Loonie Stops Falling in Anticipation of the Rate Decision

On Wednesday, the Bank of Canada announced its upcoming decision on the key interest rate, which is expected to drop by 50 basis points to 3.75%. This anticipation has led to a nearly 3% weakening of the Canadian dollar against the US dollar over the past three weeks.

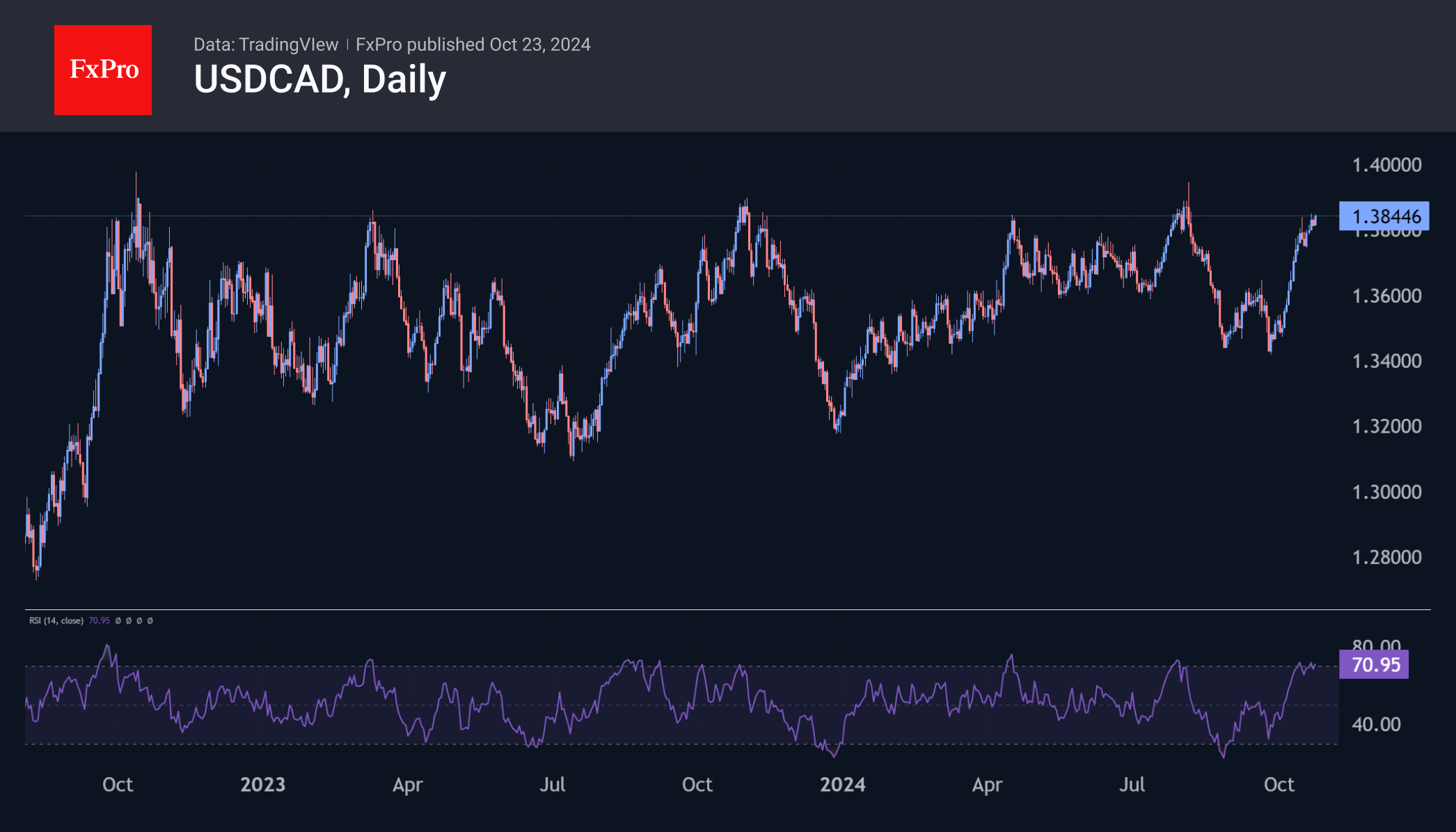

In anticipation of the rate decision, however, USDCAD has shown a tangled pattern this week, contrasting with the recent confident rise of the dollar. This pause could lead to potential volatility surrounding the decision and the accompanying commentary.

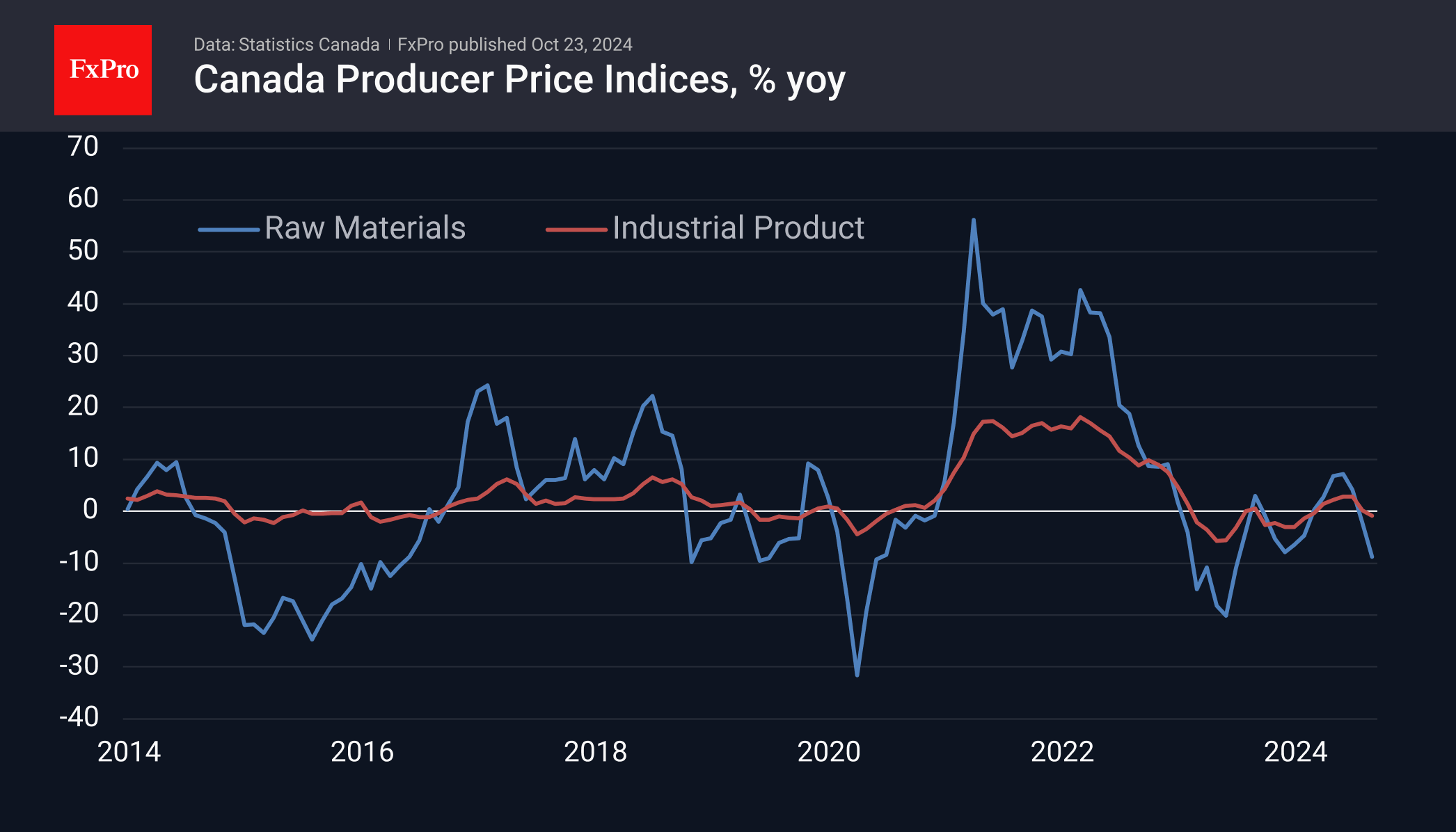

The index of manufacturers' prices has fallen below expectations, and the raw materials index has always accelerated the decline. The index of manufactured goods lost 0.6% in September after falling 0.9% previously. The annual rate of decline is in negative territory, down 0.9% year-on-year.

The Canadian goods price index fell by 3.1% in September after falling by 3% in August. On an annualised basis, the decline accelerated from 2.3% to 8.8%, the lowest in five quarters.

Last week, a weaker-than-expected report on consumer inflation was also seen, with headline price growth slowing below the 2% target to 1.6% y/y.

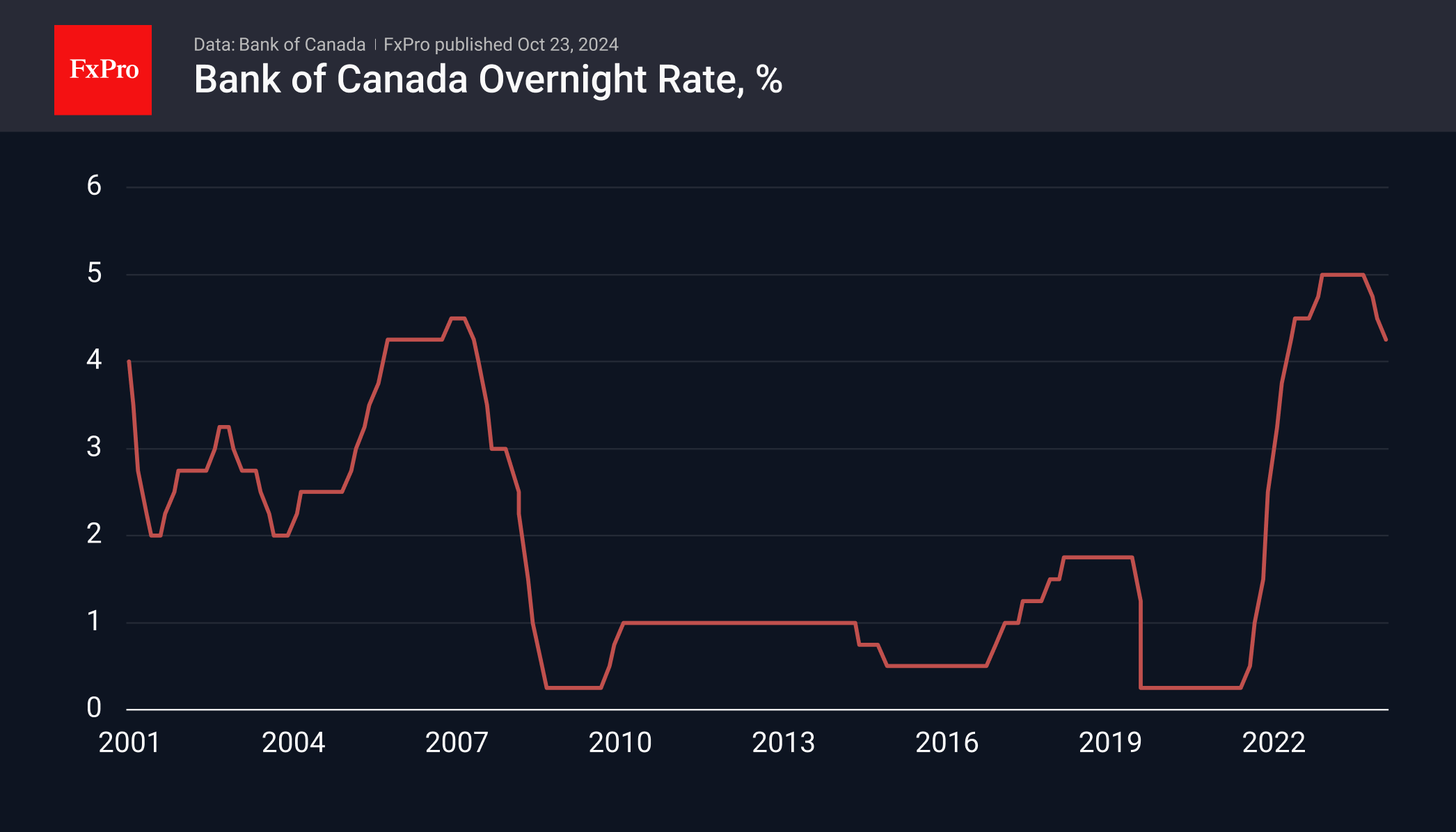

This, together with the Fed’s decisive 50-point cut in the federal funds rate in September, paved the way for an acceleration of monetary policy normalisation. Despite three 25-point cuts since June, the fed funds rate has remained near the upper end of its historical range since 2001.

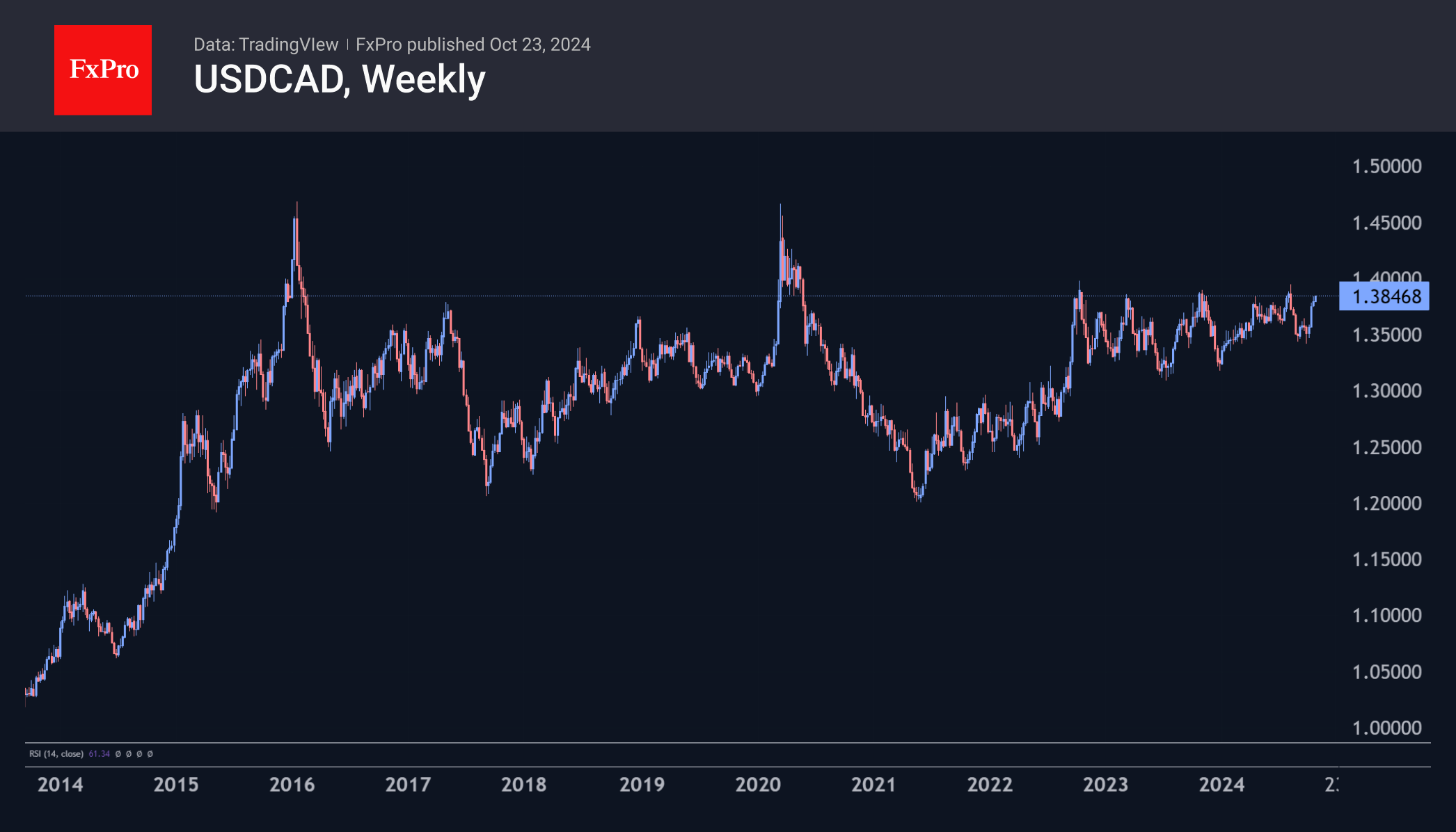

USDCAD has risen almost continuously to 1.3840, the upper boundary of the trading range of the past two years, apart from a few short-term spikes higher. This rally has created a short-term overbought condition, leading to greater downside potential than upside potential at this point.

However, traders should not be in a hurry. The central bank meeting is a strong enough reason for the pair to continue rising despite the overbought conditions. This could happen if the Bank of Canada’s comments remain dovish. A break of this two-year resistance could pave the way for USDCAD to rise above 1.4650, which has happened twice before—in 2016 and 2020.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)