the opposite to guys who let losses run and grew fat tails. Their balance looks good until they blow, but in my case I am trying to great my floating equity by getting on trend and let it run and go along by locking profits until I get stopped at profit. I am looking to get as much as I can.

forex_trader_79941

Jun 06, 2012からメンバー

1439 投稿

Jul 22, 2012 at 23:59

Jun 06, 2012からメンバー

1439 投稿

coded too much yesterday and today. get tired.

but I think I have found very strange system regarding to the momentum.

1990-2012 15 min bar open

yes correct it is 22 YEARS of BT with no optimization.

I am also surprised.

but I think I have found very strange system regarding to the momentum.

1990-2012 15 min bar open

yes correct it is 22 YEARS of BT with no optimization.

I am also surprised.

stevewalker posted:

you are correct.

correction

when floating;

equity > balance correct

equity < balance suicide

Chikot posted:

I was thinking equity is unrealized😳

Jul 22, 2012 at 23:59

Jan 14, 2010からメンバー

2299 投稿

aud/jpy looks like showing similar double top to nzd/usd. I am long and locked 110 pips +0.5% in case I am stopped but I'm starting thinking if i should close and go short. probably not. will wait for real signal on this one. will check on new daily candle after midnight.

Jul 23, 2012 at 00:01

Jan 14, 2010からメンバー

2299 投稿

By optimization you probably mean curve fitting? I have read the the most robust systems are actually not too much optimized. the simpler the more robust they are.

I wonder, when will you go live? been coding for years.

I wonder, when will you go live? been coding for years.

stevewalker posted:

you are correct.

correction

when floating;

equity > balance correct

equity < balance suicide

Chikot posted:

I was thinking equity is unrealized😳

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。