Oil loses support, activating a slump to a $20 scenario

Oil loses support, activating a slump to a $20 scenario

Crude oil has accelerated its decline since the start of the month, testing the area of the lows of the past four years, as fears of a slowing global economy clash with hints from OPEC of a willingness to stick to the plan by raising production in April.

Hearing the cartel say that demand is strong is surprising. In recent years, when prices have fallen into the current price range near $70 a barrel for Brent, the cartel has changed its plans or toughened its rhetoric, making everything about tightening the deficit. But this time, the situation is unfolding differently. There are two reasons behind the change in tone: the desire not to quarrel with the US and the attempt to increase budget revenues by selling more oil.

It is also noteworthy that statistics from the US show that with the arrival of the Trump administration, the purchase of oil for the strategic reserve has stopped. On the eve of Congress, the president indicated his intention to reduce fuel prices, which is formally negative news for oil.

It is also noteworthy that statistics from the US show that with the arrival of the Trump administration, the purchase of oil for the strategic reserve has stopped. On the eve of Congress, the president indicated his intention to reduce fuel prices, which is formally negative news for oil.

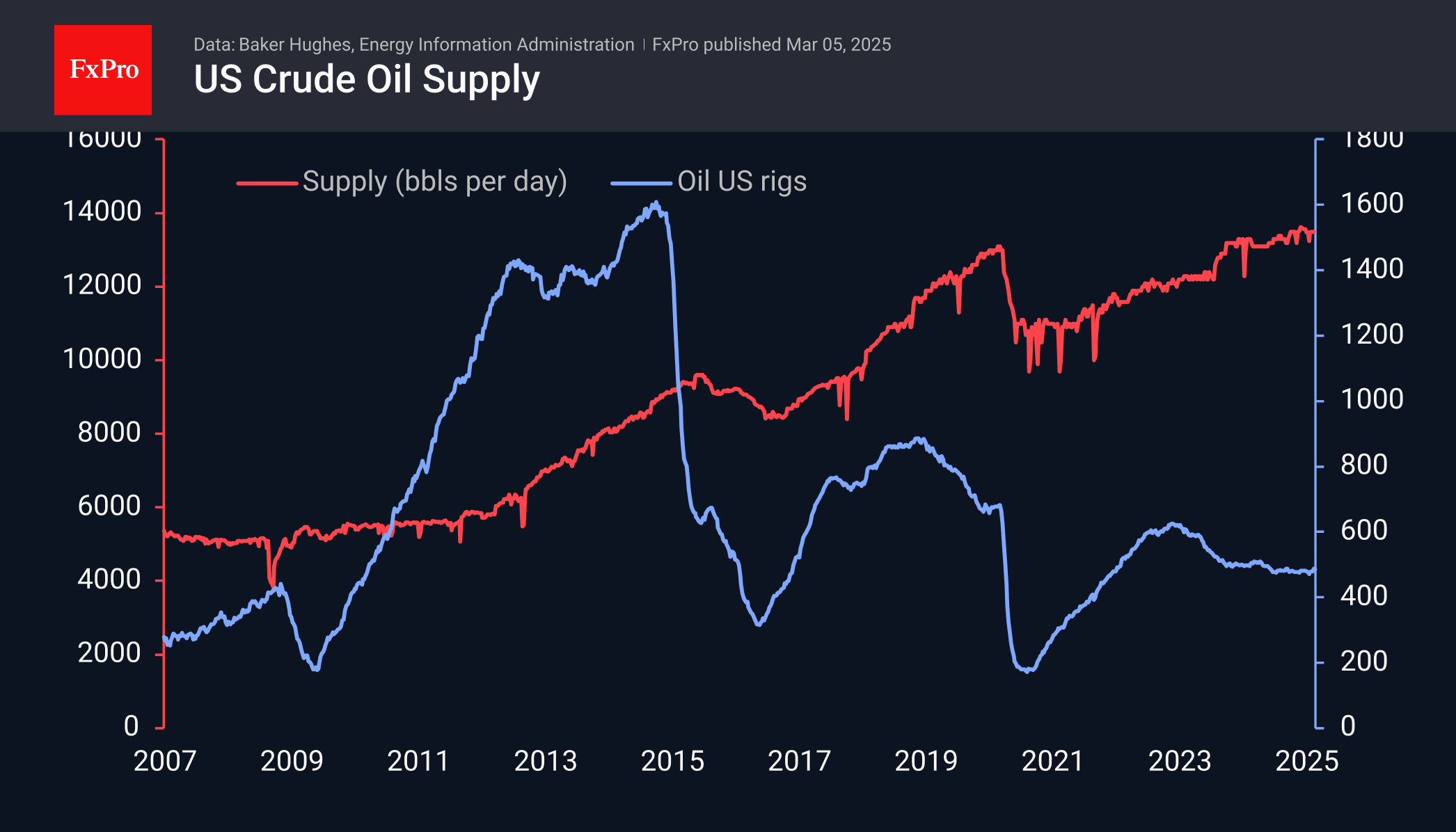

At the same time, production remains near a record 13.5 million bpd, bringing the battle for market share back on the agenda by squeezing out weaker players. Similar episodes in 2014 and 2020 saw oil plummet.

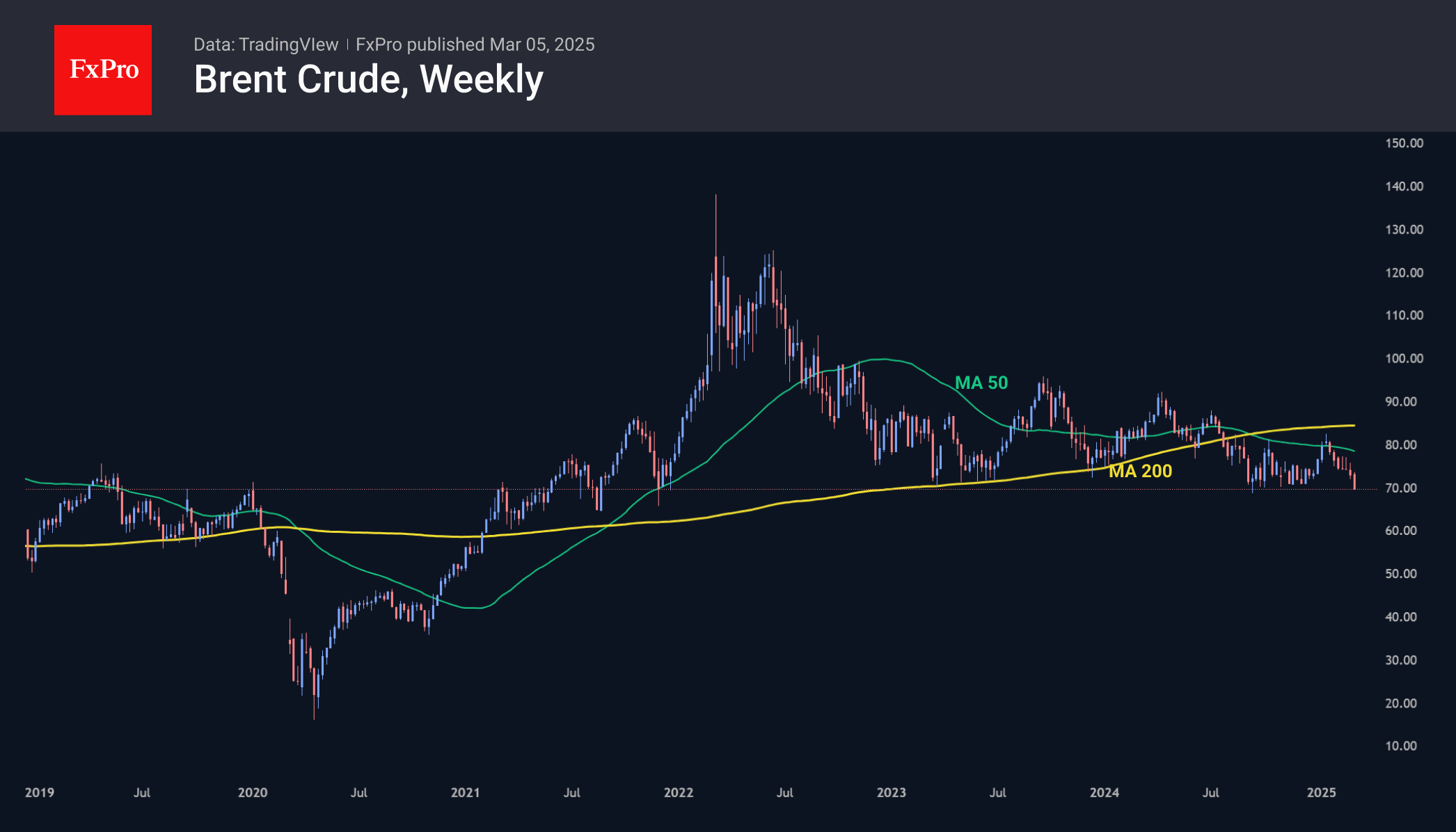

As is often the case, the bearish technical picture formed even earlier—along with Brent's consolidation under its 200-week and 50-week moving averages in the second half of last year. Now, the latest comments seem to be removing the last support for the market from a crucial psychological level.

As is often the case, the bearish technical picture formed even earlier—along with Brent's consolidation under its 200-week and 50-week moving averages in the second half of last year. Now, the latest comments seem to be removing the last support for the market from a crucial psychological level.

Having fallen from roughly the same levels in 2020, Brent only found a bottom below $20 thanks to international coordination. In 2014, a relentless fall halved the price, sending it from $115 to $45. The bottom was finally found in 2016 at nearly $27 (-75%). A failure into the $20-30 area sounds shocking but is a potentially realisable scenario.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)