Daily Global Market Update

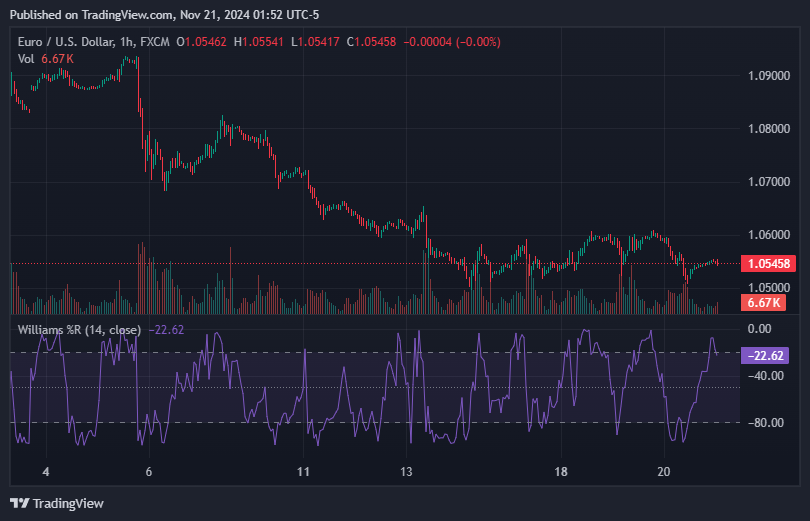

Euro's Oversold Market

The EUR/USD pair fell by 0.7% in the last session. The Williams Percent Range indicator signals that the market is currently oversold.

Dollar's Positive Momentum

The USD/JPY pair gained 0.3% in the last session. The MACD is giving a negative signal, indicating potential bearish momentum.

Gold's Positive Signal

Gold rose by 0.5% against the dollar in the last session. The Stochastic RSI is indicating a positive signal, suggesting potential upward momentum.

Amazon's Bearish Trend

Amazon's stock dropped 1% in the last session. The Stochastic indicator is signalling a negative trend, pointing towards potential further declines.

Global Financial Headlines

Global shares edged lower amid renewed geopolitical tensions between Russia and the West. Bitcoin reached a record high, and the US dollar strengthened following renewed post-election rallies. British inflation exceeded expectations, rising back above the Bank of England’s 2% target at 2.3% annually, as underlying price growth also accelerated.

Upcoming Economic Highlights

Key economic events to watch for include:

• US Consumer Sentiment Index – 1500 GMT

• Eurozone Industrial Production – 1000 GMT

• UK Unemployment Rate – 0700 GMT

• Japan Machinery Orders – 2330 GMT

• US Initial Jobless Claims – 1230 GMT