EUR/USD eyes key resistance as ECB decision looms

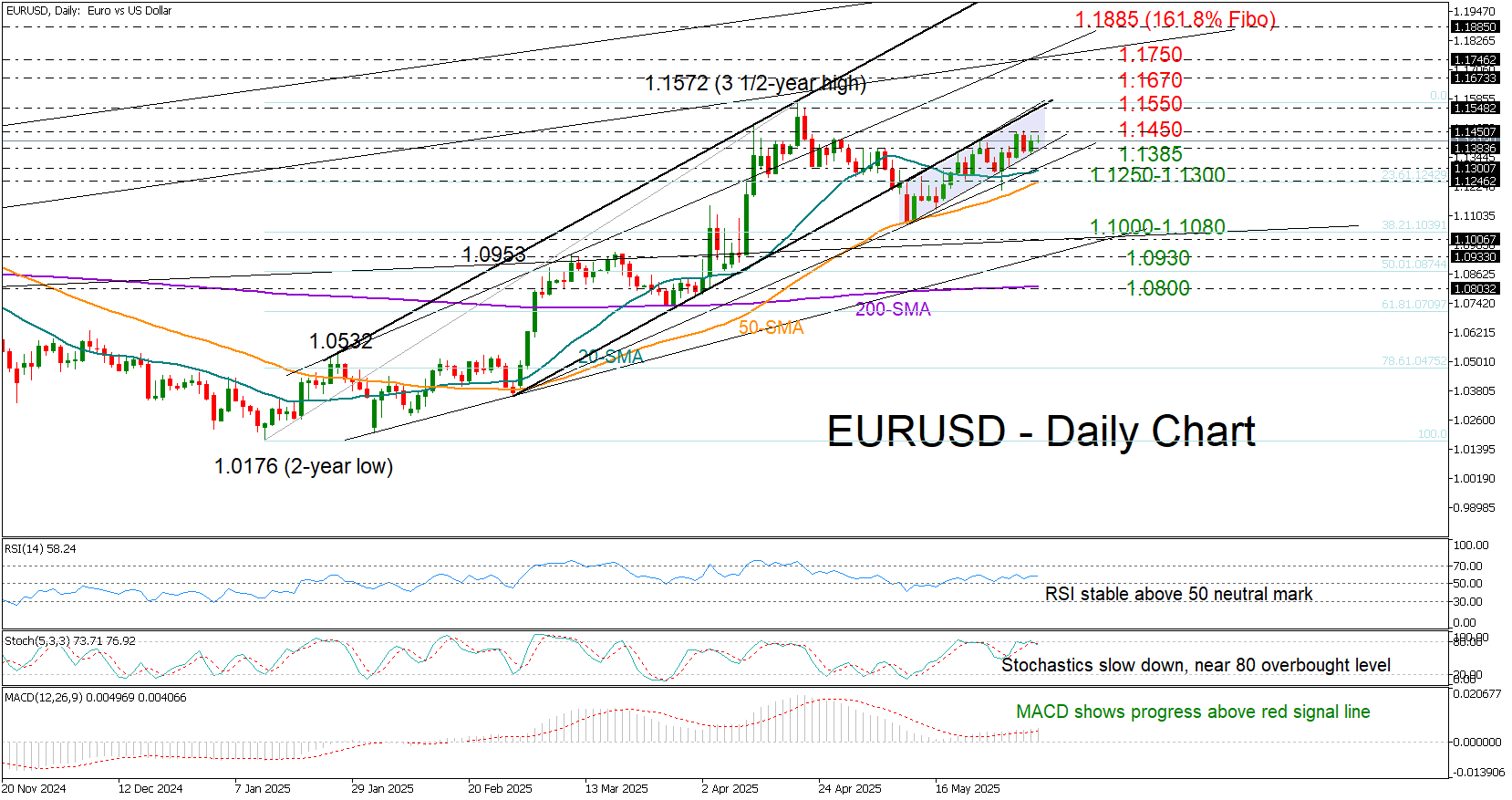

EUR/USD is trading modestly higher so far this week, encountering a key juncture near the 1.1450 level, which quickly halted Monday’s recovery attempt.

The weak momentum in price action reflects traders’ caution ahead of the ECB policy decision, scheduled for 12:15 GMT. While an eighth consecutive 25bps rate cut is fully priced in, uncertainty remains over whether further back-to-back reductions will follow, given the unclear impact of trade and geopolitical risks on inflation and economic growth.

However, with inflation falling below the central bank’s 2.0% target earlier this week and business PMI figures slipping back into contraction territory, policymakers may remain committed to their easing strategy. If they signal a higher likelihood of another rate cut in July, EURUSD could dip below the nearby support trendline at 1.1385 and test the 20-day simple moving average (SMA) around 1.1300. The 50-day SMA, which aligns with the 23.6% Fibonacci retracement of the 2025 uptrend, may then come into play near 1.1250. A breakdown of this level could accelerate losses toward the May low of 1.1080 or even further down to 1.1000.

On the flip side, additional rate cuts below 2.0% could drive real interest rates into negative territory—unless inflation continues to fall. Therefore, if the ECB adopts a more cautious, meeting-by-meeting approach and downplays the chances of a July cut, EURUSD may rebound toward the lower boundary of the broken bullish channel at 1.1550. A breakout there could open the door for a rally into the 1.1670–1.1750 zone, with the next target potentially at the 161.8% Fibonacci extension of the previous downleg at 1.1885.

Technically, as long as the RSI and MACD remain in bullish territory, a positive breakout remains possible.

In summary, EUR/USD has not lost its shine despite slowing momentum. Unless the bears push the price decisively below the 1.1300–1.1250 region, upside risks could remain intact.

.jpg)