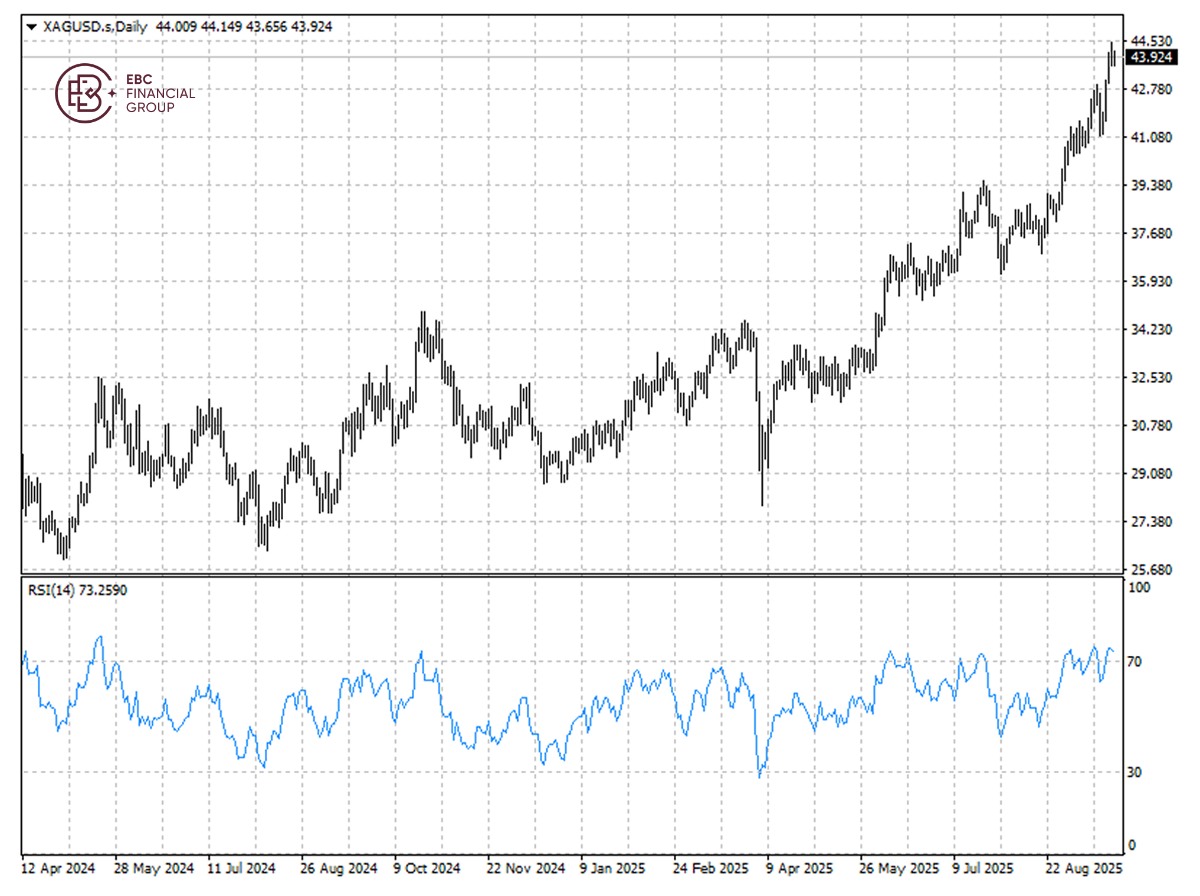

EBC Markets Briefing | Silver prices down after Powell's speech

Gold retreated from its record peak on Wednesday on profit-taking. Gold ETFTs saw accelerating inflows, with holdings expanding at the fastest pace in more than three years on Friday.

Silver, which also dropped following a yearly gain of more than 50%, could receive support from bullish options trades, with the daily volume of iShares Silver Trust options surging to 1.2 million on Friday.

Overnight, Fed Chair Powell said the central bank needs to continue balancing the competing risks of high inflation and a faltering job market in coming policy decisions, in remarks that echoed those from last week.

Gold and silver have been among the year's best-performing major commodities on a broad confluence of supportive factors, including central bank buying and lingering geopolitical tensions.

Last month HSBC has lifted its silver price forecasts for 2025, 2026, and 2027, cautioning that the rally is "due more to silver's relationship with gold than (to) underlying fundamentals".

Global solar manufacturers, the largest industrial consumers of silver, are set to reduce use of the precious metal for the first time in years amid a scorching rally in its price.

Despite its moderate pullback, silver remains in overbought territory. Therefore, we expect further losses ahead before the metal hits $43.65 – the low seen yesterday.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.