RBNZ accelerates rate hike, encouraging NZD rise

RBNZ accelerates rate hike, encouraging NZD rise

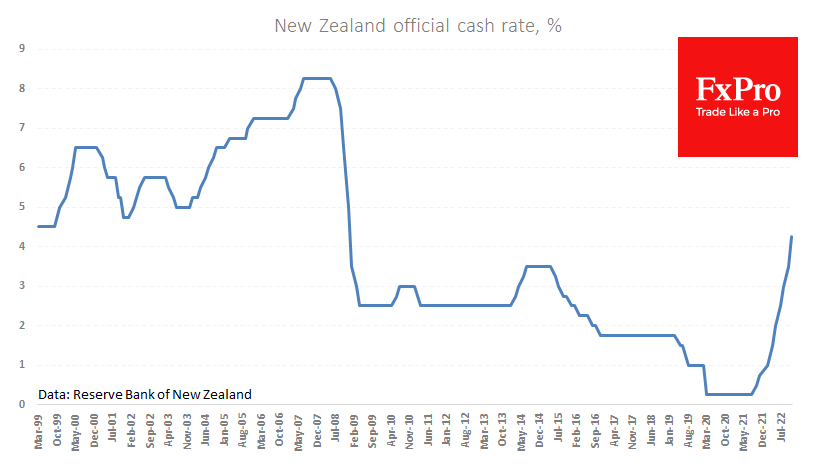

The Reserve Bank of New Zealand raised the rate by 75 points to 4.25% after five consecutive 50-point hikes. Analysts polled had anticipated such a result based on the signals sent by the central bank. RBNZ also began to reduce the balance sheet through managed sales, while before, it had stopped reinvesting coupons and matured obligations. Commenting on the decision, it states the need “to reach a higher level, and sooner than previously indicated”.

In the November monetary policy update, the RBNZ said it intends to raise the rate to 5.5% by September 2023.

Contrary to the trend set by the US and shared by Australia, the RBNZ is accelerating rate hikes and tightening other policy tools. This has been made possible by excessively high inflation (7.2% y/y), rising short-term inflation expectations (5% in one year and 3.6% in two years) and employment above sustainable levels (unemployment rate of 3.3% - near the cyclical lows of the last 40 years).

Although a key rate hike of 400 points in 14 months looks impressive, current rates are low by historical standards. Until May 2008 – before the global zero-rate policy and QE started – the RBNZ held the rate at 8.25%, and the 4.5% level was the cyclical low from 1999 to 2009. So, in this case, the anticipated 5.5% is just a return to normal and not overtightened conditions here.

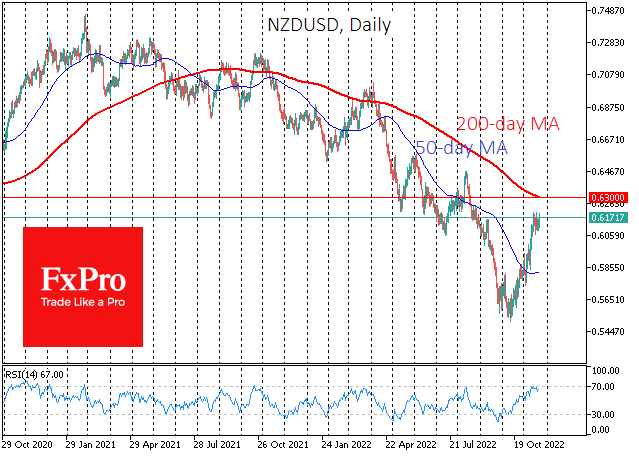

Either way, a higher rate hike is a bullish signal for the Kiwi. The NZDUSD pushed back from the bottom near 0.5500 6 weeks ago, adding 12% to 0.6170 during quite an even rally. Over the last week, we have seen some position shake-ups, after which the pair looks ready to resurface again.

A significant milestone on the way up will be the area of 0.6300, the 200 SMA and the essential support of the last seven years. A consolidation above that would firmly establish a reversal. At the same time, fundamentals such as a strong labour market and central bank resolve to fight inflation would increase interest in the Kiwi from speculators and carry traders.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)