Risk appetite turns sour again as market stress points multiply

Risk appetite remains weak

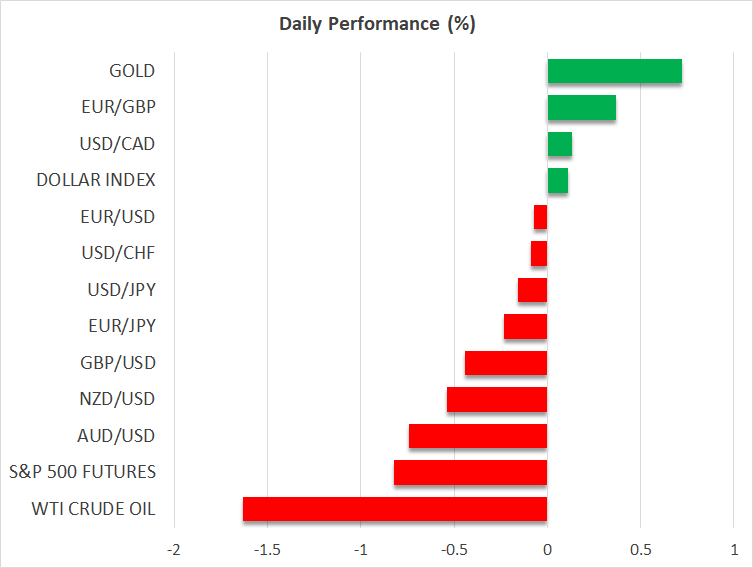

Monday’s recovery proved short-lived, as risk markets are under pressure again today. Equity indices and cryptocurrencies are losing ground, with both the S&P 500 index and ether trying to remain above 6,600 and $4,000 respectively. This is fueling fears that last Friday’s decline could be the start of a stronger correction, and not just a bump on the road higher, partly validating warnings about stretched valuation of stocks.

Understandably, trade tensions remain in the spotlight, with the US and China blaming each other for the current mess. However, as seen in previous such episodes, both sides can show a high degree of restraint, eventually leading to fruitful talks, defusing the situation once again. That said, Trump might have a different opinion this time around, with the current uncertainty dragging on until November 1, when the 100% extra tariff on Chinese imports is supposed to be imposed, or even November 10, when the three-month extension expires, with tariffs rising to triple digits from both sides. The market reaction is expected to be severe in either case, despite the belief that a solution will probably be found at the eleventh hour.

Investors are looking for bullish catalysts

Investors are looking for bright spots to turn the current bearish sentiment around. However, there has been little progress regarding the US shutdown, which is now entering its third week, defying expectations for a short-term affair. Notably, both Democrats and Republicans have not shown great appetite for compromise so far, increasing the chances of a significant period without data releases and causing sizeable damage to the US economy.

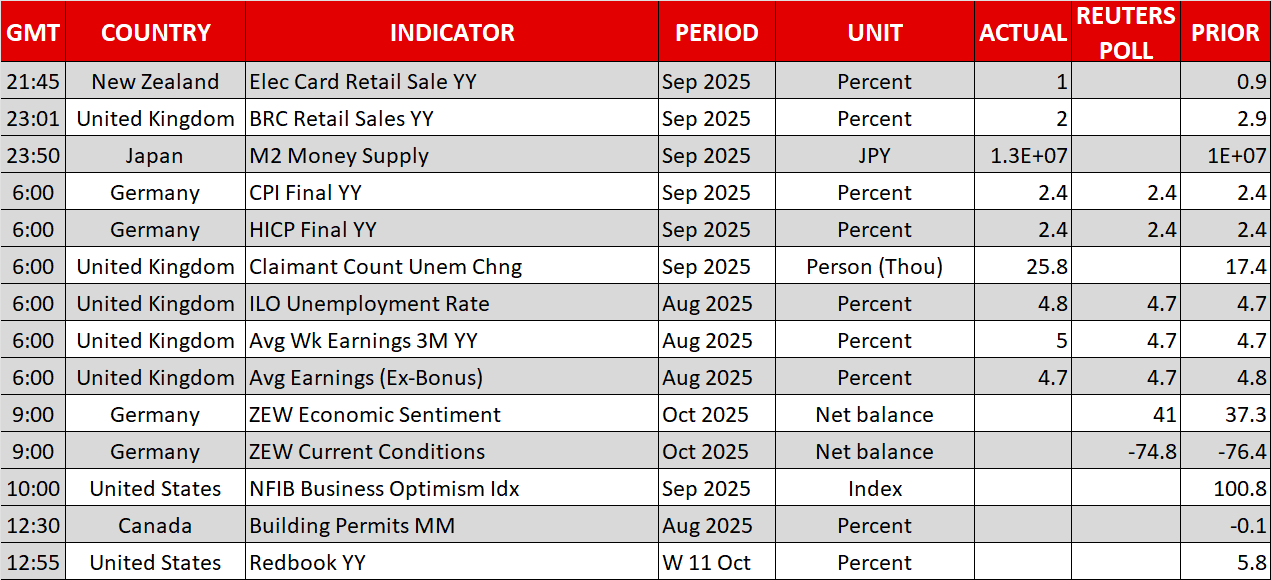

This means that investors will continue to fly blind, as the absence of pivotal US data is likely to persist, despite reports that the BLS has been trying to compile the CPI report, due tomorrow, to at least publish one key piece of information ahead of the late-October Fed meeting. In this context, the usual Fed blackout period commences on Saturday.

Hence, investors should be prepared for a barrage of commentary, starting today with Fed Chair Powell speaking on “Economic Outlook and Monetary Policy” at 16:20 GMT. Additionally, board members Bowman and Waller, along with regional Fed President Collins, will also be on the wires today and are likely to strike a dovish tone, potentially offering some reprieve to battered stocks.

This leaves corporate earnings with the tough role of lifting investor sentiment. Financial stocks will dominate this week’s calendar, potentially laying the foundation for another decent earnings round. However, the market’s focus is already on technology stocks earnings and any AI-related announcements.

The dollar fails to rally significantly

Despite recording gains across the board, the US dollar has failed to make significant progress against its main counterparts. Euro/dollar is hovering just above 1.1550 and dollar/yen rally is battling the key 151.94 level. Notably, the pound continues to underperform both against the dollar and the euro, despite the average weekly earnings, including bonuses, accelerating to 5% once again. Investors are reacting negatively to the decent increase in claims and the unemployment rate climbing to 4.8%, the highest level since May 2021.

Precious metals are edging lower today

Following a week of nonstop advances, gold has lost some ground in the past few hours, after posting a new all-time high of $4,180. It is still trading above $4,100 at the time of writing, retaining most of its recent extraordinary gains. The current move appears to be mostly profit-taking rather than a reaction to developments in Gaza. Similarly, silver is also in the red today, pausing its exponential rally. Unless the prevailing supply issues are resolved overnight, the silver bid may return.

.jpg)