Advertisement

EURUSD Exchange Rate

ユーロ対米ドル Exchange Rate (EUR to USD)

+0.37% +43.5 pips

Bid/Ask:

1.17385/1.16950

日々の範囲:

1.16789 - 1.17601

1分の範囲

5分の範囲

15分の範囲

30分の範囲

1時間の範囲

4時間の範囲

日々の範囲

秋の範囲

月の範囲

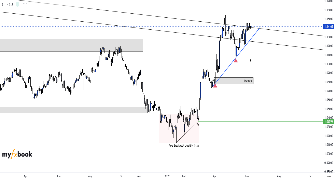

EURUSD Live Price Chart

Upcoming Events for EUR and USD

|

イベント

|

Prev.

|

Cons.

|

|||

|---|---|---|---|---|---|

|

1h 43m

ロー

|

EUR | 62.5 |

63

|

||

|

6h 42m

メッド

|

EUR | 1.6% |

-9.8%

|

||

|

7h 42m

ロー

|

EUR | -2.3% |

-2.6%

|

||

|

7h 42m

ロー

|

EUR | -3.1% |

-2.5%

|

||

|

7h 42m

ロー

|

EUR | -2% |

-2.3%

|

||

|

8h 42m

ハイ

|

EUR | -20.3 |

-19.2

|

||

|

9h 27m

メッド

|

EUR | 96 |

96

|

||

|

9h 27m

ロー

|

EUR | 96 |

95

|

||

|

9h 42m

ロー

|

EUR | ||||

|

9h 42m

ハイ

|

EUR | 11.36% |

10.7%

|

FRB and ECB Interest Rates

| 国 | Central Bank | Current Rate | Previous Rate | Next Meeting |

|---|---|---|---|---|

| United States | Federal Reserve | 4.5% | 4.5% | 6 日 |

| Euro Area | European Central Bank | 2.15% | 2.4% | 14時 57分 |

Latest EURUSD News

U.S. Existing Home Sales Slump To Nine-Month Low In June

A report released by the National Association of Realtors on Wednesday showed existing home sales in the U.S. pulled back by more than expected in the month of June. NAR said existing home sales slumped by 2.7 percent to an annual rate of 3.93 million in June after jumping by 1.0 percent to a revised rate of 4.04 million in May.

RTTNews

|

6時54分前

U.S. Dollar Falls On Tariff Uncertainty

The U.S. dollar fell against its major counterparts in the New York session on Tuesday, amid fading hopes of a trade deal between the country and Europe.

RTTNews

|

1日前

U.S. Dollar Falls Against Majors

The U.S. dollar weakened against its major counterparts in the New York session on Monday.

RTTNews

|

2日前

U.S. Leading Economic Index Dips Slightly More Than Expected In June

A report released by the Conference Board on Monday showed its reading on leading U.S. economic indicators fell by slightly more than expected in the month of June. The Conference Board said its leading economic index declined by 0.3 percent in June following a revised unchanged reading in May.

RTTNews

|

2日前

Analysis for EURUSD

ATFX Market Outlook 23rd July 2025

The S&P 500 closed at a record high on Tuesday, despite a sharp drop in General Motors and gains in Tesla, as investors focused on recent and upcoming corporate earnings and signs of progress in U.S. trade negotiations. U.S. equity indices were mixed: the Dow rose 0.4%, the S&P 500 edged higher, and the Nasdaq fell 0.39%.

ATFX

|

16時51分前

EUR/USD Rises as Investors Remain Cautious Amid Mounting Risks

The EUR/USD pair climbed higher, settling near 1.1688 by Tuesday, as investors adopted a cautious stance ahead of key trade negotiation updates. The looming 1 August deadline –set by the US for new trade agreements – has kept markets on edge.

RoboForex

|

1日前

Markets Juggle Mixed Signals as FX Steadies, NZD Slips, and Oil Falls | 22nd July 2025

Global markets opened cautiously as investors reacted to US-EU trade tensions, oil supply concerns, and New Zealand rate cut speculation. The US Dollar held steady near 98.00, while NZD slipped below 0.5950. EUR/USD stayed firm near 1.1700, and the PBOC set a stronger yuan fix at 7.1460. WTI crude dropped to $65.50 amid oversupply fears.

Moneta Markets

|

1日前

ATFX Market Outlook 22nd July 2025

The S&P 500 and Nasdaq closed at record highs on Monday, led by gains in Alphabet and other mega-cap tech stocks. Investors remain optimistic that a potential trade deal could offset the economic damage from the Trump administration's global tariffs, as several major companies are set to report earnings this week. Among the main indices, the Dow dipped slightly, while the Nasdaq increased by 0.38%

ATFX

|

1日前

EURUSD Exchange Rates Analysis

EURUSD 過去のデータ - 日付範囲と時間枠から選べる履歴EURUSDデータ。

EURUSD ボラティリティ - EURUSDリアルタイムでの通貨ボラティリティ分析。

EURUSD 相関 - EURUSDリアルタイムでの通貨相関関係分析。

EURUSD インジケーター - EURUSDリアルタイムインジケーター。

EURUSD パターン - EURUSDリアルタイムの価格パターン。

EURUSD Technical Analysis

Technical Summary:

買い

| パターン | 買い (3) | 売り (1) |

|---|---|---|

| Belt-hold |

m15

|

|

| Closing Marubozu |

m30

|

|

| Hikkake |

h4

|

|

| Long Line |

m1

|

Legend:

買い

売り

Neutral

Live Spreads

| ブローカー | EUR/USD |

|---|---|

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

.png) Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

Open Account

Open Account

|

- |

チャートアクティビティ

-

Lusindiso123によるEURUSD,H4 Jun 25 at 23:29

-

cokresによるEURUSD,H4 Jun 22 at 11:39

-

PedrojuanによるEURUSD,M30 Jun 09 at 16:15

-

ANKTraderによるEURUSD,D1 Jun 08 at 07:35

-

jordanbel4tによるEURUSD,M1 Jun 02 at 17:48